- United States

- /

- Biotech

- /

- NasdaqGS:GOSS

3 US Penny Stocks With Market Caps Over $100M

Reviewed by Simply Wall St

As the U.S. stock market closes out a strong year on a weak note, with major indices posting significant gains despite recent downturns, investors are exploring diverse opportunities to balance their portfolios. Penny stocks, often representing smaller or newer companies, still hold potential for growth and value that larger firms might miss. In this article, we examine three penny stocks that stand out for their financial strength and potential to offer attractive returns in today's complex market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $6.03M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.84B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.43M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $97.13M | ★★★★★☆ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $93.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $43.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $24.65M | ★★★★★☆ |

Click here to see the full list of 734 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Research Solutions (NasdaqCM:RSSS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Research Solutions, Inc. offers a cloud-based software-as-a-service platform and related services for researchers across corporate, academic, government, and individual sectors globally, with a market cap of $126.09 million.

Operations: The company generates revenue from its Publishing - Periodicals segment, amounting to $46.61 million.

Market Cap: $126.09M

Research Solutions, Inc. recently reported a revenue increase to US$12.04 million for Q1 2024, up from US$10.06 million the previous year, and achieved a net income of US$0.67 million compared to a loss last year, indicating improved financial performance despite being unprofitable overall. The company is debt-free with sufficient cash runway for over three years due to positive free cash flow growth. Recent strategic changes include appointing Sefton Cohen as Chief Revenue Officer to enhance its AI-enabled research platform capabilities and drive revenue growth across global markets while maintaining high customer satisfaction rates.

- Unlock comprehensive insights into our analysis of Research Solutions stock in this financial health report.

- Assess Research Solutions' future earnings estimates with our detailed growth reports.

Gossamer Bio (NasdaqGS:GOSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gossamer Bio, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing seralutinib for treating pulmonary arterial hypertension (PAH) in the United States, with a market cap of $199.03 million.

Operations: Gossamer Bio, Inc. has not reported any revenue segments as it is focused on developing seralutinib for pulmonary arterial hypertension in the United States.

Market Cap: $199.03M

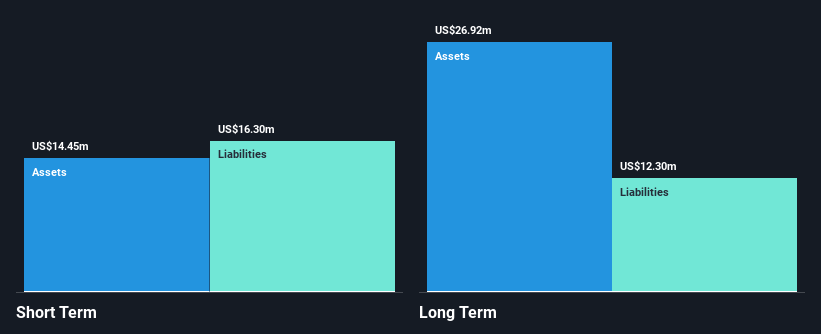

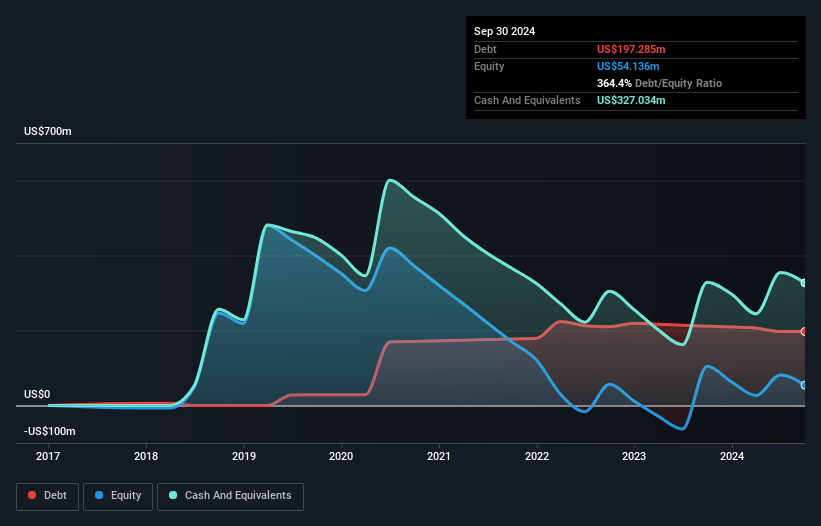

Gossamer Bio, Inc., a clinical-stage biopharmaceutical company, has shown financial resilience despite being pre-revenue. It reported sales of US$9.48 million for Q3 2024 and a reduced net loss of US$30.8 million compared to the previous year. The company's short-term assets (US$344.3 million) cover both its short- and long-term liabilities effectively, highlighting strong liquidity management. Although Gossamer's debt-to-equity ratio has increased significantly over five years, it maintains more cash than total debt, suggesting prudent financial practices amidst ongoing development efforts for seralutinib aimed at treating pulmonary arterial hypertension in the U.S market.

- Get an in-depth perspective on Gossamer Bio's performance by reading our balance sheet health report here.

- Understand Gossamer Bio's earnings outlook by examining our growth report.

Five Point Holdings (NYSE:FPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, operates through its subsidiary to own and develop mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County, with a market cap of approximately $539.48 million.

Operations: The company's revenue segments include Valencia ($103.08 million), Commercial ($9.62 million), Great Park ($568.62 million), and San Francisco ($0.67 million).

Market Cap: $539.48M

Five Point Holdings, LLC, a mixed-use and planned communities developer, has experienced slower revenue growth with US$17.01 million in Q3 2024 compared to US$65.92 million a year ago. Despite this, the company maintains high-quality earnings and has achieved profitability over the past five years with robust earnings growth of 64% annually. The company's financial position is stable; short-term assets of US$2.7 billion exceed both short- and long-term liabilities significantly, though its operating cash flow coverage for debt remains low at 3.7%. Recent board changes reflect strategic shifts following equity interest transactions involving Glick Family Investments.

- Jump into the full analysis health report here for a deeper understanding of Five Point Holdings.

- Gain insights into Five Point Holdings' historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 734 US Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOSS

Gossamer Bio

A clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives