- United States

- /

- Software

- /

- NasdaqGS:PLTR

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 11% over the past year with earnings anticipated to grow by 15% per annum in the coming years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for revenue expansion and innovation, positioning them well within a market poised for continued earnings growth.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.14% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 51.11% | 57.42% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.85% | 59.41% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.89% | 59.89% | ★★★★★★ |

| Lumentum Holdings | 23.48% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Protagonist Therapeutics (PTGX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company that focuses on developing peptide therapeutics for hematology, blood disorders, and inflammatory and immunomodulatory diseases, with a market cap of $3.29 billion.

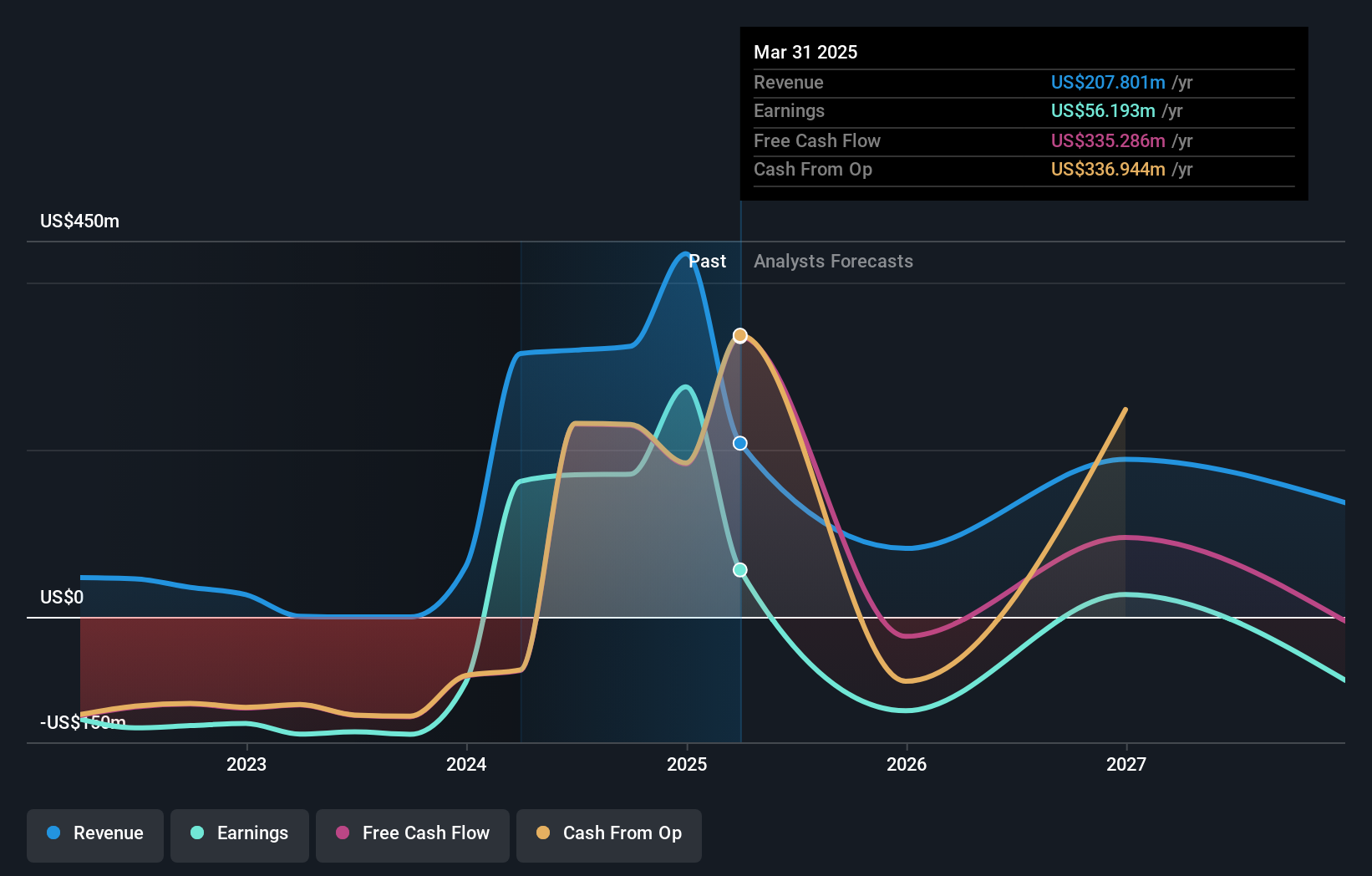

Operations: Protagonist Therapeutics generates revenue primarily from its biotechnology segment, amounting to $207.80 million. The company is involved in the development of peptide therapeutics targeting specific medical conditions, including hematology and inflammatory diseases.

Protagonist Therapeutics has demonstrated a robust trajectory in its financial and operational performance, notably with a 20.6% forecasted annual revenue growth that outpaces the US market average of 8.8%. Despite recent challenges, including a net loss reported in Q1 2025 contrasting sharply with substantial net income the previous year, the company's strategic focus on innovative treatments like rusfertide for polycythemia vera shows promise. This focus is underscored by significant R&D investment aimed at advancing their pipeline, which could potentially reshape treatment paradigms in their segment. Moreover, expected earnings growth at an impressive rate of 40.1% annually highlights Protagonist's potential to leverage its scientific advancements into financial success.

Insmed (INSM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Insmed Incorporated is a biopharmaceutical company focused on developing and commercializing therapies for serious and rare diseases across the United States, Europe, Japan, and other international markets, with a market cap of $18.65 billion.

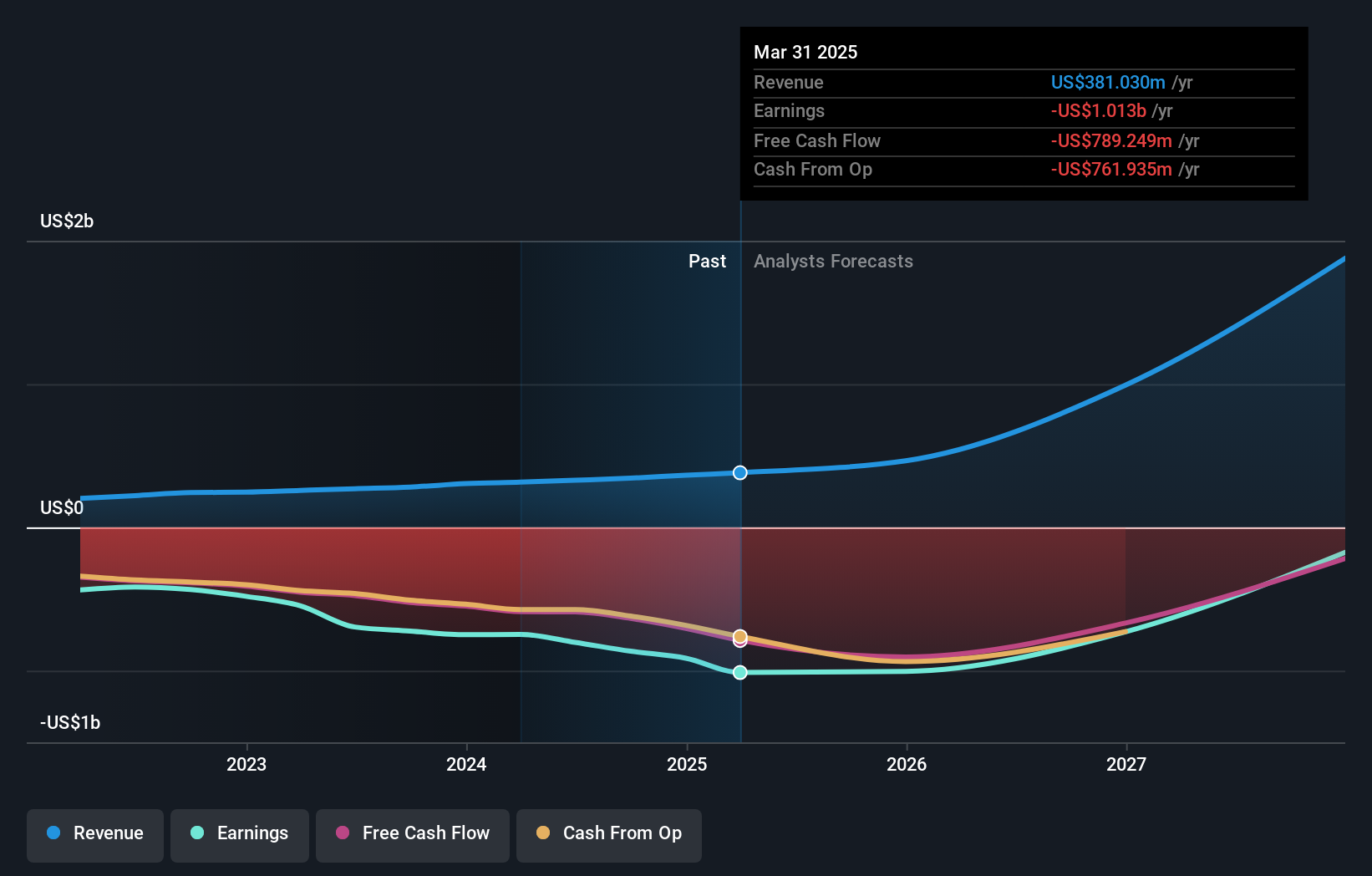

Operations: The company generates revenue primarily from the development and commercialization of therapies for patients with rare diseases, totaling $381.03 million.

Insmed has been making significant strides in the biotech sector, underscored by its recent inclusion in multiple Russell indexes and a successful $750 million equity offering. These developments reflect growing investor confidence spurred by promising Phase 2b results for treprostinil palmitil, which achieved all primary and secondary efficacy endpoints. Despite a current unprofitable status, Insmed's aggressive R&D focus—evidenced by substantial investments—is poised to drive future profitability with an expected revenue growth of 42.8% per year and earnings forecast to surge at an annual rate of 61.4%. This strategic emphasis on innovation positions Insmed well within the high-growth tech landscape, particularly as it advances treatments for rare diseases with high unmet medical needs.

Palantir Technologies (PLTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Palantir Technologies Inc. develops software platforms for intelligence operations globally and has a market cap of $335.34 billion.

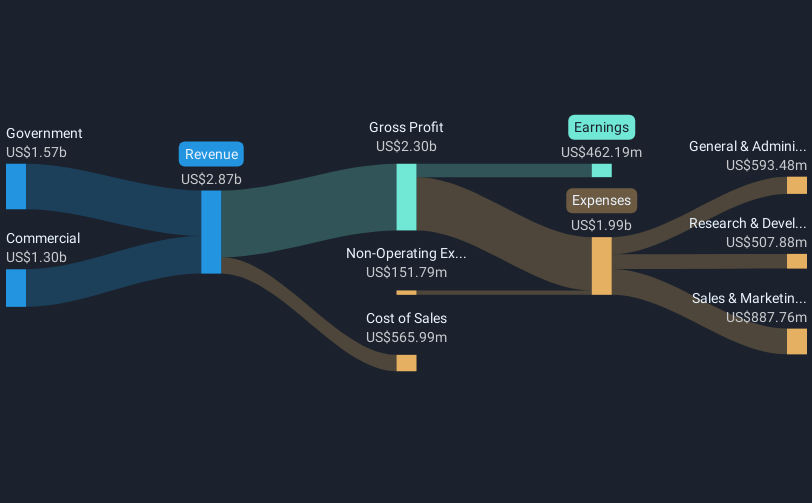

Operations: The company generates revenue primarily through two segments: Commercial, which brought in $1.39 billion, and Government, with $1.72 billion in revenue.

Palantir Technologies, amidst a dynamic tech landscape, continues to forge strategic alliances enhancing its operational AI capabilities across various sectors. Recently, the company announced collaborations with Tomorrow.io and BlueForge Alliance to integrate advanced weather intelligence and accelerate digital shipbuilding respectively. These partnerships not only expand Palantir's service offerings but also solidify its position in critical industries by leveraging its AI-driven platforms for real-time decision-making. Financially, Palantir has shown robust growth with a 22.4% increase in annual revenue and an impressive 30.6% rise in earnings per year, underpinned by substantial R&D investments that drive continuous innovation and maintain competitive edge in high-stakes markets like defense and government services.

- Dive into the specifics of Palantir Technologies here with our thorough health report.

Assess Palantir Technologies' past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 227 US High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives