- United States

- /

- Pharma

- /

- NasdaqGS:INDV

How Indivior’s Return to Profitability and Higher Revenue Guidance Will Impact INDV Investors

Reviewed by Simply Wall St

- Indivior reported a return to profitability in the second quarter of 2025, posting US$18 million in net income and raising its full-year net revenue guidance.

- This turnaround marks a significant shift from the previous year's net loss and highlights progress amid ongoing legal and management challenges.

- We'll explore how Indivior's improved net revenue guidance sharpens the investment narrative around its operational and risk management progress.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Indivior's Investment Narrative?

Indivior’s latest swing to profitability, with US$18 million in net income and a raised full-year revenue outlook, stands out as a key turning point for the company. This fresh guidance could sharpen the immediate focus on Indivior’s operational execution and efforts to build investor confidence, particularly as previous debates centered on recurring losses and one-off charges. While these results highlight improvement, the immediate catalysts now center on ongoing product performance, new leadership integration, and execution on recently approved therapies. However, the positive news does not erase risks, particularly ongoing class action litigation, concerns about high debt levels, and repeated management changes, which may all shape sentiment in the quarters ahead. The business remains in a transition phase, and whether stronger earnings can be sustained or legal pressures escalate will likely be in sharper focus as investors adjust their outlook in real time.

But despite the upbeat earnings, legal issues continue to cast a shadow that investors should be watching closely.

Exploring Other Perspectives

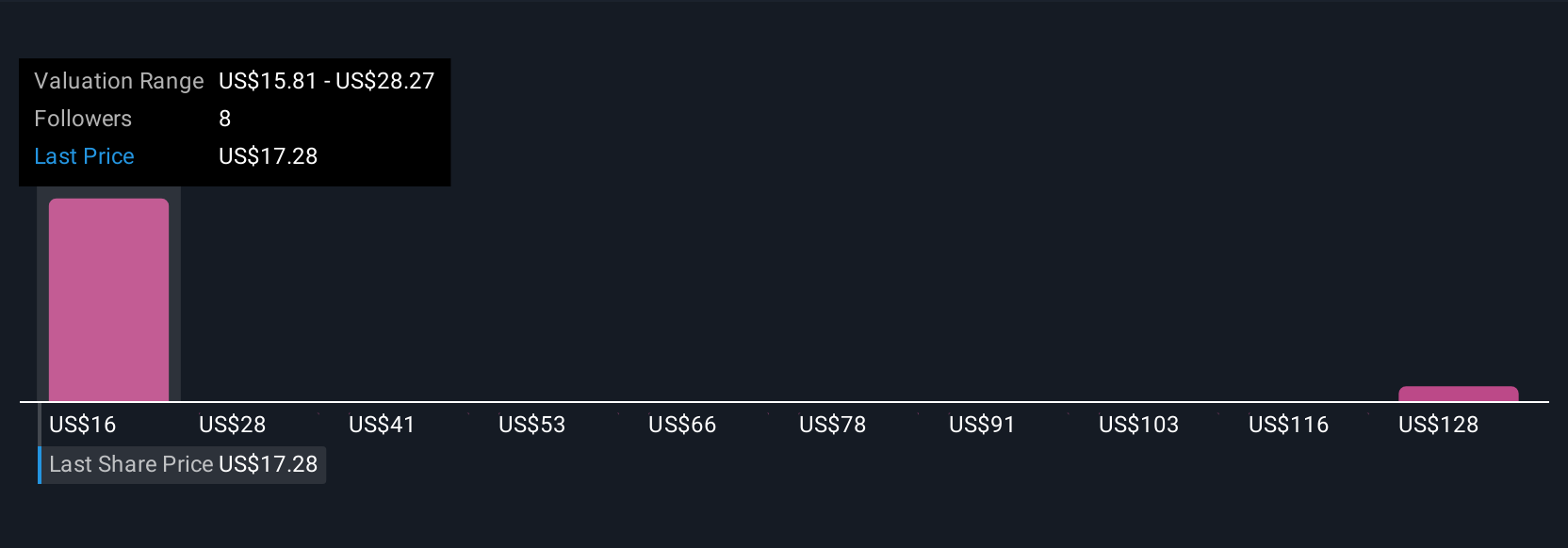

Explore 5 other fair value estimates on Indivior - why the stock might be worth 30% less than the current price!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives