- United States

- /

- Biotech

- /

- NasdaqGM:GTH

Genetron Holdings Limited (NASDAQ:GTH) Released Earnings Last Week And Analysts Lifted Their Price Target To US$26.22

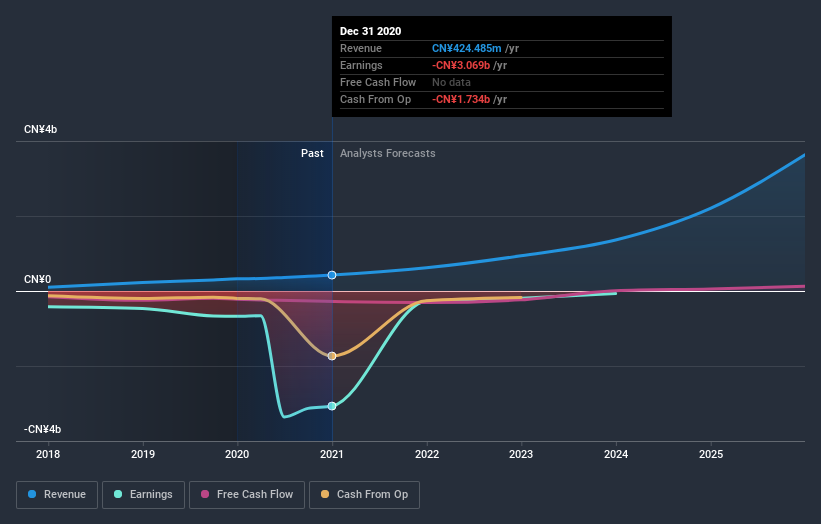

There's been a major selloff in Genetron Holdings Limited (NASDAQ:GTH) shares in the week since it released its annual report, with the stock down 21% to US$18.25. Revenues were in line with expectations, at CN¥424m, while statutory losses ballooned to CN¥50.78 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Genetron Holdings

Following the latest results, Genetron Holdings' four analysts are now forecasting revenues of CN¥619.0m in 2021. This would be a sizeable 46% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 97% to CN¥1.62. Before this latest report, the consensus had been expecting revenues of CN¥631.4m and CN¥1.62 per share in losses.

The consensus price target rose 8.0% to US$26.22, with the analysts increasing their valuations as the business executes in line with forecasts. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Genetron Holdings analyst has a price target of US$30.00 per share, while the most pessimistic values it at US$20.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Genetron Holdings' past performance and to peers in the same industry. It's clear from the latest estimates that Genetron Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 46% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 34% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 17% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Genetron Holdings to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Genetron Holdings going out to 2025, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for Genetron Holdings that you should be aware of.

When trading Genetron Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:GTH

Genetron Holdings

Genetron Holdings Limited, a precision oncology platform company, focuses on cancer management by utilizing technologies in molecular biology and data science in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives