- United States

- /

- Biotech

- /

- NasdaqGS:IONS

Ionis Pharmaceuticals (IONS): Revisiting Valuation After a Strong 1-Year Share Price Surge

Reviewed by Simply Wall St

Ionis Pharmaceuticals (IONS) has quietly turned into one of the market’s better comeback stories, with the stock up sharply over the past year even as near term returns cooled this week.

See our latest analysis for Ionis Pharmaceuticals.

After a sharp run that has pushed the share price to 78.86 dollars and delivered a year to date share price return of 127.33 percent, this week’s pullback simply cools the pace. A 1 year total shareholder return of 107.58 percent and 3 year total shareholder return of 105.90 percent still point to strong, long term momentum.

If Ionis has you rethinking what is possible in biotech, it might be a good time to explore other standout names across healthcare stocks as fresh candidates for your watchlist.

With Ionis now trading just below analyst targets yet still showing a sizeable intrinsic discount, investors face a key question: is this high growth biotech still undervalued, or is the market already pricing in its future pipeline?

Most Popular Narrative: 8.2% Undervalued

With Ionis closing at 78.86 dollars versus a narrative fair value near 86 dollars, the current pricing implies the market is still catching up to an ambitious long term roadmap.

The analysts have a consensus price target of $68.346 for Ionis Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $43.0.

Want to see what justifies a fair value above today’s price when consensus targets sit lower and profits are still years away? The narrative leans on rapid revenue compounding, a step change in margins, and a future earnings multiple more often reserved for high growth leaders. Curious how those moving pieces fit together and what has to go right for the math to hold? Read on to unpack the full story behind that valuation path.

Result: Fair Value of $85.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several pivotal approvals and pricing negotiations could still disappoint, which may limit uptake in broader indications and challenge the revenue and margin acceleration embedded in this narrative.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another Angle on Valuation

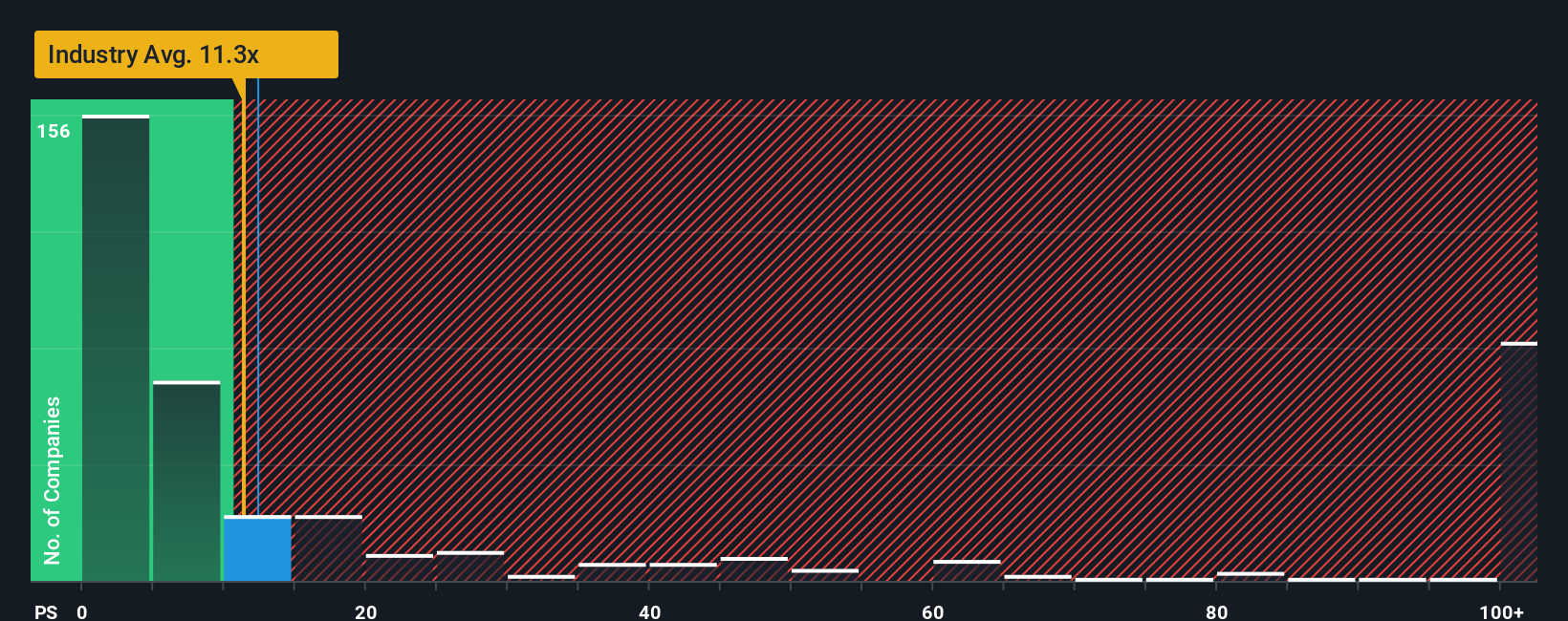

Step away from narrative fair value and the numbers start to look stretched. Ionis trades at a price to sales ratio of 13.2 times, versus 12.1 times for the US biotech sector and a fair ratio closer to 4.7 times. That gap signals downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ionis Pharmaceuticals.

Looking for more investment ideas?

Put your research momentum to work now, or risk missing opportunities that could reshape your portfolio with targeted ideas tailored to different market themes and strategies.

- Explore potential early-stage opportunities by scanning these 3590 penny stocks with strong financials that already show stronger financial footing than many names in their price range.

- Position yourself at the center of the automation trend with these 27 AI penny stocks that combine innovation with scalable commercial opportunities.

- Identify value-focused opportunities using these 894 undervalued stocks based on cash flows to find companies priced below what their projected cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026