- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

ICON (NASDAQ:ICLR) stock performs better than its underlying earnings growth over last five years

Some ICON Public Limited Company (NASDAQ:ICLR) shareholders are probably rather concerned to see the share price fall 34% over the last three months. But the silver lining is the stock is up over five years. However we are not very impressed because the share price is only up 30%, less than the market return of 103%.

The past week has proven to be lucrative for ICON investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for ICON

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

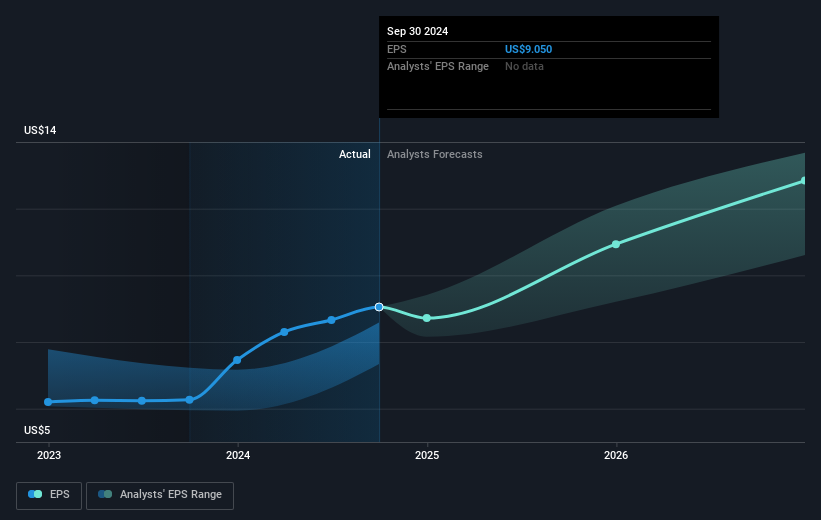

Over half a decade, ICON managed to grow its earnings per share at 6.2% a year. This EPS growth is reasonably close to the 5% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Indeed, it would appear the share price is reacting to the EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on ICON's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in ICON had a tough year, with a total loss of 22%, against a market gain of about 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is ICON cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Very undervalued with solid track record.