- United States

- /

- Biotech

- /

- NasdaqGS:HOWL

There's No Escaping Werewolf Therapeutics, Inc.'s (NASDAQ:HOWL) Muted Revenues Despite A 28% Share Price Rise

Werewolf Therapeutics, Inc. (NASDAQ:HOWL) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 62%.

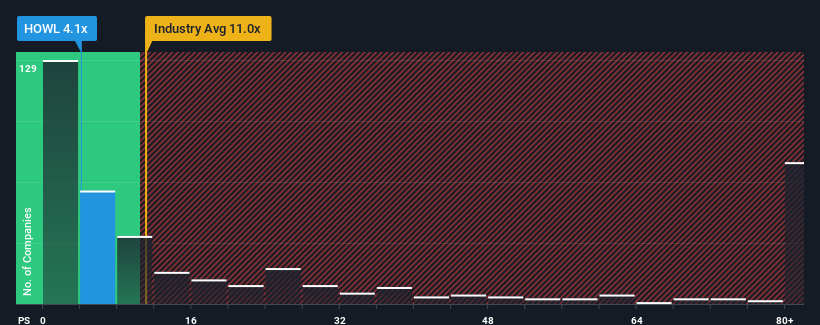

Even after such a large jump in price, Werewolf Therapeutics' price-to-sales (or "P/S") ratio of 4.1x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11x and even P/S above 47x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Werewolf Therapeutics

What Does Werewolf Therapeutics' Recent Performance Look Like?

Recent times have been advantageous for Werewolf Therapeutics as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Werewolf Therapeutics.How Is Werewolf Therapeutics' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Werewolf Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 182% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 13% each year over the next three years. With the industry predicted to deliver 219% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Werewolf Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Werewolf Therapeutics' P/S?

Werewolf Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Werewolf Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Werewolf Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Werewolf Therapeutics (2 are a bit concerning) you should be aware of.

If these risks are making you reconsider your opinion on Werewolf Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Werewolf Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Werewolf Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOWL

Werewolf Therapeutics

A biopharmaceutical company, engages in the development of therapeutics engineered to stimulate the body’s immune system for the treatment of cancer.

Excellent balance sheet moderate.

Market Insights

Community Narratives