- United States

- /

- Biotech

- /

- NasdaqGS:HALO

Does Halozyme Still Offer Upside After ENHANZE Milestone and 38% YTD Share Gain?

Reviewed by Bailey Pemberton

Trying to decide what to do with Halozyme Therapeutics stock right now? You’re definitely not alone. Whether you’ve been holding on to shares for years or are just scouting for the next growth story in biotech, Halozyme has had a compelling ride. Its share price closed at $66.36 recently, a figure that might prompt some double takes given how the stock has behaved lately. Despite a challenging last month, with the price sliding down by 12.5%, Halozyme has climbed an impressive 38.2% year-to-date and a robust 26.9% in the past year. For those who zoom out even further, the bigger picture shows a gain of 51.2% over three years and a stunning 113.4% leap over the past five years.

Of course, some of these moves are tied to positive shifts in market sentiment for the biotech sector and for companies focused on drug delivery platforms like Halozyme. The market, it seems, is recognizing potential in the company’s innovative business model, which is helping push shares to new heights and sparking debates about whether the stock still offers value at current levels.

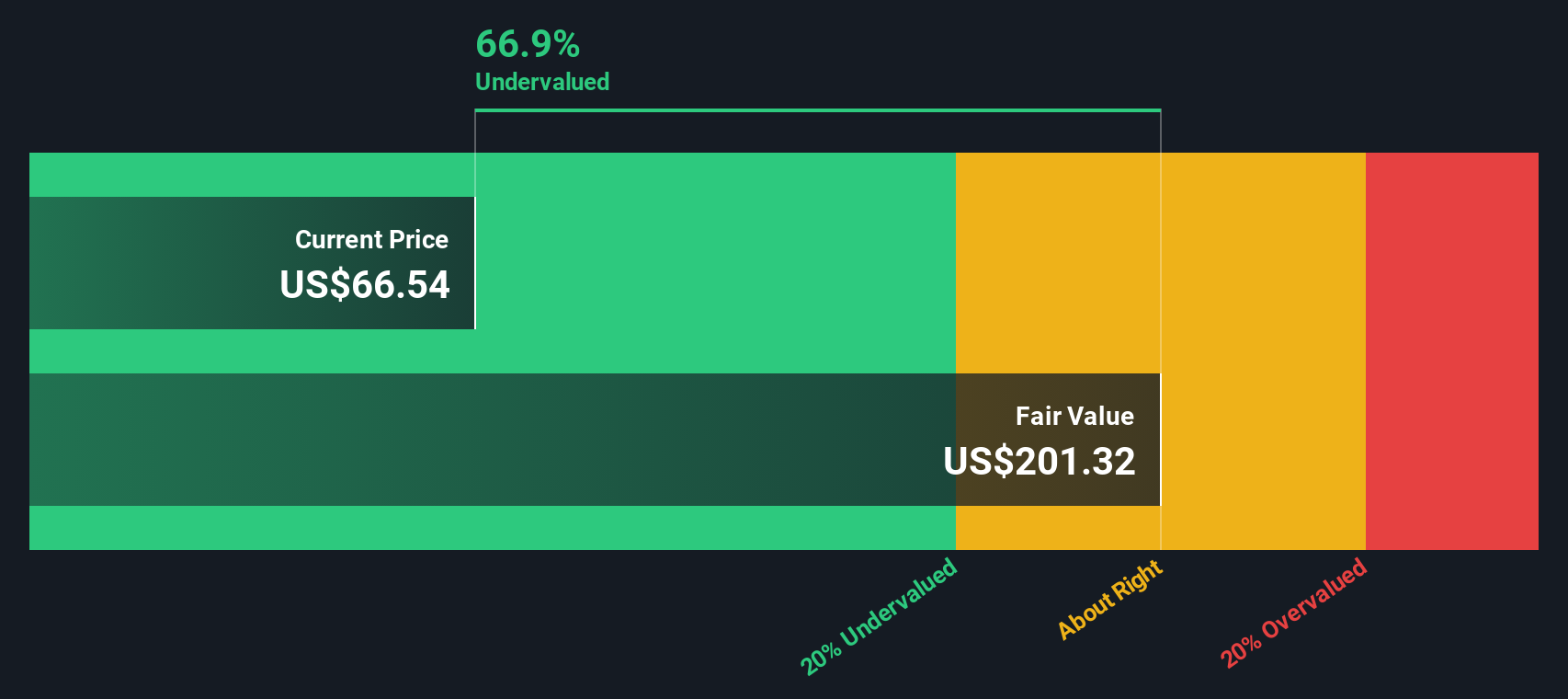

Speaking of value, Halozyme earns a valuation score of 5 out of 6, meaning it screens as undervalued in almost every test analysts throw at it. If you’re looking for a deep dive into what’s really driving that score and how traditional valuation methods stack up against other ways to view the stock’s potential, read on. There is a smarter way to figure out what Halozyme could really be worth, which we’ll get to by the end.

Approach 1: Halozyme Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company’s future cash flows and discounts them back to today’s value. This approach aims to estimate the intrinsic worth of the business. For Halozyme Therapeutics, the DCF method is based on projecting free cash flow to equity over several years and then discounting those amounts using a reasonable rate to reflect risk and the time value of money.

Currently, Halozyme generates $534.5 million in free cash flow. Analysts estimate continued solid growth in the years ahead, with cash flow expected to reach $1.06 billion by 2026 and almost $2.9 billion by 2035. While analyst estimates generally cover five years, Simply Wall St extends these projections further based on expected growth rates and company trends. This approach results in stepwise increases each year, with discounted projections used to reflect their value today.

Considering all these future streams of cash together, the DCF model produces an intrinsic value for Halozyme Therapeutics stock of $432.01 per share. This value is considerably higher than the company’s current share price of $66.36, suggesting that the market price implies a steep discount. In numerical terms, the stock appears 84.6% undervalued according to this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Halozyme Therapeutics is undervalued by 84.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Halozyme Therapeutics Price vs Earnings

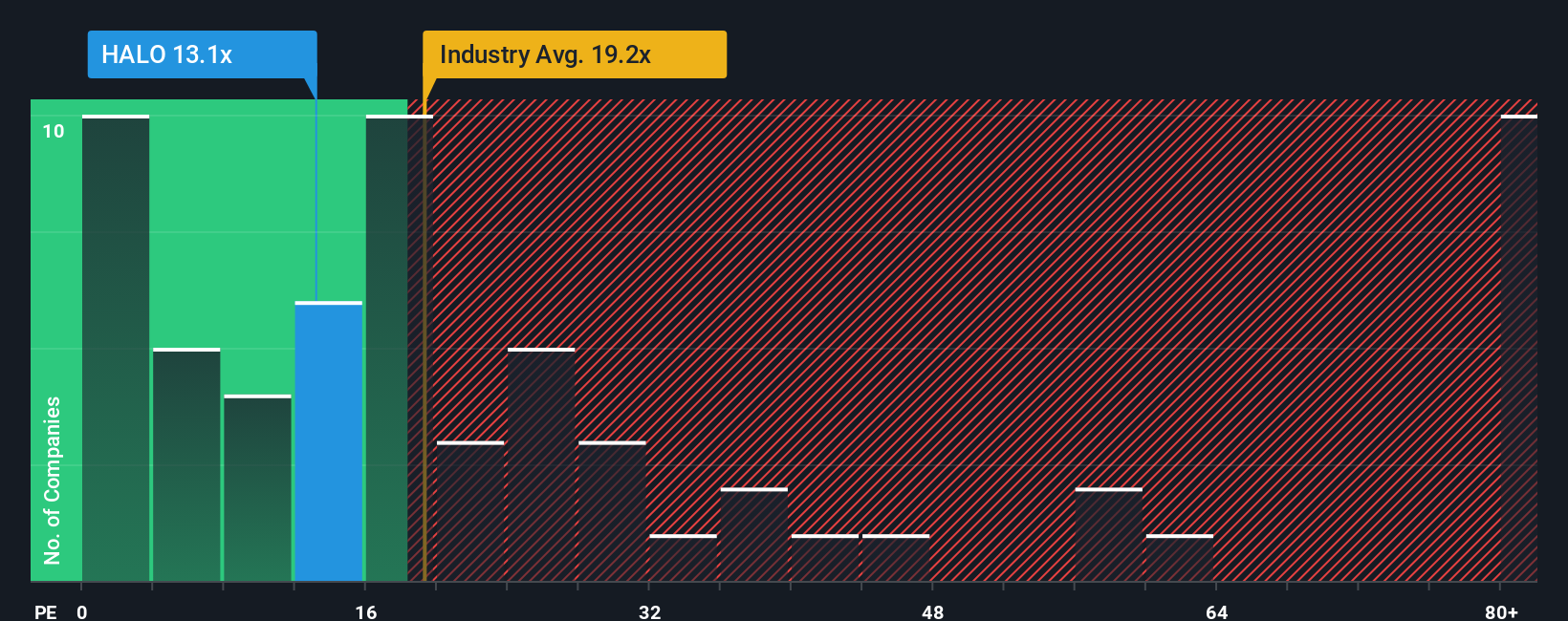

For profitable companies like Halozyme Therapeutics, the Price-to-Earnings (PE) ratio is often the valuation yardstick of choice. This multiple tells investors how much they are paying for each dollar of the company’s earnings. A lower PE can signal a bargain if future growth holds up, while a higher PE suggests the stock is priced for higher expectations or lower risk. What qualifies as a “normal” PE depends on factors such as earnings growth, profitability, and the market’s appetite for risk in the sector.

Halozyme is currently trading at a PE of 13.9x, noticeably below both its peer average of 20.3x and the broader biotech industry average of 17.1x. However, it is important to look beyond simple comparisons. Simply Wall St’s proprietary “Fair Ratio” refines the assessment by factoring in Halozyme’s unique mix of earnings growth, industry position, profit margins, market capitalization, and company-specific risks. In this case, Halozyme’s Fair Ratio is 21.7x, which is higher than both its own PE and the benchmarks above.

This is where the Fair Ratio stands out. Unlike a straight industry or peer comparison, it incorporates all the critical elements that actually move a company’s value, tailoring expectations specifically for Halozyme’s profile. When the Fair Ratio is significantly higher than the stock’s actual PE, it suggests that the market is still underpricing the company’s prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Halozyme Therapeutics Narrative

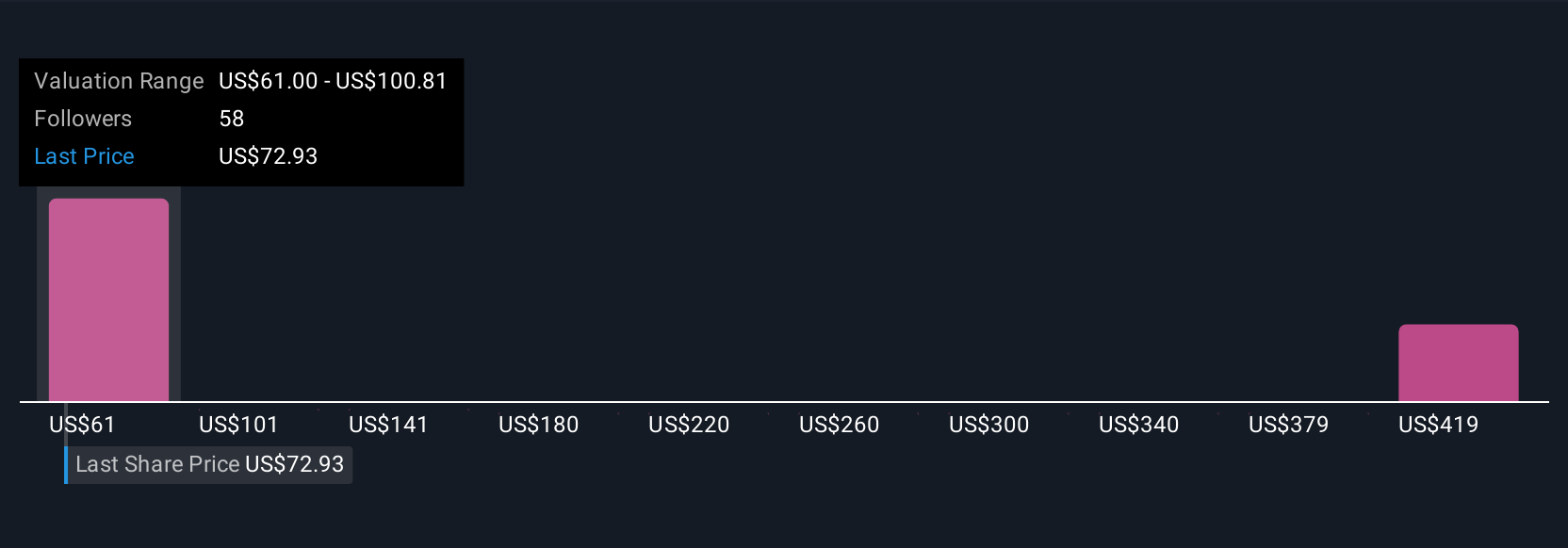

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your investment story about Halozyme Therapeutics. It combines your own expectations for future revenue, earnings, and profit margins with the reasoning behind them, going beyond just numbers or models. Narratives make it simple to link your perspective on the company, including industry trends, risks, and opportunities, to a clear and dynamic financial forecast, which then leads to a fair value estimate.

On Simply Wall St’s Community page, you can easily create, follow, and compare Narratives. This tool is used by millions of investors to connect their view of the business with actionable investing decisions. Because Narratives update automatically whenever news, earnings, or new forecasts are released, you always see up-to-date results that reflect real company developments. This means you can compare your chosen Fair Value to the current price, so you know whether you believe it is time to buy, hold, or sell.

For example, some investors see major global adoption of ENHANZE and set a bullish fair value for Halozyme as high as $91 per share, while others focus on competition and regulatory risks and estimate a more cautious $51 per share. Your Narrative can be anywhere in between, reflecting your unique outlook.

Do you think there's more to the story for Halozyme Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives