- United States

- /

- Biotech

- /

- NasdaqGS:GRAL

Will GRAIL's (GRAL) Swift Capital Raise Redefine Its Approach to Funding Growth?

Reviewed by Sasha Jovanovic

- GRAIL, Inc. recently completed a follow-on equity offering of US$300 million, following closely after filing a shelf registration for up to US$332.79 million in securities and reporting third quarter results.

- This sequence of financing actions, occurring immediately after earnings showed narrowing net losses and increased revenue, underscores GRAIL's active efforts to strengthen its capital position as it pursues expanded growth initiatives.

- We'll examine how GRAIL's move to quickly raise capital following improved earnings results could influence its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

GRAIL Investment Narrative Recap

To be a GRAIL shareholder, one needs to believe in the company's ability to secure broad payer reimbursement and regulatory approvals, unlocking demand for its Galleri multi-cancer early detection test. The recent US$300 million follow-on equity offering gives GRAIL additional runway but does not materially change the short-term catalyst of key trial readouts, nor does it eliminate the biggest immediate risk, persistent high net losses and ongoing cash burn if revenue does not accelerate further.

The most relevant recent announcement is GRAIL's third-quarter earnings, which showed a narrowing net loss of US$88.98 million and revenue growth to US$36.19 million year-on-year. This financial improvement sets the backdrop for the new capital raise, but with profitability not expected soon, progress toward positive clinical trial results and payer coverage remains paramount. In contrast, while new funding supports operations, investors should be aware that...

Read the full narrative on GRAIL (it's free!)

GRAIL's outlook anticipates $232.5 million in revenue and $37.3 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 20.1% and reflects a $480.3 million increase in earnings from a current level of -$443.0 million.

Uncover how GRAIL's forecasts yield a $90.00 fair value, a 19% downside to its current price.

Exploring Other Perspectives

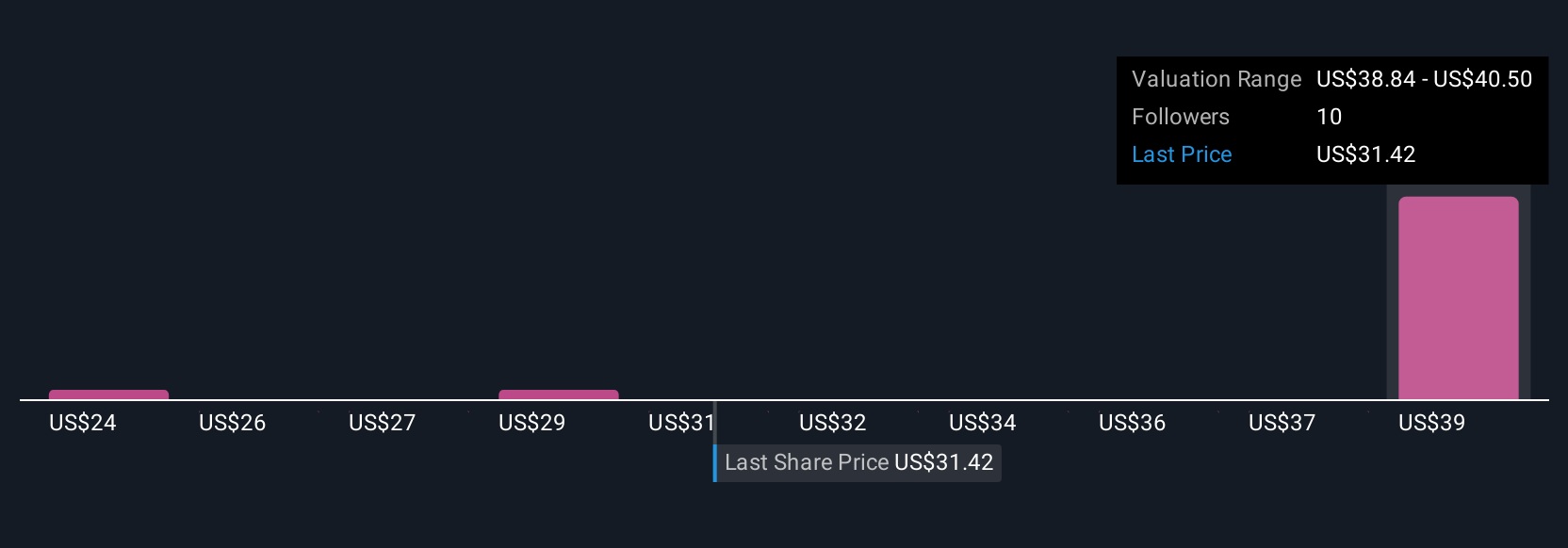

Four private investors in the Simply Wall St Community estimated GRAIL’s fair value between US$29.87 and US$121.03 per share. With net losses still substantial and financial sustainability in question, consider how varied expectations can influence market outcomes before relying solely on analyst projections.

Explore 4 other fair value estimates on GRAIL - why the stock might be worth less than half the current price!

Build Your Own GRAIL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GRAIL research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free GRAIL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GRAIL's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAL

GRAIL

A commercial-stage healthcare company, provides multi-cancer early detection testing and services in the United States and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.