- United States

- /

- Pharma

- /

- NasdaqGS:INVA

Did New Zoliflodacin Data and FDA Review Just Shift Innoviva's (INVA) Investment Narrative?

Reviewed by Sasha Jovanovic

- Innoviva Specialty Therapeutics recently announced it will present six data sets, including subgroup results from the Phase 3 zoliflodacin trial for uncomplicated gonorrhea, at IDWeek 2025, with ongoing FDA review and multiple antibiotic portfolio updates highlighted.

- The company's collaboration with the Global Antibiotic Research & Development Partnership on zoliflodacin signals advancing efforts against antibiotic-resistant infections and may influence clinical practice and regulatory landscapes.

- We'll explore how new clinical data and the FDA review for Innoviva's lead antibiotic candidate could shift its long-term investment story.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Innoviva's Investment Narrative?

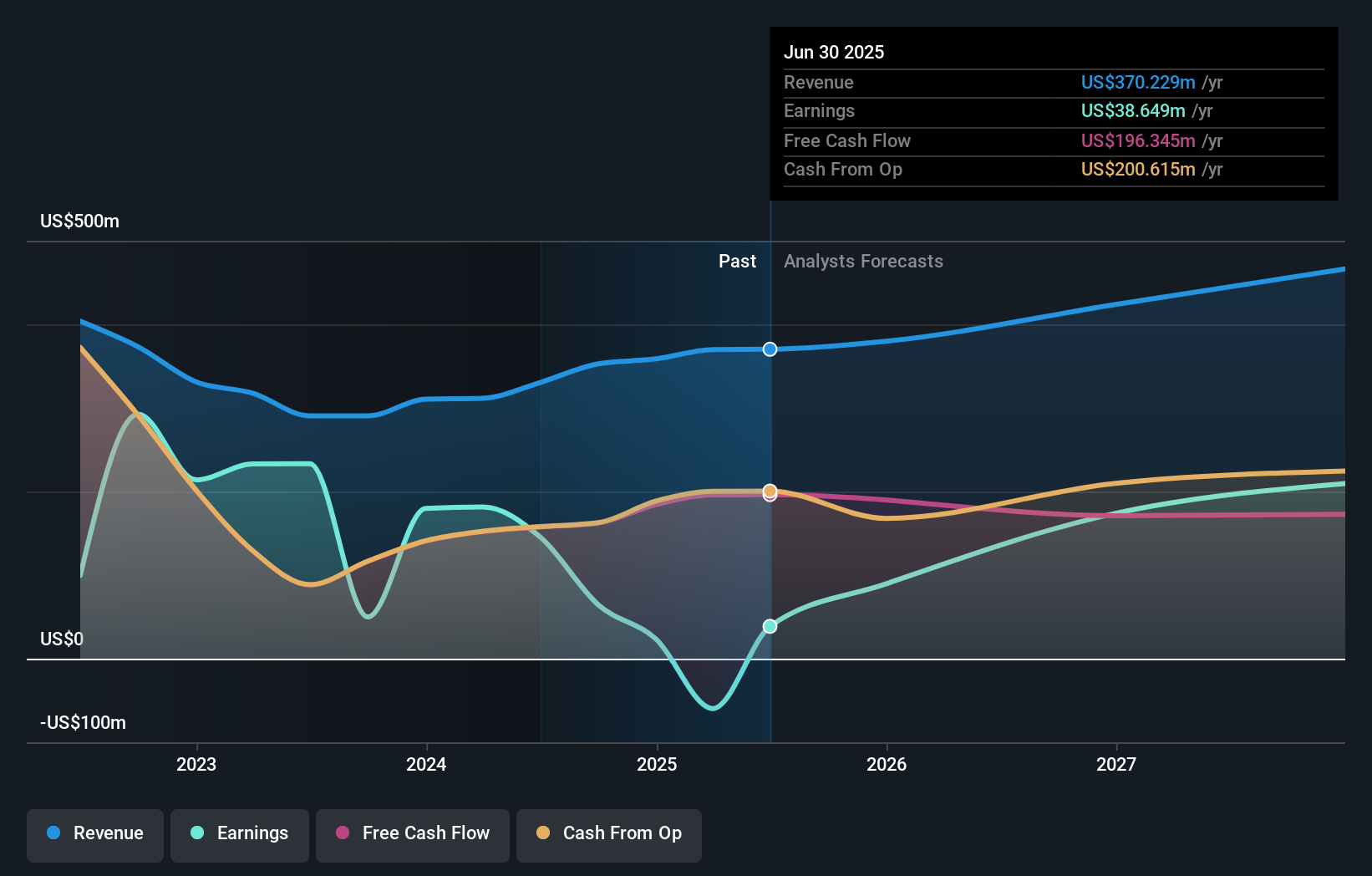

For investors thinking about Innoviva, the story hinges on belief in the company's push to expand its specialty therapeutics business and progress in its antibiotic pipeline. The spotlight on IDWeek 2025, with six new clinical data sets and updates on zoliflodacin's FDA review, could sharpen focus on short-term regulatory catalysts, especially as antibiotic resistance remains a public health concern. This recent event may shift the near-term risk profile, with commercial and regulatory milestones for zoliflodacin taking precedence over past GAAP earnings volatility or one-off items that previously weighed on perception. While the earning recovery and slow revenue growth had set a cautious tone, meaningful progress in the pipeline could attract new attention, particularly as the share price sits at a substantial discount to some fair value estimates. Still, pricing risk, competition, and the relatively high valuation multiples remain factors to watch as the story evolves.

On the flip side, the high Price-to-Earnings ratio is a risk investors shouldn't overlook. Despite retreating, Innoviva's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Innoviva - why the stock might be worth over 2x more than the current price!

Build Your Own Innoviva Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innoviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innoviva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innoviva's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives