- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

Revenues Working Against Immatics N.V.'s (NASDAQ:IMTX) Share Price

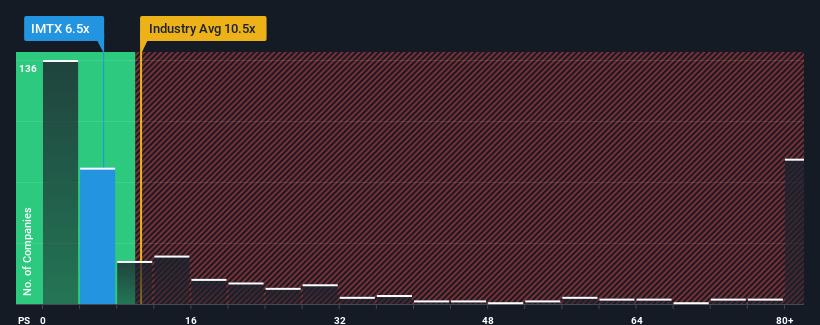

With a price-to-sales (or "P/S") ratio of 6.5x Immatics N.V. (NASDAQ:IMTX) may be sending bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 10.5x and even P/S higher than 62x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Immatics

How Immatics Has Been Performing

Immatics could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Immatics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Immatics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Immatics' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 53% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 18% each year as estimated by the seven analysts watching the company. Meanwhile, the broader industry is forecast to expand by 112% each year, which paints a poor picture.

In light of this, it's understandable that Immatics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Immatics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Immatics (1 is potentially serious!) that you should be aware of.

If you're unsure about the strength of Immatics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives