- United States

- /

- Biotech

- /

- NasdaqGS:IMGN

There's Reason For Concern Over ImmunoGen, Inc.'s (NASDAQ:IMGN) Massive 95% Price Jump

The ImmunoGen, Inc. (NASDAQ:IMGN) share price has done very well over the last month, posting an excellent gain of 95%. The last 30 days were the cherry on top of the stock's 535% gain in the last year, which is nothing short of spectacular.

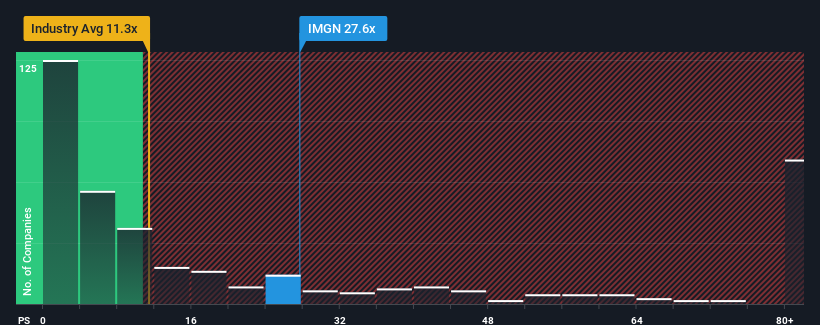

Following the firm bounce in price, ImmunoGen's price-to-sales (or "P/S") ratio of 27.6x might make it look like a strong sell right now compared to other companies in the Biotechs industry in the United States, where around half of the companies have P/S ratios below 11.3x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for ImmunoGen

How Has ImmunoGen Performed Recently?

Recent times have been advantageous for ImmunoGen as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ImmunoGen will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ImmunoGen?

ImmunoGen's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 201% last year. The latest three year period has also seen an excellent 215% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 49% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 235% each year growth forecast for the broader industry.

With this information, we find it concerning that ImmunoGen is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On ImmunoGen's P/S

The strong share price surge has lead to ImmunoGen's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for ImmunoGen, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for ImmunoGen (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of ImmunoGen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade ImmunoGen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IMGN

ImmunoGen

ImmunoGen, Inc., a commercial-stage biotechnology company, focuses on developing and commercializing the antibody-drug conjugates (ADCs) for cancer patients.

Exceptional growth potential with adequate balance sheet.