- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

Will Immatics (IMTX) Gain Momentum as New CFO Brings Biopharma Commercialization Expertise?

Reviewed by Sasha Jovanovic

- Immatics N.V. has appointed Venkat Ramanan, Ph.D., as its new Chief Financial Officer, bringing over 25 years of biopharmaceutical finance experience and succeeding Arnd Christ.

- Dr. Ramanan’s extensive background in guiding companies through product launches and international expansion is expected to support Immatics’ move toward commercializing its PRAME cell therapy, anzu-cel, for metastatic melanoma.

- We’ll explore how Dr. Ramanan’s expertise in advancing biopharma commercialization influences Immatics’ broader investment narrative at this critical juncture.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Immatics' Investment Narrative?

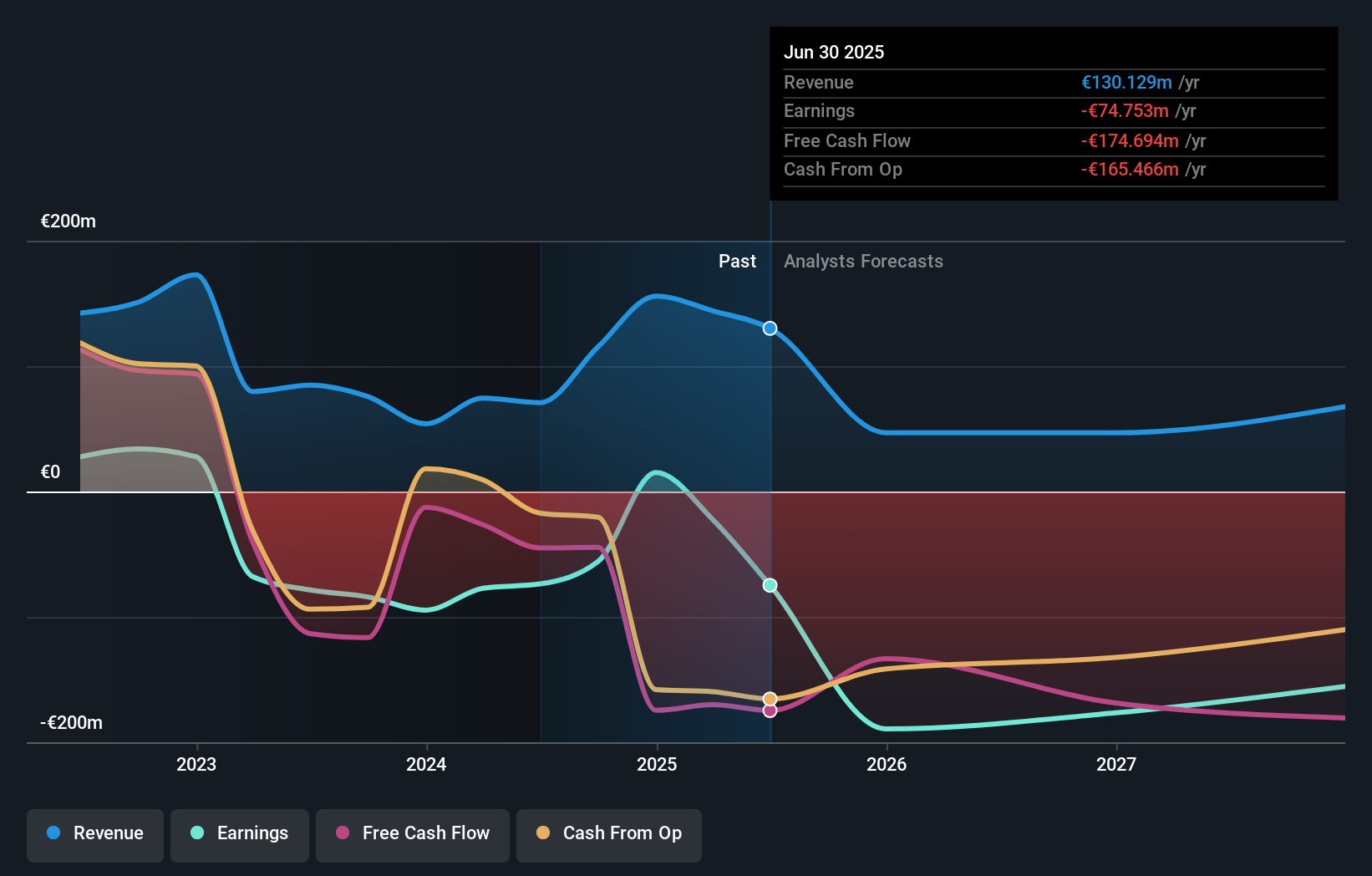

For investors looking at Immatics N.V., the core belief centers on the company’s ability to advance and commercialize its PRAME-targeted cell therapy, anzu-cel, especially as early data from the Phase 1b trial points to promising efficacy in metastatic melanoma. The recent appointment of Dr. Venkat Ramanan as CFO could sharpen the company’s focus on scaling up for commercialization, given his background in guiding product launches and managing financial operations across industry heavyweights. In the short term, Dr. Ramanan’s arrival may influence the structuring of further capital raises, alliances, and operational efficiency as Immatics faces growing development costs and ongoing net losses, which rose sharply this year. While the share price has experienced a surge recently, likely reflecting optimism, the company is still unprofitable, not forecast to become profitable soon, and operating in a sector where clinical and regulatory execution risk remains high. Whether this leadership change is sufficient to alter the capital or risk profile is yet to play out, but the potential for a more robust commercial strategy is clear as Immatics readies for major trial milestones.

But, despite the momentum, operational losses and dilution risks shouldn’t be overlooked by investors. In light of our recent valuation report, it seems possible that Immatics is trading beyond its estimated value.Exploring Other Perspectives

Explore 3 other fair value estimates on Immatics - why the stock might be worth less than half the current price!

Build Your Own Immatics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immatics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Immatics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immatics' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives