- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

IDEAYA Biosciences (IDYA): Valuation Check After Pipeline Progress Sparks Fresh Investor Interest

Reviewed by Simply Wall St

If you have been following IDEAYA Biosciences (IDYA), you have likely noticed a sharp uptick in attention after a series of clinical data releases. Over the past week, the company presented encouraging results for three different programs: IDE849 for small cell lung cancer, darovasertib in primary uveal melanoma, and IDE397 in combination with Trodelvy in late-line urothelial cancer. Each update points to promising efficacy and manageable safety. These are key details that matter when evaluating biotech stocks where clinical milestones can rapidly shift expectations.

The steady drip of positive trial data appears to have fueled optimism, shining a spotlight on IDEAYA’s pipeline at a time when long-term momentum matters. In the past month, the stock is up around 8%, building on a 10% gain in the past three months. Yet, if you zoom out, the one-year return is still down more than 31%. Despite the pullback from last year’s highs, IDEAYA’s five-year total return clocks in at nearly 888%. This underlines both the volatile nature and the powerful upside these kinds of stories can carry for patient investors, especially as new clinical milestones arrive.

This brings us to a big question: With momentum building and a suite of programs moving forward, is the market underpricing IDEAYA’s future growth, or is all the good news already baked into today’s share price?

Price-to-Book of 2.3x: Is it Justified?

Based on the price-to-book ratio, IDEAYA Biosciences trades at a multiple of 2.3 times book value, which is slightly higher than the US Biotechs industry average of 2.2x. This suggests that, compared to its peers, the stock appears somewhat expensive on this metric.

The price-to-book (P/B) ratio measures the market's valuation of a company's equity relative to its book value. For biotech firms that are often unprofitable and capital-intensive, P/B can signal how much investors are willing to pay above the company’s net assets. This often reflects the perceived value of upcoming clinical milestones and future growth potential.

While the premium is modest, it indicates that the market may be assigning extra value to IDEAYA’s pipeline progress or future potential, even as profitability still lies ahead. The higher ratio may be difficult to justify if clinical or commercial success is delayed. However, strong pipeline momentum could sustain investor optimism.

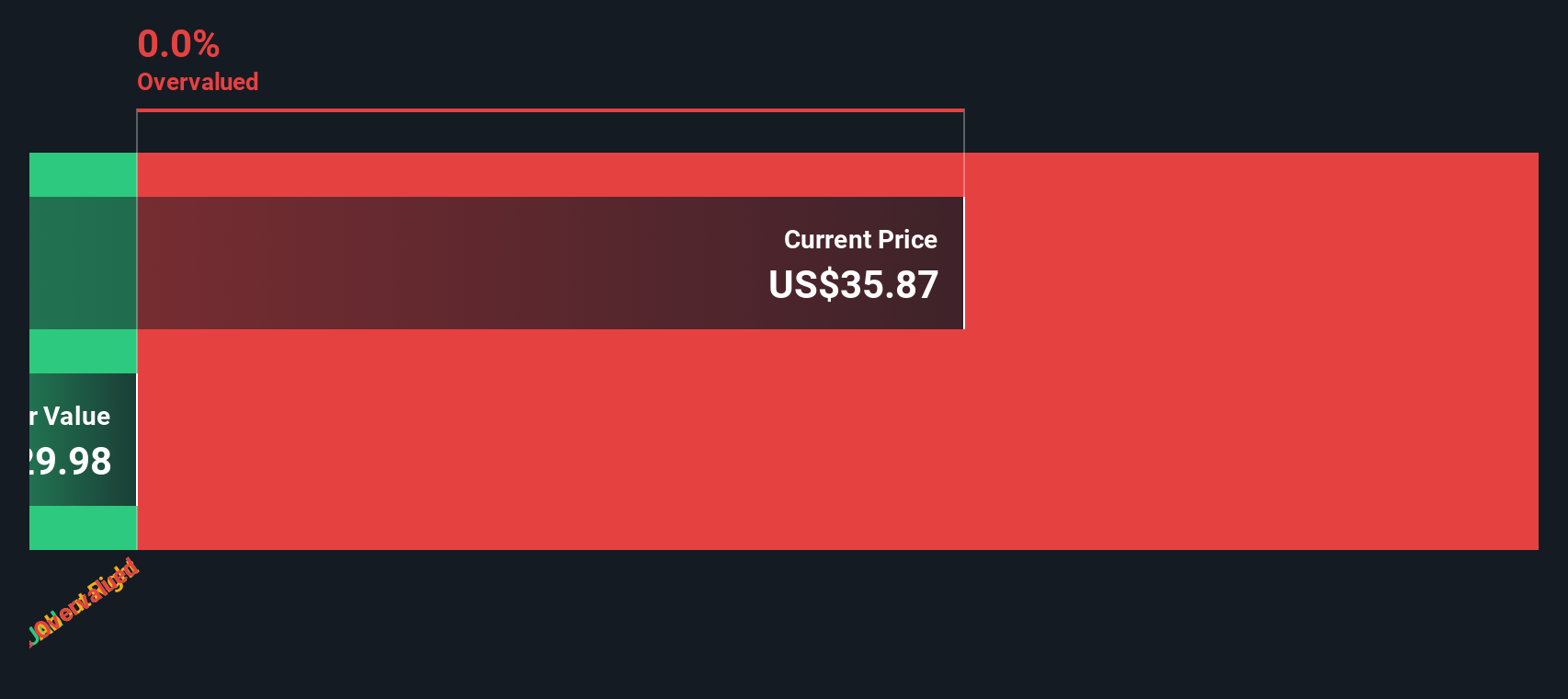

Result: Fair Value of $24.71 (ABOUT RIGHT)

See our latest analysis for IDEAYA Biosciences.However, persistent losses and any setbacks in clinical trials could quickly erode current optimism. This highlights how fragile biotech momentum can be for investors.

Find out about the key risks to this IDEAYA Biosciences narrative.Another View: Discounted Cash Flow

Taking a different perspective, our DCF model looks at the company based on its expected future cash flows rather than book values. This approach currently finds IDEAYA’s value to be in line with the market. However, does this method truly capture the story for a biotech in growth mode?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IDEAYA Biosciences Narrative

If you feel there’s another angle to consider or want to work through the numbers yourself, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your IDEAYA Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Take your portfolio to the next level by checking out these handpicked stock themes. The right opportunity could be one click away, so don’t miss out!

- Supercharge your growth strategy by uncovering promising up-and-comers with penny stocks with strong financials on their side.

- Tap into the next healthcare breakthrough by browsing companies at the forefront of medical innovation, all found by using our healthcare AI stocks.

- Boost your income potential with equities that consistently deliver strong payouts. Start your search with dividend stocks with yields > 3% now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026