- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Is UBS’s Outlook Cut and Pipeline Setbacks Shifting the Investment Case for Harmony Biosciences (HRMY)?

Reviewed by Sasha Jovanovic

- UBS recently lowered its outlook on Harmony Biosciences Holdings following clinical trial setbacks, including the Phase 3 failure of Zygel in Fragile X Syndrome and regulatory rejection for idiopathic hypersomnia, raising concerns about the company's future growth prospects.

- This development highlights emerging competitive threats to Harmony’s core narcolepsy business, particularly from new orexin agonist therapies that could impact market share for its flagship product, Wakix.

- We'll examine how concerns over future pipeline setbacks and growing competition could shift the investment outlook for Harmony Biosciences Holdings.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Harmony Biosciences Holdings Investment Narrative Recap

To own a stake in Harmony Biosciences Holdings today, an investor must believe in the company's ability to defend Wakix's position in the narcolepsy market, despite growing competition, and to successfully build a diversified pipeline. The recent Phase 3 Zygel trial setback coupled with increased regulatory scrutiny does materially heighten risk to near-term growth, especially as new orexin-based therapies edge closer to market, potentially eroding Harmony’s narcolepsy franchise.

This is particularly relevant given Harmony’s September 2025 announcement of ZYN002's failure to meet its primary endpoint in Fragile X syndrome, which not only limits immediate pipeline-driven revenue upside but also underscores the challenge of achieving growth outside of Wakix. While other formulations and indications remain in development, progress on these fronts may take time to offset recent disappointments.

In contrast, investors should also be aware of the rising threat posed by more advanced orexin agonist therapies and what this could mean for…

Read the full narrative on Harmony Biosciences Holdings (it's free!)

Harmony Biosciences Holdings is projected to reach $1.2 billion in revenue and $333.5 million in earnings by 2028. This outlook assumes a 17.0% annual revenue growth rate and an earnings increase of $152.6 million from the current earnings of $180.9 million.

Uncover how Harmony Biosciences Holdings' forecasts yield a $44.55 fair value, a 66% upside to its current price.

Exploring Other Perspectives

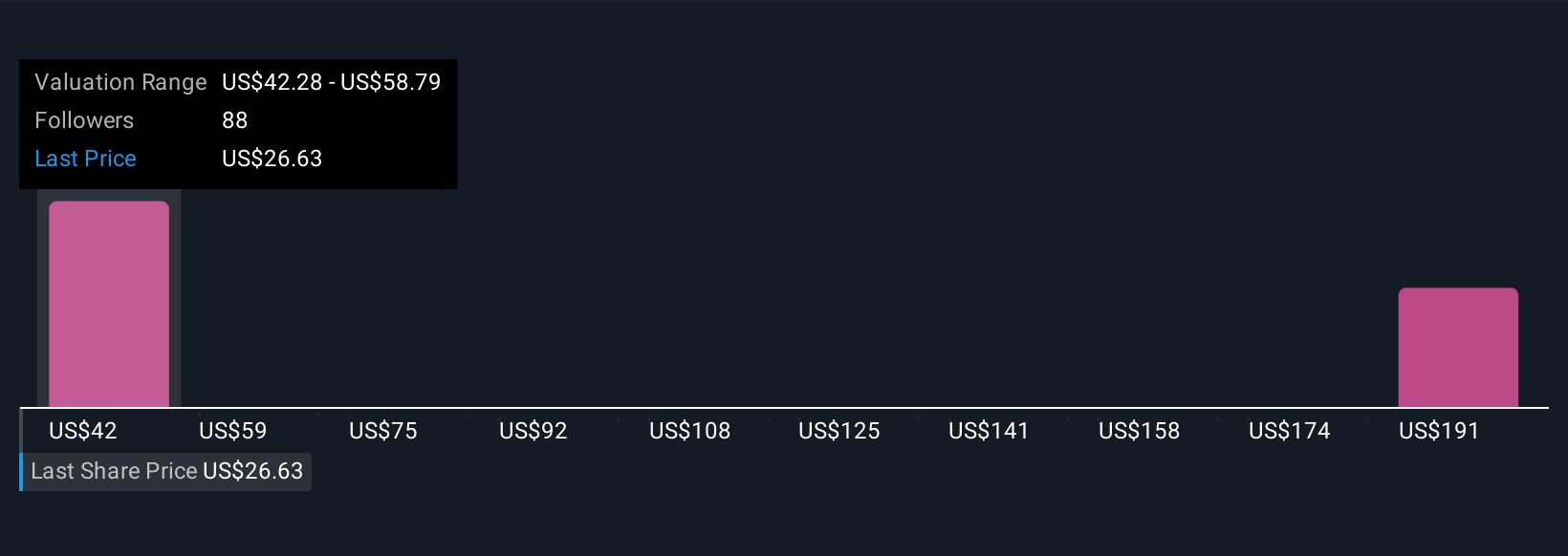

Simply Wall St Community members have posted fair value estimates for Harmony ranging from US$42.28 to US$207.40, with eight different opinions informing the spectrum. This wide variance stands against immediate pipeline setbacks and intensifying competition, inviting you to compare these diverse views before forming your outlook.

Explore 8 other fair value estimates on Harmony Biosciences Holdings - why the stock might be worth over 7x more than the current price!

Build Your Own Harmony Biosciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmony Biosciences Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmony Biosciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmony Biosciences Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives