- United States

- /

- Biotech

- /

- NasdaqGS:GRAL

GRAIL (GRAL) Is Up 21.5% After $110 Million Samsung Partnership and Asia Expansion Deal – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 16, 2025, GRAIL, Inc. announced a stock purchase agreement to raise approximately US$110 million from the issuance of 1,570,308 common shares at US$70.05 each, with new investors including Samsung Electronics and related entities.

- The collaboration will support commercialization of GRAIL's Galleri multi-cancer early detection test in Asia and open new avenues for clinical research and health data integration, marking a substantial step in GRAIL's planned international expansion.

- We'll examine how the Samsung partnership and sizable equity investment could reshape GRAIL's growth outlook and international ambitions.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

GRAIL Investment Narrative Recap

To be a GRAIL shareholder, you have to believe that multi-cancer early detection will become a standard of care around the world, and that GRAIL’s Galleri test can secure broad regulatory approval and payer reimbursement before rivals catch up. While the announcement of Samsung’s US$110 million private placement and partnership strengthens GRAIL’s cash position and supports commercial growth in Asia, it does not meaningfully change the near-term catalyst of critical clinical trial readouts, nor does it resolve the biggest risk of ongoing heavy cash burn paired with a lack of profitability.

One of the most relevant recent events is the October 23 product update, where early REFLECTION study results indicated a 1.3 percent cancer detection rate for the Galleri test in a veteran cohort. Positive trial updates such as this continue to reinforce the major clinical catalysts that could help unlock regulatory approval and payer support, which remain essential for real market adoption and future revenue growth.

Yet, in sharp contrast to the international excitement, investors should pay close attention to the continued scale of net losses and cash consumption...

Read the full narrative on GRAIL (it's free!)

GRAIL's narrative projects $232.5 million revenue and $37.3 million earnings by 2028. This requires 20.1% yearly revenue growth and a $480.3 million increase in earnings from current earnings of -$443.0 million.

Uncover how GRAIL's forecasts yield a $56.50 fair value, a 35% downside to its current price.

Exploring Other Perspectives

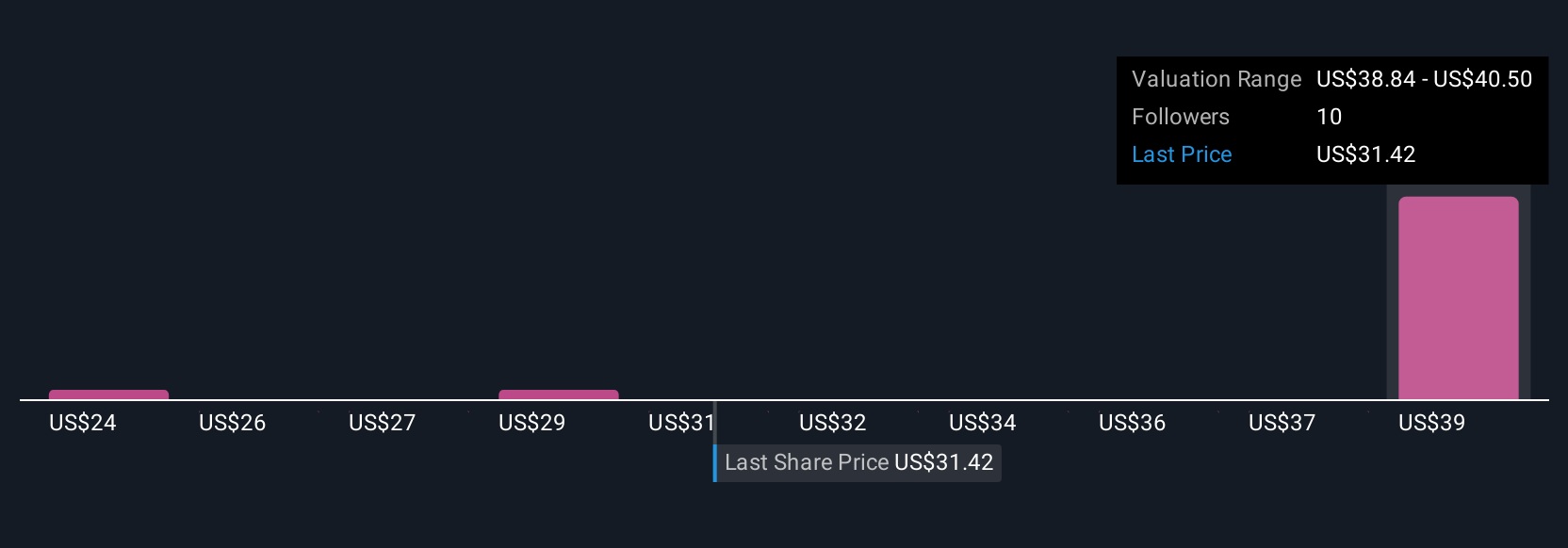

Five members of the Simply Wall St Community place GRAIL’s fair value between US$23.86 and US$121.03, reflecting wide conviction gaps. Especially as new funding supports GRAIL’s expansion efforts, uncertainty about future profitability remains top of mind for many market participants seeking different viewpoints.

Explore 5 other fair value estimates on GRAIL - why the stock might be worth as much as 40% more than the current price!

Build Your Own GRAIL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GRAIL research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free GRAIL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GRAIL's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAL

GRAIL

A commercial-stage healthcare company, provides multi-cancer early detection testing and services in the United States and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives