- United States

- /

- Biotech

- /

- NasdaqGS:GOSS

Assessing Gossamer Bio (GOSS) Valuation After FDA Progress and Pulmonary Hypertension Pipeline Advances

Reviewed by Simply Wall St

Most Popular Narrative: 60.9% Undervalued

According to the most widely followed valuation narrative, Gossamer Bio is currently seen as deeply undervalued. This perspective views the company’s future prospects, driven by late-stage clinical progress and expanding global partnerships, as yet to be fully appreciated in the current stock price.

*The collaboration with Chiesi Group to enter a global registrational Phase III study for seralutinib in PH-ILD enhances the opportunity for expanded indications and market reach, potentially impacting revenue positively. The anticipation of potential first-in-class treatment status for seralutinib, with observed safety and reverse remodeling effects, implies significant market adoption potential, which could improve net margins due to competitive product positioning.*

Want to know which breakthrough assumptions are powering this eye-catching fair value? The narrative is betting big on a future profit turnaround, ambitious revenue leaps, and a premium market multiple. How does the story stack up, and what specific numbers do analysts think can get Gossamer Bio there? Dig into the main drivers that set this bullish valuation apart from the crowd.

Result: Fair Value of $8.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in Phase III trials or delays from regulatory challenges could quickly dampen the optimism that is driving current price targets.

Find out about the key risks to this Gossamer Bio narrative.Another View: The Market Ratio Test

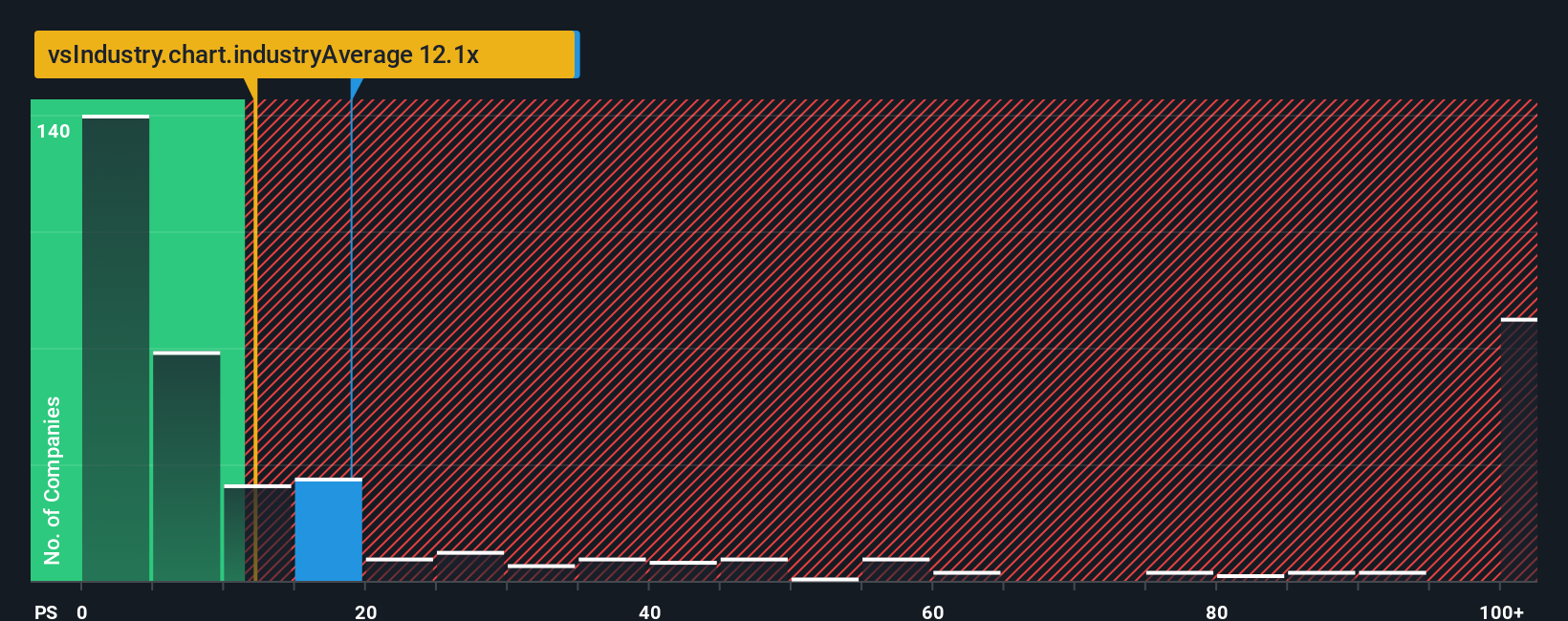

Looking at Gossamer Bio from a different angle, a traditional market ratio paints a less optimistic picture. This view suggests the stock could be on the expensive side, at least for now. Which perspective will ultimately prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Gossamer Bio to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Gossamer Bio Narrative

If you see things differently or want to analyze the numbers your own way, it only takes a few minutes to shape your own perspective. Do it your way.

A great starting point for your Gossamer Bio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let smart opportunities pass you by. The right screener can reveal hidden gems and high-potential stocks you might otherwise miss. Take charge of your investment strategy today.

- Supercharge your portfolio by targeting strong balance sheets and robust prospects with our selection of penny stocks with strong financials.

- Tap into next-generation breakthroughs with real-world applications across healthcare by scanning the most promising healthcare AI stocks shaping the future of medicine.

- Hunt for true bargains and long-term growth by filtering companies that shine as undervalued stocks based on cash flows based on their real cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOSS

Gossamer Bio

A clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States.

High growth potential and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)