- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Assessing Illumina’s Value After the Recent Stock Rally and Q1 Earnings Report

Reviewed by Bailey Pemberton

If you have been watching Illumina, you have probably noticed the stock seems to have gotten caught up in a whirlwind recently. It has been a tough ride for anyone holding shares, with long-term returns running deep in the red, down nearly 70% over the past five years. Recently, though, the mood has shifted a bit. In just the past week, Illumina climbed 6.4%, a notable pop, and even over the last month it is up 2.1%. While that is still well below its earlier heights, these upticks suggest some renewed optimism is making its way into the market’s view of Illumina.

Much of this improvement in sentiment comes as investors weigh shifting perceptions about risk and potential reward. Even with the biotech sector facing challenges, Illumina draws attention because investors are sensing a possible turning point. Hints of strategic clarity around its business model and confidence in demand for its sequencing technology are filtering through, and that can shift how people value the company, even before any fundamental numbers change significantly.

Valuation is often where debate heats up, and Illumina’s case is especially interesting. According to our checks, the company earns a value score of 4 out of 6, meaning Illumina is undervalued on four separate measures right now. That is not common for a high-profile name in such a high-growth industry. Up next, we will dig deeper into how these valuation approaches stack up. Even better, we will share a perspective that goes beyond the usual number crunching.

Why Illumina is lagging behind its peers

Approach 1: Illumina Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that projects a company’s future free cash flows and then discounts them back to their present value. This method estimates what the entire business is intrinsically worth today, based on expected future cash generation.

For Illumina, the latest reported Free Cash Flow stands at $917.6 million. Analysts have forecasted cash flow out to 2028, with Simply Wall St extrapolating those estimates to 2035. According to these projections, Illumina’s Free Cash Flow is expected to grow steadily each year and reach approximately $957.7 million in 2035. All figures are calculated in US dollars.

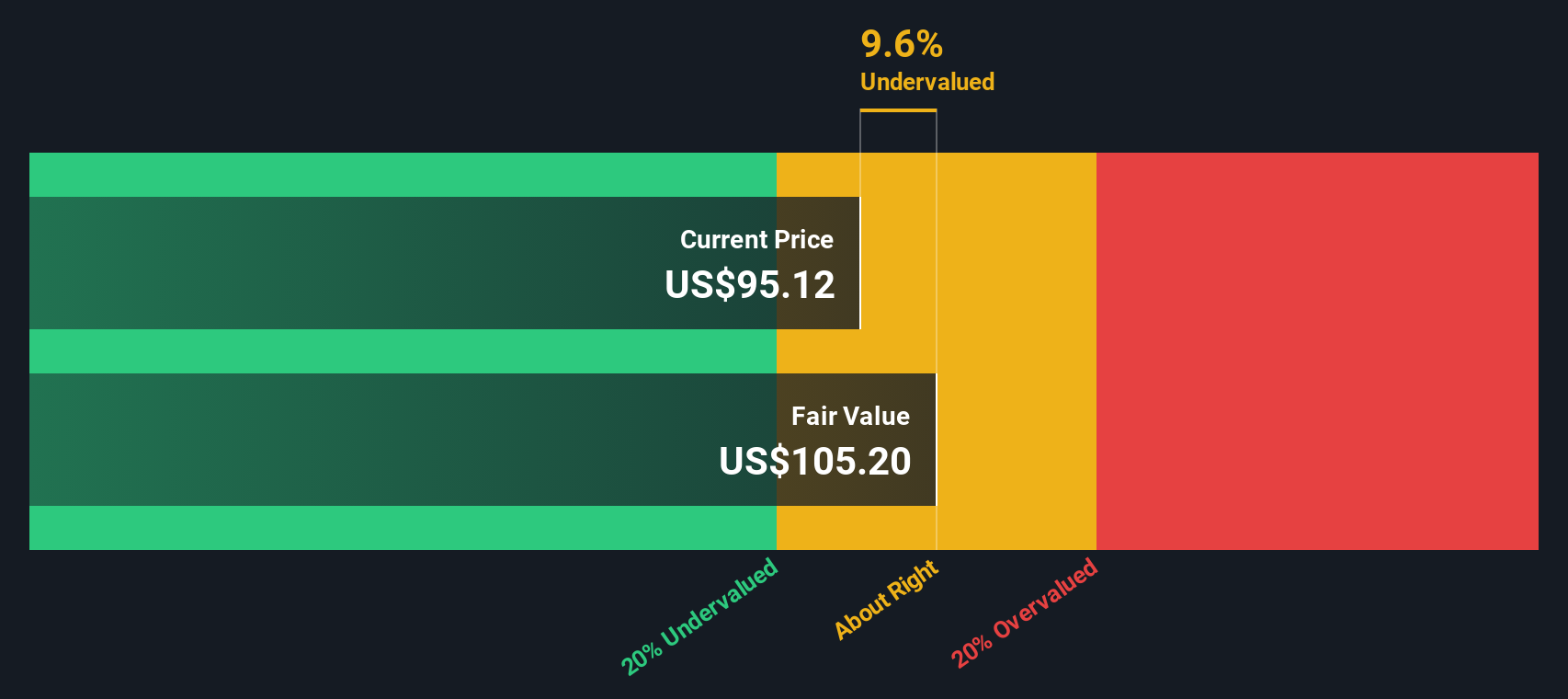

Based on the DCF analysis (using the 2 Stage Free Cash Flow to Equity model), the estimated intrinsic share value comes to $103.79. This represents a 2.7% discount compared to the current market price, which indicates the stock is just slightly undervalued.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Illumina's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Illumina Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored way to value companies with steady profitability, like Illumina. It gives investors a quick check on how much they are paying for each dollar of current earnings, making it especially relevant for companies where positive earnings can be expected year after year.

Market expectations for future growth, profitability, and risk all contribute to what makes a “normal” or “fair” PE ratio for a stock. High-growth, low-risk companies tend to command higher PE ratios. In contrast, slower growers or those facing more industry uncertainty may trade at a discount.

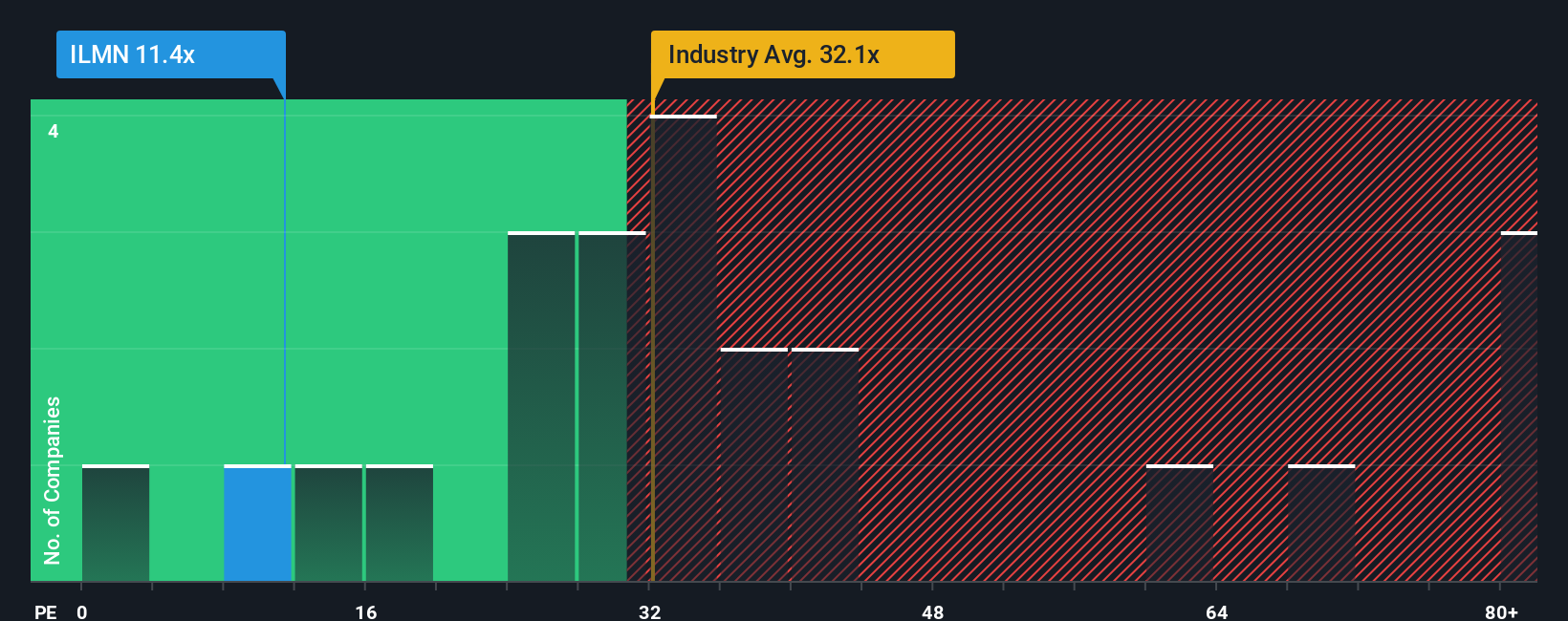

Illumina currently trades at a PE ratio of 12.36x. For context, this is well below the Life Sciences industry average of 32.73x and also lower than the peer average of 28.73x. Such a gap suggests the market is cautious about Illumina, possibly reflecting uncertainties or lower expectations compared to its industry peers.

Simply Wall St's “Fair Ratio” for Illumina stands at 18.14x. This proprietary metric goes deeper than a simple peer or industry comparison by factoring in specifics like Illumina’s recent earnings growth, profit margins, risks, market cap, and competitiveness within its sector. The Fair Ratio offers a more balanced view of what multiple the company deserves.

Comparing Illumina’s current PE to its Fair Ratio, the stock trades noticeably below what the Fair Ratio suggests would be “normal.” By this measure, Illumina looks undervalued using its PE multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Illumina Narrative

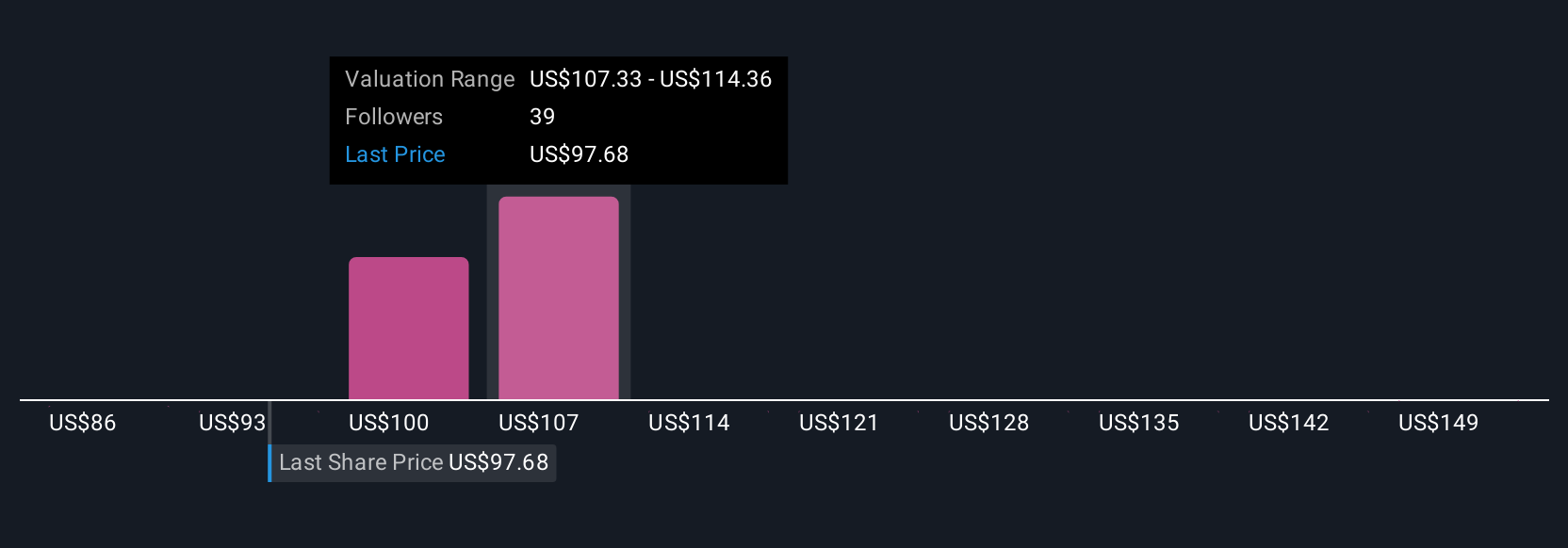

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is more than just numbers; it is a clear story about a company’s future based on your own assumptions about growth, risk, demand, and margins. Narratives let investors explain in plain language what they believe will happen for Illumina and then connect that belief directly to a financial forecast and an estimated fair value.

Narratives are not just for professionals. They are an easy and accessible tool available to millions of investors on the Simply Wall St Community page. By building your own Narrative for Illumina, you can see exactly how your expectations line up against others. You can also quickly spot if you want to buy, hold, or sell by comparing your Fair Value with today’s share price. These Narratives are updated dynamically any time new facts emerge, whether that is a major earnings report or industry news, keeping your outlook current and relevant.

Take Illumina as an example. Some investors believe next-generation sequencing will drive double-digit growth, fueling a fair value as high as $185. Others worry about competition and budget constraints, landing on a fair value as low as $75. With Narratives, both perspectives are visible, so you can see the full range of market thinking in real time and decide which story makes the most sense for your own investment goals.

Do you think there's more to the story for Illumina? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives