- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

If You Had Bought IDEAYA Biosciences (NASDAQ:IDYA) Stock A Year Ago, You Could Pocket A 68% Gain Today

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the IDEAYA Biosciences, Inc. (NASDAQ:IDYA) share price is 68% higher than it was a year ago, much better than the market return of around 41% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow IDEAYA Biosciences for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for IDEAYA Biosciences

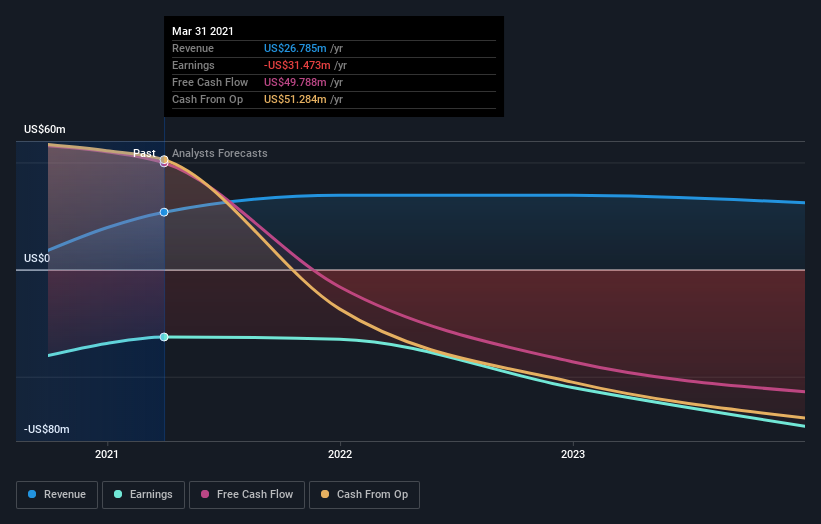

Given that IDEAYA Biosciences didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

IDEAYA Biosciences is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

IDEAYA Biosciences shareholders should be happy with the total gain of 68% over the last twelve months. That's better than the more recent three month gain of 8.8%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with IDEAYA Biosciences (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

We will like IDEAYA Biosciences better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade IDEAYA Biosciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives