- United States

- /

- Biotech

- /

- NasdaqGM:IVVD

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Amidst a backdrop of declining major stock indexes, with the S&P 500 and Dow Jones Industrial Average experiencing their fourth consecutive losses due to AI bubble concerns and tepid labor data, the tech-heavy Nasdaq has also seen a recent decline. In this environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and potential for innovation despite broader market challenges.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.12% | 23.48% | ★★★★★☆ |

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Workday | 11.15% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Viridian Therapeutics | 56.24% | 54.30% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.76% | 116.48% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Invivyd (IVVD)

Simply Wall St Growth Rating: ★★★★★☆

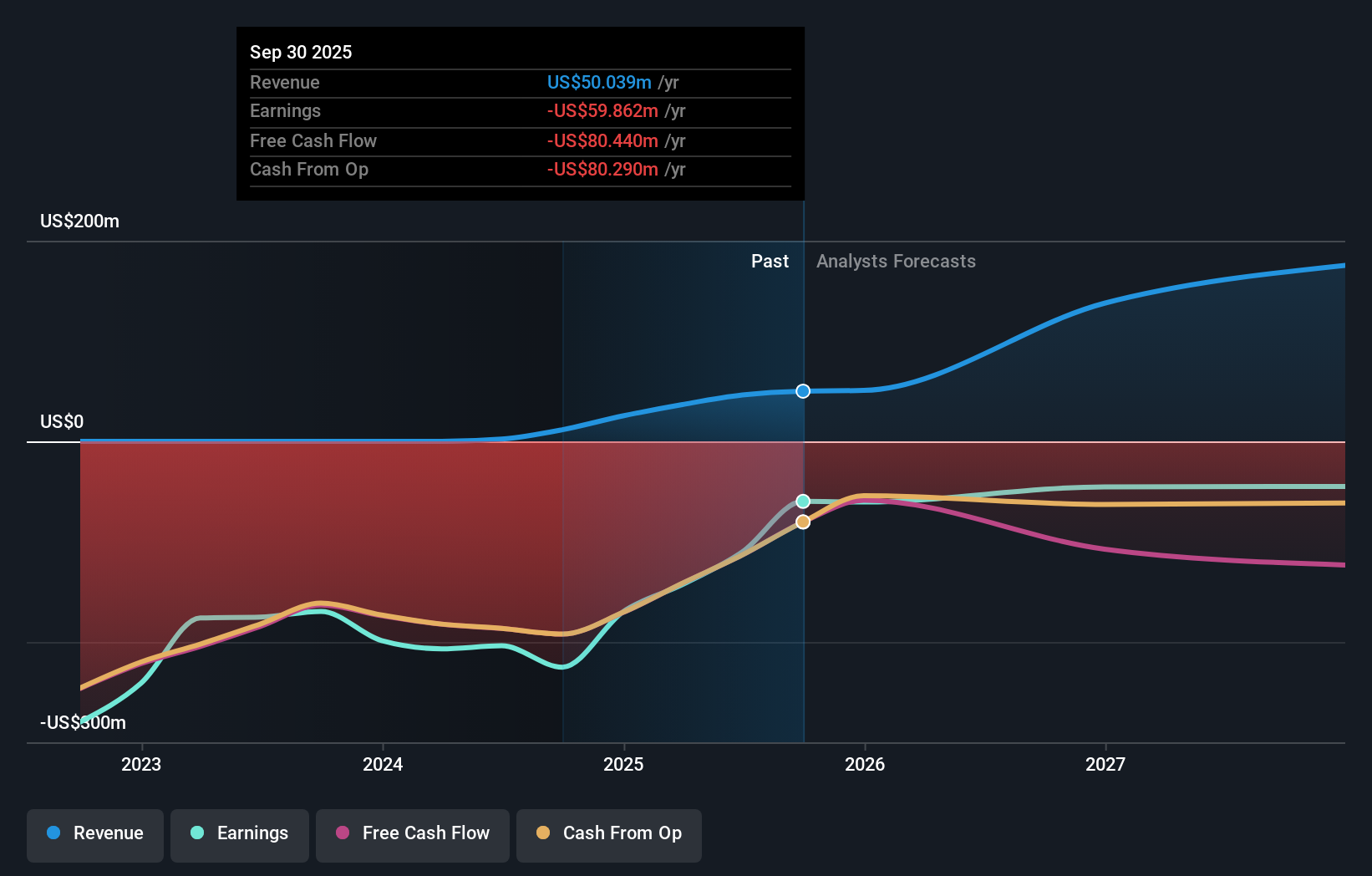

Overview: Invivyd, Inc. is a biopharmaceutical company specializing in antibody-based solutions for infectious diseases in the United States, with a market cap of $517.53 million.

Operations: The company's primary revenue stream comes from its focus on the discovery, development, and commercialization of antibody-based solutions for infectious diseases, generating $50.04 million.

Invivyd, Inc. has demonstrated a robust commitment to innovation in the biotech sector, particularly with its recent nomination of VBY329 for preclinical development aimed at combating Respiratory Syncytial Virus (RSV). This initiative is part of a broader strategy to explore monoclonal antibodies for various infectious diseases, signaling potential growth in a market projected to reach $3-$4 billion by 2030. Despite facing substantial shareholder dilution this past year and reporting a net loss reduction from $60.74 million to $10.47 million in Q3 2025, Invivyd's aggressive R&D efforts underscore its pursuit of groundbreaking treatments that could revolutionize patient care for vulnerable populations.

- Delve into the full analysis health report here for a deeper understanding of Invivyd.

Gain insights into Invivyd's historical performance by reviewing our past performance report.

Neurocrine Biosciences (NBIX)

Simply Wall St Growth Rating: ★★★★☆☆

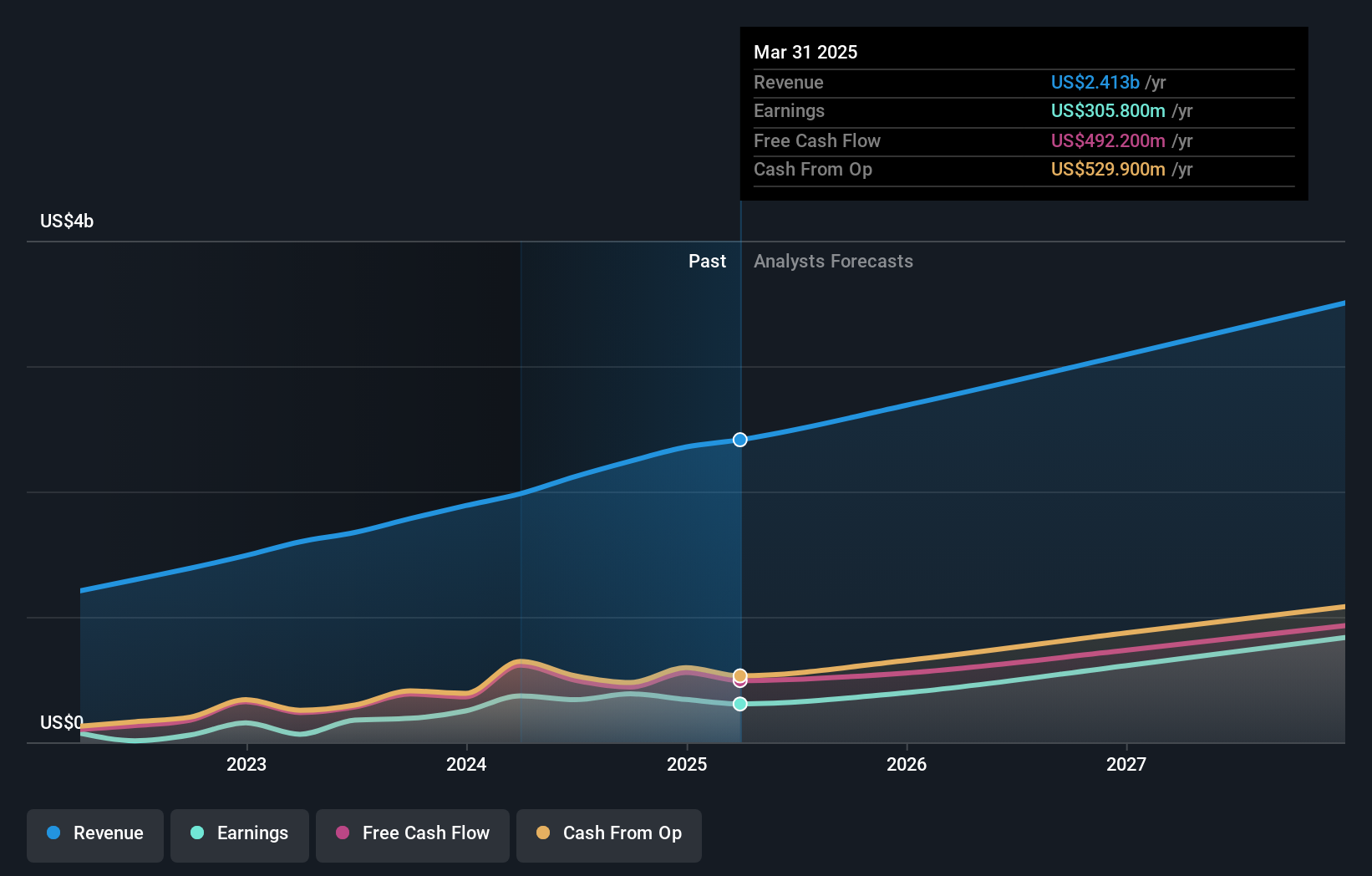

Overview: Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally with a market cap of approximately $15.36 billion.

Operations: Neurocrine Biosciences focuses on the research, development, and commercialization of pharmaceuticals for neurological and related disorders, generating approximately $2.68 billion in revenue from these activities.

Neurocrine Biosciences has been actively enhancing its portfolio with significant R&D investments, as evidenced by their recent strategic alliance to develop NLRP3 inhibitors, potentially worth up to $881.5 million. This move, coupled with a robust pipeline of mid-to-late phase clinical developments across various therapeutic areas, underscores their commitment to addressing complex neurological and neuropsychiatric disorders. Moreover, the company's revenue surged to $2.06 billion over nine months in 2025, marking an impressive growth from the previous year’s $1.73 billion, while net income also rose from $238.2 million to $324.9 million in the same period. These financial achievements reflect Neurocrine's strong operational execution and innovative edge in high-growth tech within biopharmaceuticals.

- Take a closer look at Neurocrine Biosciences' potential here in our health report.

Assess Neurocrine Biosciences' past performance with our detailed historical performance reports.

Pure Storage (PSTG)

Simply Wall St Growth Rating: ★★★★★☆

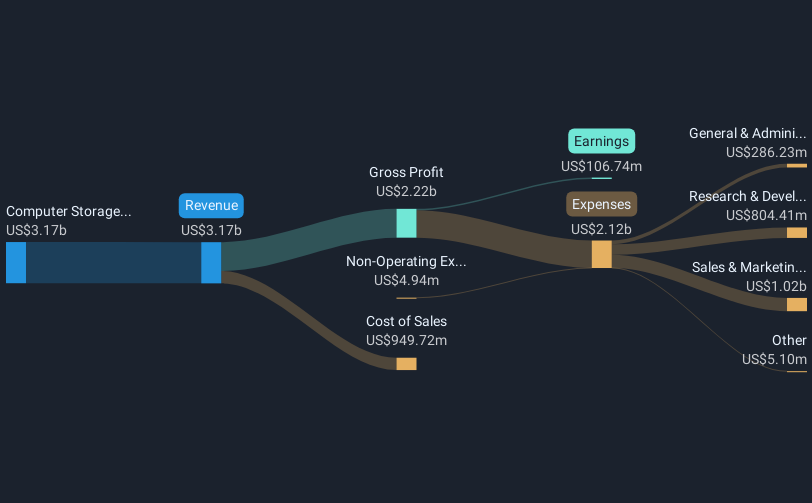

Overview: Pure Storage, Inc. offers data storage and management solutions globally, with a market cap of $22.97 billion.

Operations: Pure Storage generates revenue primarily from its computer storage devices, amounting to $3.48 billion. The company's offerings focus on data storage and management technologies across the U.S. and international markets.

Amidst a dynamic tech landscape, Pure Storage stands out with its strategic focus on enhancing AI capabilities and cloud integration. The company's recent earnings reveal a robust upward trajectory in revenue, reaching $2.6 billion over nine months—an increase from the previous year's $2.29 billion. This growth is complemented by an ambitious R&D framework that not only fuels innovation but also aligns with evolving market demands for comprehensive data solutions and cyber resilience. Significant too is Pure Storage's proactive capital management; the firm has repurchased shares worth $480 million since last year, underscoring confidence in its financial health and future prospects. With new leadership aiming to expand global sales and innovative offerings like the AI-powered Pure1 AI Copilot, Pure Storage is adeptly positioned to navigate the complexities of next-gen tech environments.

- Unlock comprehensive insights into our analysis of Pure Storage stock in this health report.

Explore historical data to track Pure Storage's performance over time in our Past section.

Where To Now?

- Gain an insight into the universe of 76 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IVVD

Invivyd

A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion