- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 24% over the past year, with earnings forecast to grow by 15% annually. In this context of robust growth expectations, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in a rapidly evolving industry landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

MicroVision (NasdaqGM:MVIS)

Simply Wall St Growth Rating: ★★★★★☆

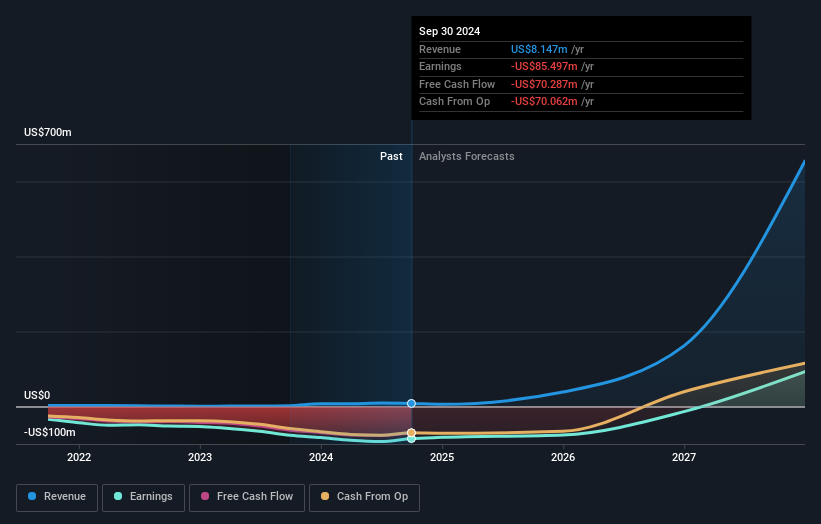

Overview: MicroVision, Inc. focuses on developing and selling lidar sensors and software for automotive safety and autonomous driving applications, with a market capitalization of approximately $330.72 million.

Operations: The company generates revenue primarily from the sale and servicing of lidar hardware and software, amounting to $8.15 million.

MicroVision, despite its unprofitability, is navigating a high-growth trajectory with an expected annual revenue surge of 64.6%, outpacing the broader US market's growth rate of 9.2%. This aggressive expansion is underscored by recent strategic moves such as ramping up production of its MOVIA L sensors, targeting the robust industrial sector demand. The company's forward-looking strategy also includes becoming profitable within three years, supported by a significant increase in earnings projected at an annual rate of 62.16%. These developments reflect MicroVision's adaptability and potential to capitalize on emerging market opportunities despite current financial challenges and shareholder dilution over the past year.

- Click here and access our complete health analysis report to understand the dynamics of MicroVision.

Assess MicroVision's past performance with our detailed historical performance reports.

Exelixis (NasdaqGS:EXEL)

Simply Wall St Growth Rating: ★★★★☆☆

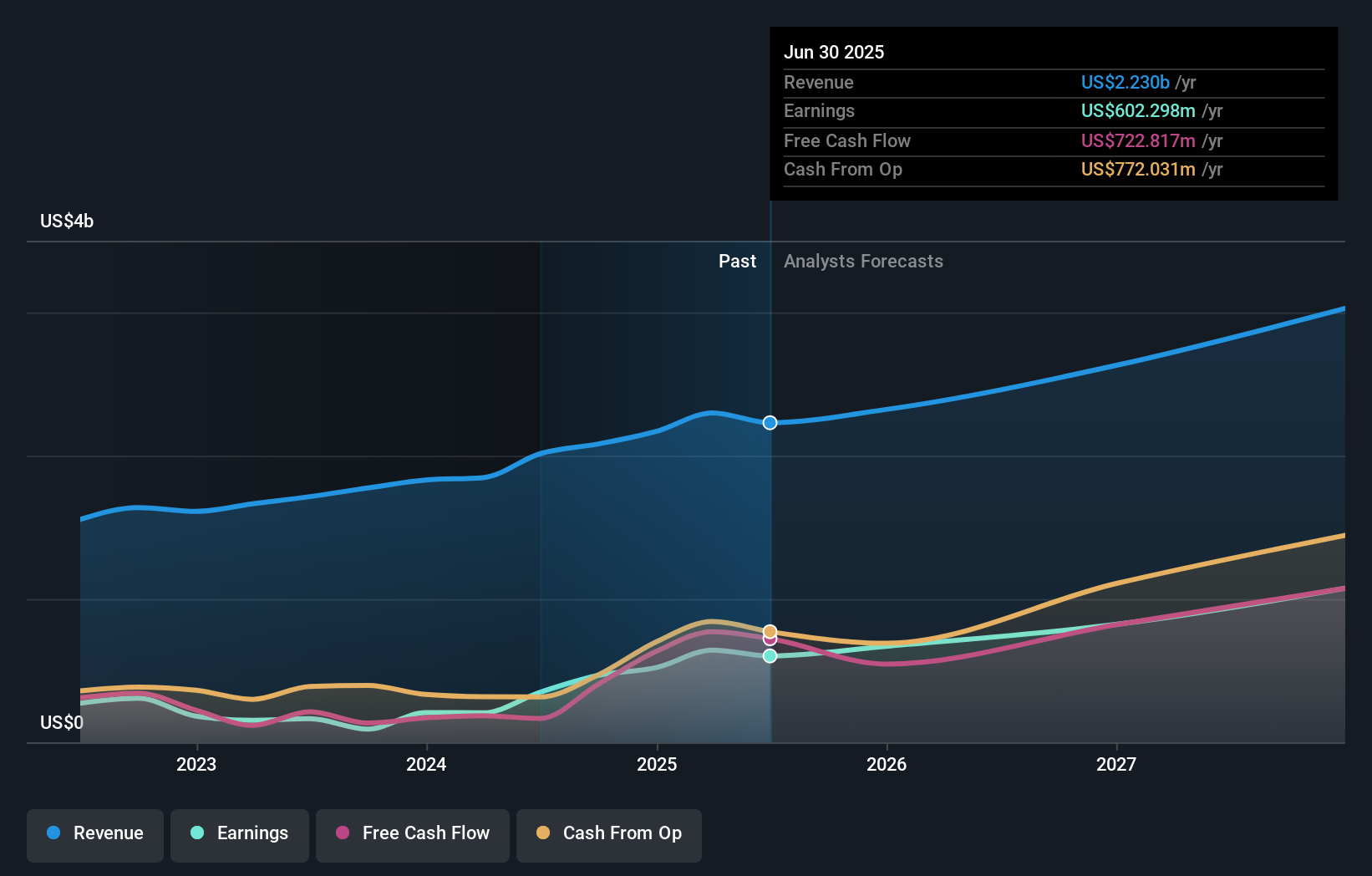

Overview: Exelixis, Inc. is an oncology company dedicated to discovering, developing, and commercializing new medicines for difficult-to-treat cancers in the United States, with a market cap of approximately $9.66 billion.

Operations: Exelixis generates revenue primarily from the discovery, development, and commercialization of medicines targeting difficult-to-treat cancers, amounting to $2.08 billion. The company focuses its efforts within the United States oncology market.

Exelixis, a player in the competitive biotech field, has demonstrated robust financial and operational growth with a remarkable 407.1% increase in earnings over the past year. This growth trajectory is complemented by an anticipated annual revenue rise of 9.3%, slightly outpacing the broader US market's forecast of 9.2%. Recent strategic developments include FDA interactions regarding new drug applications for cabozantinib, enhancing its portfolio in treating complex cancers. These initiatives not only underscore Exelixis’s commitment to expanding its therapeutic footprint but also highlight its strategic agility in navigating regulatory landscapes and enhancing shareholder value through focused R&D efforts and recent share repurchases totaling $12.37 million.

- Get an in-depth perspective on Exelixis' performance by reading our health report here.

Examine Exelixis' past performance report to understand how it has performed in the past.

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

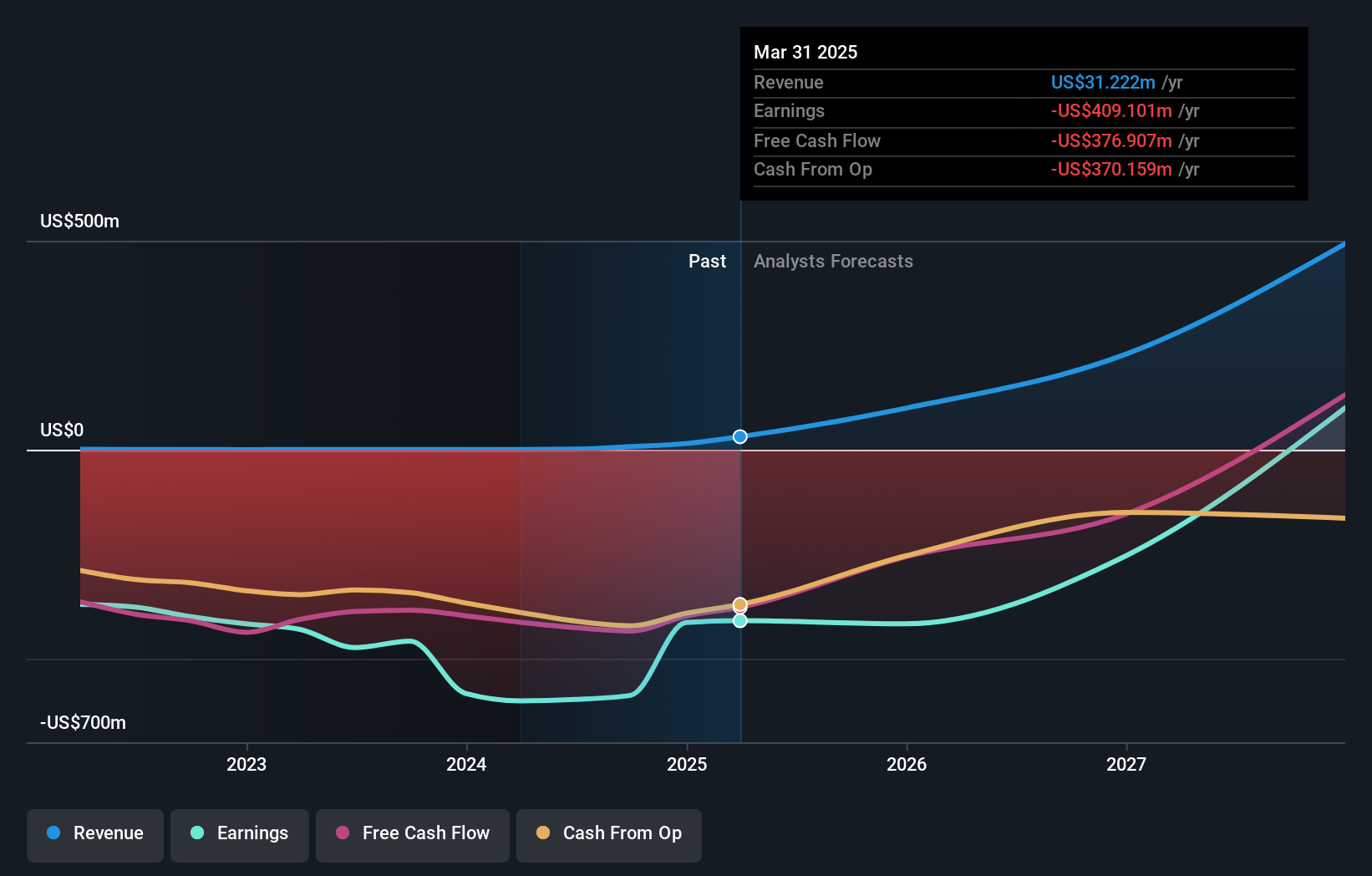

Overview: ImmunityBio, Inc. is a clinical-stage biotechnology company focused on developing therapies and vaccines that enhance the natural immune system to combat cancers and infectious diseases, with a market cap of approximately $1.94 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $7.33 million. As a clinical-stage entity, it is focused on advancing therapies and vaccines aimed at enhancing immune responses against cancer and infectious diseases.

ImmunityBio, despite its current unprofitability, is poised for significant growth with expected revenue increases of 72.1% annually—outpacing the broader U.S. market's 9.2% forecast. The company recently completed a $100 million follow-on equity offering and announced a strategic alliance with nCartes to streamline data processes in clinical trials, highlighting its innovative approach to enhancing operational efficiencies and reducing costs. This collaboration could revolutionize data management in clinical settings, potentially accelerating ImmunityBio's journey towards profitability within three years as it continues to develop groundbreaking immunotherapies like ANKTIVA, which has shown a 71% complete response rate in treating bladder cancer.

- Dive into the specifics of ImmunityBio here with our thorough health report.

Evaluate ImmunityBio's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our US High Growth Tech and AI Stocks list of 236 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A clinical-stage biotechnology company, engages in developing therapies and vaccines that bolster the natural immune system to defeat cancers and infectious diseases.

High growth potential low.