- United States

- /

- Pharma

- /

- NasdaqGM:HROW

Harrow (HROW): Evaluating Valuation After $250 Million Private Notes Offering and Debt Refinancing

Reviewed by Kshitija Bhandaru

If you’ve been eyeing Harrow (HROW) lately, you’ve probably noticed the buzz around their fresh $250 million private notes offering due in 2030. Completing this sizable debt raise and rolling the proceeds into refinancing existing loans is more than just shuffling numbers. It’s a move that could reset the company’s financial game plan, with sizable implications for both risk and growth. For investors deciding what to do with HROW, this isn’t just a routine balance sheet maneuver. It signals a shift in strategy that has the market’s attention.

The timing here is interesting. Over the past month, Harrow’s stock has climbed 13%, and it’s up a striking 43% in the past three months. These are clear signs of building momentum in the wake of debt-related headlines. That said, the 12-month return is slightly underwater, and there have been other developments, like a recent auditor switch, that may have muddied the picture for those watching short-term signals versus the long-term potential. The stock’s trajectory suggests investors are actively weighing what this refinancing means for future growth, profitability, and risk profile.

So, with Harrow’s recent moves and share price rally, is there still value to be found, or has the market already priced in the next phase of growth?

Most Popular Narrative: 26% Undervalued

The prevailing narrative views Harrow as significantly undervalued relative to its projected growth and future profit potential.

“The rapidly growing demand for Harrow's portfolio of specialty ophthalmic drugs, particularly VEVYE, IHEEZO, and TRIESENCE, is positioned to accelerate further as aging populations and increased prevalence of chronic ocular diseases expand the baseline patient pool. This supports sustainable long-term revenue growth. Strategic expansion into new indications and broader patient segments, such as TRIESENCE's expected launch into the large ocular inflammation market and BYQLOVI's entry into the post-operative care segment, coupled with rising healthcare access and coverage in the U.S., should increase prescription volumes and elevate top-line performance.”

Curious about what’s fueling this bold price target? There’s a financial model here with eye-catching forecasts for sales growth, profit margins, and future earnings power. The numbers behind it hint at a transformation worthy of investor attention. Ready to see why some believe the story for Harrow is just getting started?

Result: Fair Value of $60.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are risks, including Harrow’s dependency on key flagship products and uncertainty about whether recent rapid growth rates can be sustained.

Find out about the key risks to this Harrow narrative.Another Perspective: Multiples Send a Different Signal

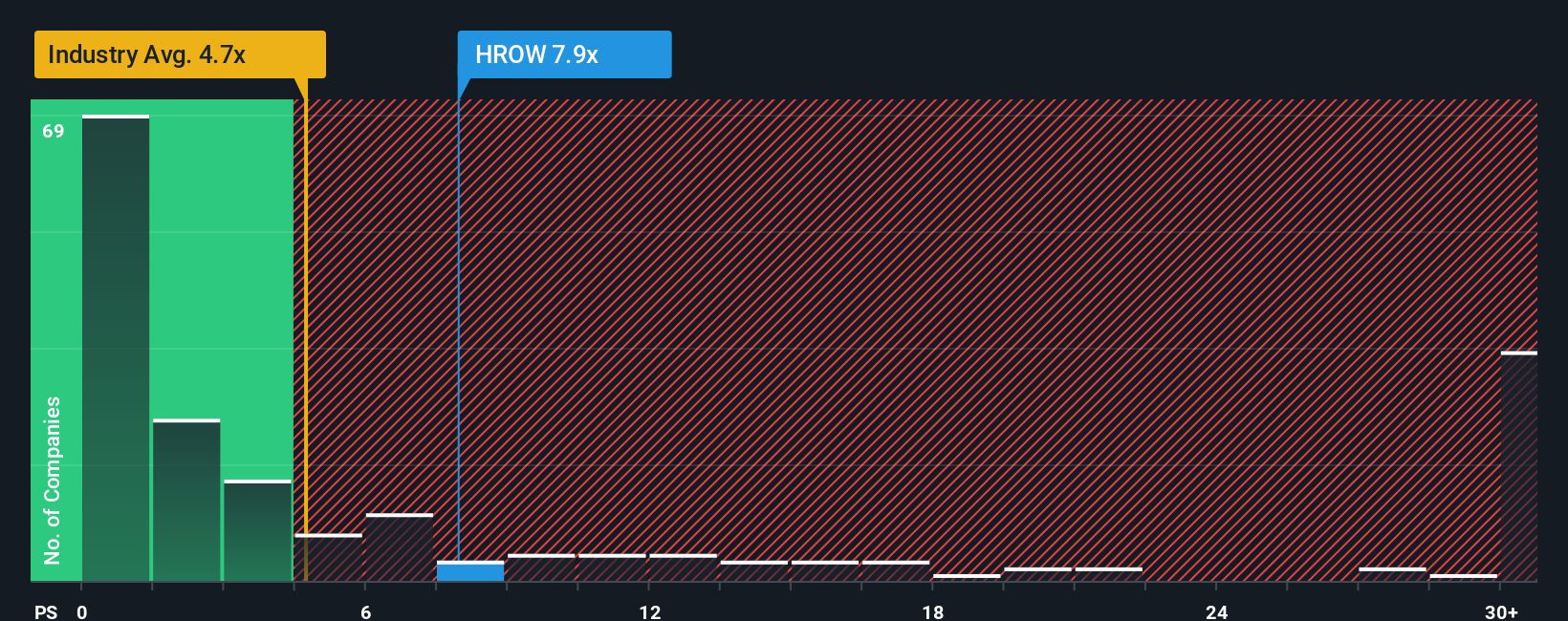

While the fair value model suggests plenty of upside, looking through the lens of the sales-based valuation presents a more cautious picture. By this measure, Harrow actually looks expensive compared to other pharmaceutical stocks. The question is whether growth is strong enough to justify this, or if expectations are simply running too high.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Harrow to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Harrow Narrative

Not convinced by the current viewpoint, or want to run the numbers your way? You can dive in and shape your own story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Harrow.

Looking for More Smart Investing Moves?

Don’t limit your opportunities to just one company when there’s a world of promising stocks out there. Act now to stay ahead of the curve and uncover tomorrow’s potential portfolio stars using these handpicked ideas.

- Target rapid growth by zeroing in on penny stocks with strong financials through our penny stocks with strong financials; they could be your next breakout winners.

- Get ahead of the AI revolution by spotting AI penny stocks using the AI penny stocks; these companies are pushing the boundaries in artificial intelligence.

- Capture value opportunities by focusing on undervalued stocks based on cash flows in the undervalued stocks based on cash flows; see which businesses the market is overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives