- United States

- /

- Biotech

- /

- NasdaqGM:IRON

How Disc Medicine’s (IRON) FDA Filing and Board Change May Shape Its First-in-Class Therapy Ambitions

Reviewed by Sasha Jovanovic

- Disc Medicine recently submitted a New Drug Application to the US FDA for bitopertin targeting erythropoietic protoporphyria, seeking accelerated approval and Priority Review based on positive clinical study outcomes.

- Shortly after, director Mona Ashiya, Ph.D., resigned from the board with no disputes cited, while insider transactions also took place but were not linked to operational concerns.

- We'll explore how the FDA submission for bitopertin, as a potential first-in-class therapy for EPP, informs Disc Medicine's investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Disc Medicine's Investment Narrative?

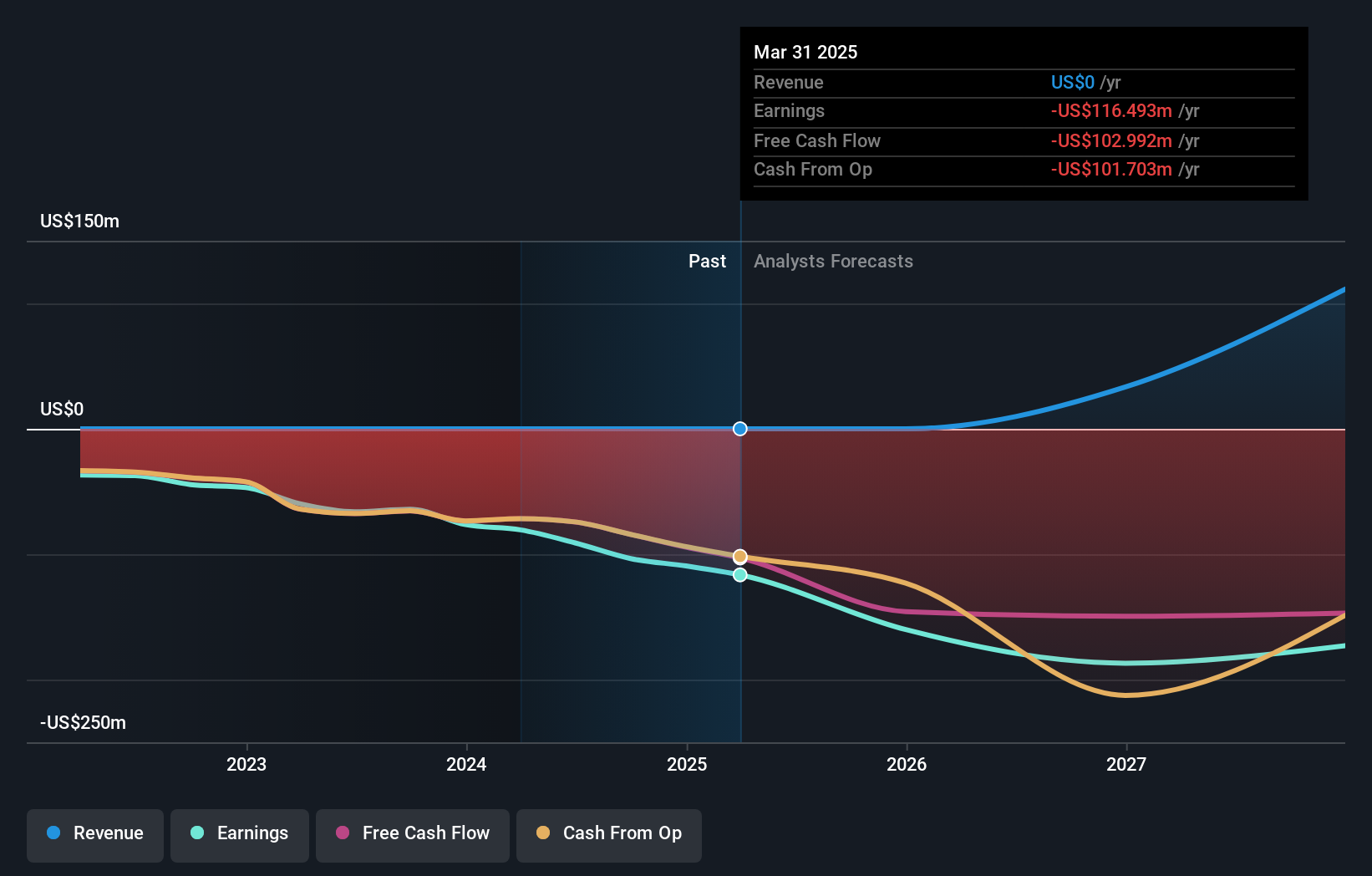

For Disc Medicine, the current investment thesis centers on the belief that bitopertin could achieve FDA approval as the first disease-modifying therapy for erythropoietic protoporphyria (EPP), potentially opening a commercial opportunity in a rare and underserved disease area. The recent NDA submission under the accelerated approval pathway, combined with the request for Priority Review, has emerged as the most important short-term catalyst for the company. With clinical data showing improvements in key patient outcomes, the case for near-term value creation appears tied to regulatory progress. The resignation of board member Mona Ashiya, given its stated lack of operational disagreement, is unlikely to materially alter these near-term drivers or add new risks, especially with the board remaining experienced and recently refreshed. Despite strong price momentum ahead of the news, Disc remains unprofitable and dependent on successful product development, regulatory review, and eventual commercialization, making it especially sensitive to clinical and FDA outcomes. In the short term, changes to board composition are less relevant than the fact that the company has yet to generate revenue, and must rely on its pipeline to deliver on high growth expectations. On the other hand, regulatory outcomes remain uncertain and could significantly influence the company's valuation trajectory.

Disc Medicine's shares have been on the rise but are still potentially undervalued by 27%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth as much as 39% more than the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

No Opportunity In Disc Medicine?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives