- United States

- /

- Pharma

- /

- NasdaqGS:ITCI

Intra-Cellular Therapies (NASDAQ:ITCI) shareholders have earned a 25% CAGR over the last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Intra-Cellular Therapies, Inc. (NASDAQ:ITCI) which saw its share price drive 203% higher over five years. In the last week shares have slid back 2.4%.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Intra-Cellular Therapies

Intra-Cellular Therapies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Intra-Cellular Therapies can boast revenue growth at a rate of 80% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 25% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Intra-Cellular Therapies seems like a high growth stock - so growth investors might want to add it to their watchlist.

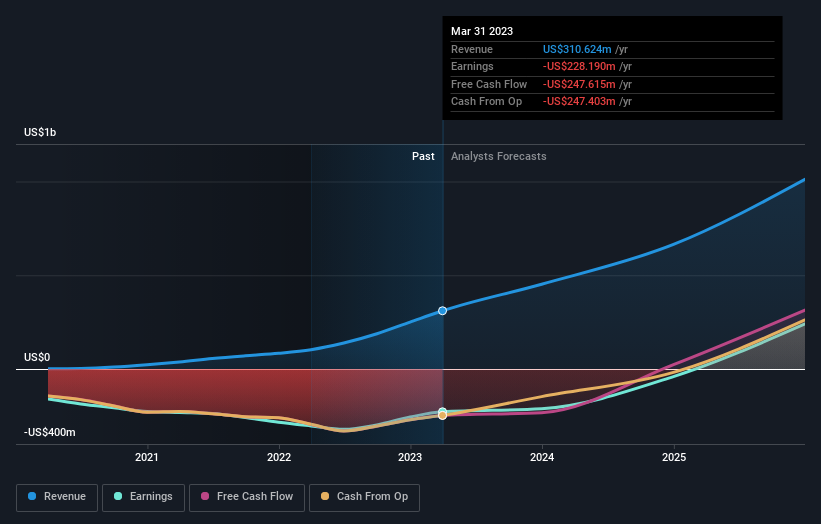

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Intra-Cellular Therapies is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Intra-Cellular Therapies shareholders gained a total return of 14% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 25% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before spending more time on Intra-Cellular Therapies it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITCI

Intra-Cellular Therapies

A biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in psychiatric and neurological disorders in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives