- United States

- /

- Biotech

- /

- NasdaqGS:GTHX

Why Investors Shouldn't Be Surprised By G1 Therapeutics, Inc.'s (NASDAQ:GTHX) 44% Share Price Plunge

G1 Therapeutics, Inc. (NASDAQ:GTHX) shares have retraced a considerable 44% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

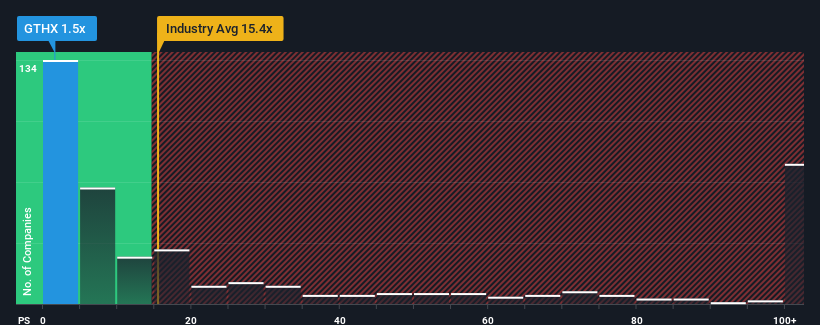

After such a large drop in price, G1 Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.4x and even P/S higher than 71x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for G1 Therapeutics

What Does G1 Therapeutics' Recent Performance Look Like?

Recent times haven't been great for G1 Therapeutics as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on G1 Therapeutics.How Is G1 Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as G1 Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 66% gain to the company's top line. The latest three year period has also seen an excellent 171% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 296% per annum growth forecast for the broader industry.

In light of this, it's understandable that G1 Therapeutics' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does G1 Therapeutics' P/S Mean For Investors?

Having almost fallen off a cliff, G1 Therapeutics' share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of G1 Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 3 warning signs for G1 Therapeutics (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on G1 Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade G1 Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTHX

G1 Therapeutics

A commercial-stage biopharmaceutical company, engages in the discovery, development, and commercialization of small molecule therapeutics for the treatment of patients with cancer in the United States.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives