- United States

- /

- Biotech

- /

- NYSEAM:SCPX

Here's Why We're Not Too Worried About Heat Biologics' (NASDAQ:HTBX) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Heat Biologics (NASDAQ:HTBX) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Heat Biologics

Does Heat Biologics Have A Long Cash Runway?

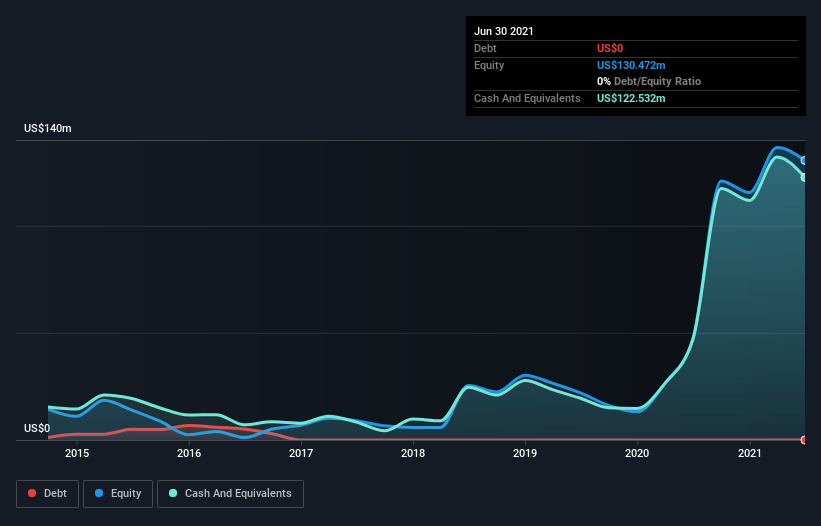

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2021, Heat Biologics had US$123m in cash, and was debt-free. In the last year, its cash burn was US$27m. Therefore, from June 2021 it had 4.6 years of cash runway. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Heat Biologics Growing?

Heat Biologics actually ramped up its cash burn by a whopping 77% in the last year, which shows it is boosting investment in the business. As if that's not bad enough, the operating revenue also dropped by 30%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Heat Biologics Raise Cash?

Even though it seems like Heat Biologics is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$184m, Heat Biologics' US$27m in cash burn equates to about 15% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Heat Biologics' Cash Burn A Worry?

On this analysis of Heat Biologics' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Heat Biologics' situation. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 4 warning signs for Heat Biologics that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

When trading Heat Biologics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Scorpius Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:SCPX

Scorpius Holdings

Through its subsidiary Scorpius BioManufacturing, operates as an integrated contract development and manufacturing organization.

Slight and fair value.