- United States

- /

- Life Sciences

- /

- NasdaqCM:HBIO

Even With A 25% Surge, Cautious Investors Are Not Rewarding Harvard Bioscience, Inc.'s (NASDAQ:HBIO) Performance Completely

The Harvard Bioscience, Inc. (NASDAQ:HBIO) share price has done very well over the last month, posting an excellent gain of 25%. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

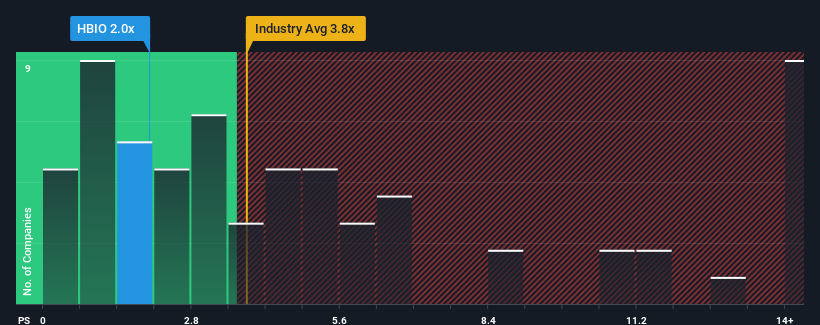

Although its price has surged higher, Harvard Bioscience's price-to-sales (or "P/S") ratio of 2x might still make it look like a buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.8x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Harvard Bioscience

How Harvard Bioscience Has Been Performing

With revenue that's retreating more than the industry's average of late, Harvard Bioscience has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Harvard Bioscience's future stacks up against the industry? In that case, our free report is a great place to start.How Is Harvard Bioscience's Revenue Growth Trending?

Harvard Bioscience's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.6%. Regardless, revenue has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 5.3%. Meanwhile, the broader industry is forecast to contract by 2.1%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Harvard Bioscience's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Harvard Bioscience's P/S

The latest share price surge wasn't enough to lift Harvard Bioscience's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Harvard Bioscience's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Harvard Bioscience you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Harvard Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HBIO

Harvard Bioscience

Develops, manufactures, and sells technologies, products, and services for life science applications in the United States, Germany, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success