- United States

- /

- Software

- /

- NasdaqGS:MAPS

Prenetics Global And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As the post-election stock market rally loses steam, major indexes in the United States have shown mixed results, reflecting investor uncertainty amid fluctuating interest rates and inflation data. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential value and growth opportunities. Though the term "penny stocks" may seem outdated, these investments can still offer unique prospects when backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81915 | $6.09M | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $1.50 | $81.55M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.52M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.02B | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.40 | $125.19M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $72.53M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2482 | $9.05M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9278 | $87.69M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Prenetics Global (NasdaqGM:PRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prenetics Global Limited is a health sciences company dedicated to advancing consumer and clinical health, with a market cap of $54.86 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: $54.86M

Prenetics Global Limited, with a market cap of US$54.86 million, reported second-quarter sales of US$5.94 million and a net loss of US$10.72 million, showing improvement from the previous year. Despite being unprofitable and experiencing high volatility in share price, the company is debt-free with short-term assets exceeding liabilities by a significant margin. Revenue is forecast to grow substantially at over 90% per year; however, profitability isn't expected soon. The management and board are relatively new with average tenures under two years, indicating potential strategic shifts ahead for this health sciences firm.

- Click here and access our complete financial health analysis report to understand the dynamics of Prenetics Global.

- Evaluate Prenetics Global's prospects by accessing our earnings growth report.

InflaRx (NasdaqGS:IFRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InflaRx N.V. is a clinical-stage biopharmaceutical company focused on discovering and developing C5a inhibitor technology in Germany and the United States, with a market cap of $88.91 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company.

Market Cap: $88.91M

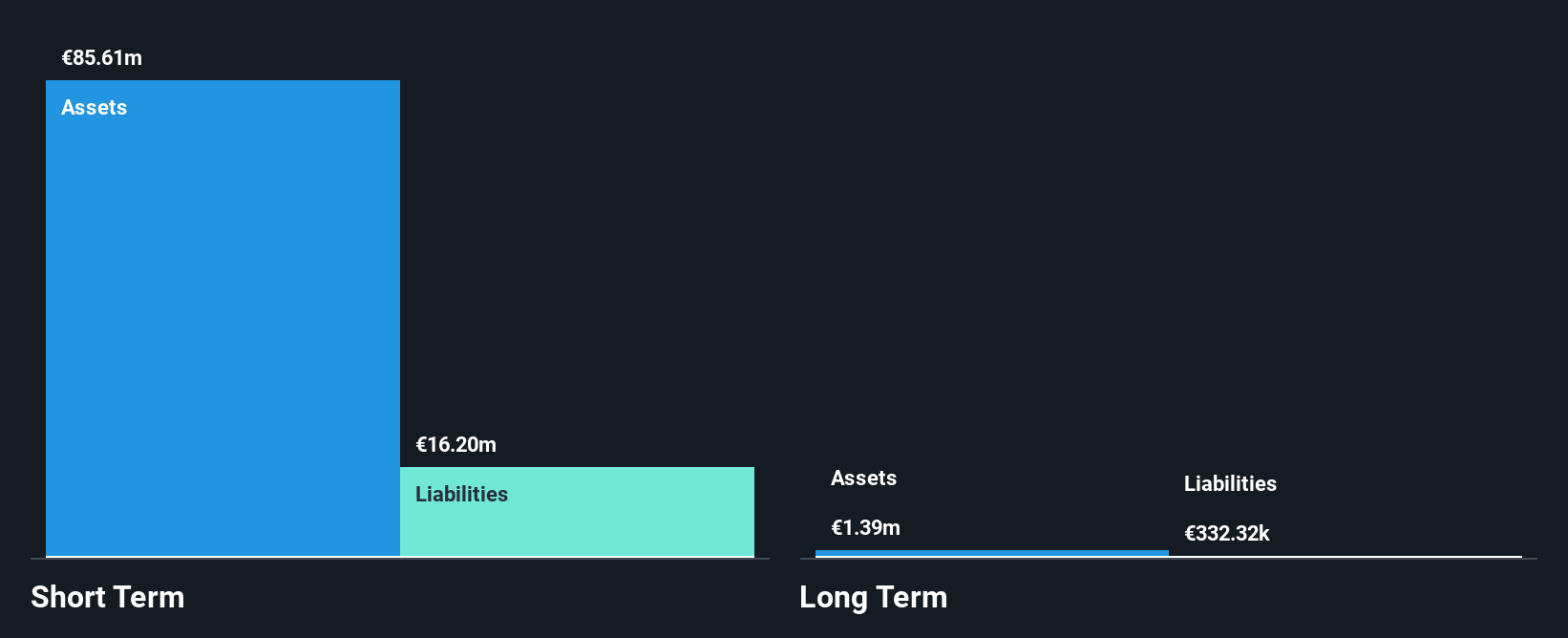

InflaRx, with a market cap of US$88.91 million, is pre-revenue and reported minimal sales of €0.17 million for the first nine months of 2024, highlighting its early-stage status. Despite reducing losses by 2.3% annually over five years, it remains unprofitable with a net loss increasing to €40.95 million year-to-date. The company has less than one year of cash runway and no debt obligations, indicating financial vulnerability but also no leverage risk. Its management team averages nearly four years in tenure, suggesting stability amid ongoing development efforts in C5a inhibitor technology across Germany and the U.S.

- Jump into the full analysis health report here for a deeper understanding of InflaRx.

- Examine InflaRx's earnings growth report to understand how analysts expect it to perform.

WM Technology (NasdaqGS:MAPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WM Technology, Inc. offers ecommerce and compliance software solutions for retailers and brands in the cannabis market both in the United States and internationally, with a market cap of approximately $119.96 million.

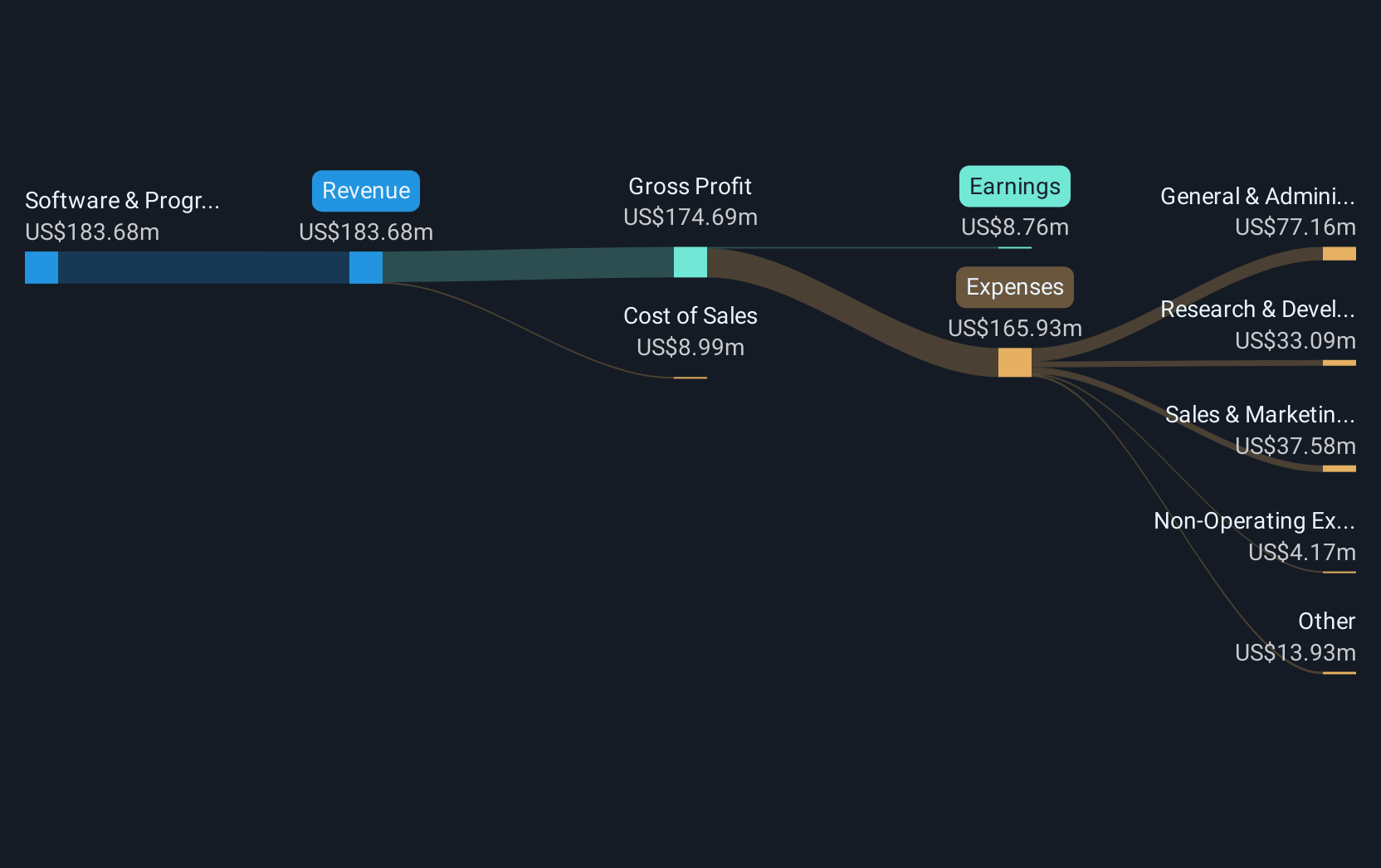

Operations: WM Technology generates revenue primarily from its Software & Programming segment, totaling $183.45 million.

Market Cap: $119.96M

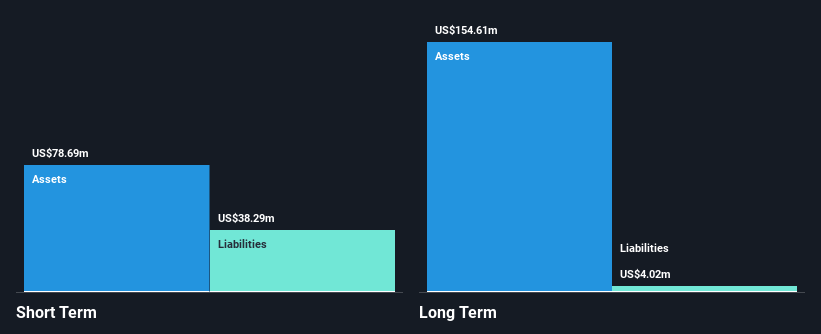

WM Technology, Inc., with a market cap of US$119.96 million, faces challenges typical of penny stocks. Despite generating US$183.45 million in revenue from its Software & Programming segment, the company is currently unprofitable and has a negative return on equity. However, it remains debt-free and possesses sufficient cash runway for over three years if current free cash flow levels are maintained. Recent developments include receiving a Nasdaq compliance notice due to its stock trading below US$1 per share and facing legal challenges over alleged misleading statements about user metrics, which could impact investor sentiment further.

- Get an in-depth perspective on WM Technology's performance by reading our balance sheet health report here.

- Assess WM Technology's future earnings estimates with our detailed growth reports.

Next Steps

- Click through to start exploring the rest of the 735 US Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WM Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAPS

WM Technology

Provides ecommerce and compliance software solutions to retailers and brands in cannabis market in the United States and internationally.

Flawless balance sheet and undervalued.