- United States

- /

- Food

- /

- NYSE:BRCC

February 2025 US Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market is showing signs of strength, with major indexes like the S&P 500 closing just shy of record highs and posting weekly gains. In such a robust market environment, investors often seek opportunities in lesser-known corners like penny stocks. These smaller or newer companies can offer significant growth potential when supported by strong financial fundamentals. We'll explore three penny stocks that stand out for their financial resilience and potential to deliver substantial returns for investors looking to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 702 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Genenta Science (NasdaqCM:GNTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genenta Science S.p.A. is a clinical-stage biotechnology company based in Italy that focuses on developing hematopoietic stem cell gene therapies for treating solid tumors, with a market cap of $79.90 million.

Operations: Currently, there are no reported revenue segments for Genenta Science.

Market Cap: $79.9M

Genenta Science, a clinical-stage biotech firm, is pre-revenue with no significant revenue streams and a market cap of US$79.90 million. Despite being unprofitable with increasing losses over the past five years, Genenta maintains financial stability with its short-term assets exceeding liabilities and no debt on its books. The company has a cash runway of 2.9 years if current cash flow trends persist. Recent strategic developments include an enhanced partnership with AGC Biologics for exclusive manufacturing capabilities in Milan, potentially boosting production efficiency as it advances trials for metastatic Renal Cell Cancer and Glioblastoma Multiforme therapies.

- Click to explore a detailed breakdown of our findings in Genenta Science's financial health report.

- Explore Genenta Science's analyst forecasts in our growth report.

Black Diamond Therapeutics (NasdaqGS:BDTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Diamond Therapeutics, Inc. is a clinical-stage oncology medicine company specializing in the discovery and development of MasterKey therapies for genetically defined tumors, with a market cap of $134.11 million.

Operations: Black Diamond Therapeutics, Inc. does not report any revenue segments as it is currently in the clinical stage of developing oncology medicines.

Market Cap: $134.11M

Black Diamond Therapeutics, with a market cap of US$134.11 million, is a pre-revenue clinical-stage oncology company focused on MasterKey therapies for genetically defined tumors. Despite being unprofitable and experiencing increasing losses at 9.9% annually over the past five years, it remains debt-free and financially stable with short-term assets of US$115.5 million covering its liabilities. The company has enough cash to sustain operations for over a year if current cash flow trends continue or 1.5 years if cash outflow decreases by historical rates. Shareholder dilution has been minimal despite high share price volatility recently observed in the market.

- Click here and access our complete financial health analysis report to understand the dynamics of Black Diamond Therapeutics.

- Examine Black Diamond Therapeutics' earnings growth report to understand how analysts expect it to perform.

BRC (NYSE:BRCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BRC Inc. operates in the United States, focusing on purchasing, roasting, and selling coffee along with coffee accessories and branded apparel, with a market cap of approximately $557.39 million.

Operations: The company generates revenue primarily from its Consumer Products Business, which accounts for $405.26 million.

Market Cap: $557.39M

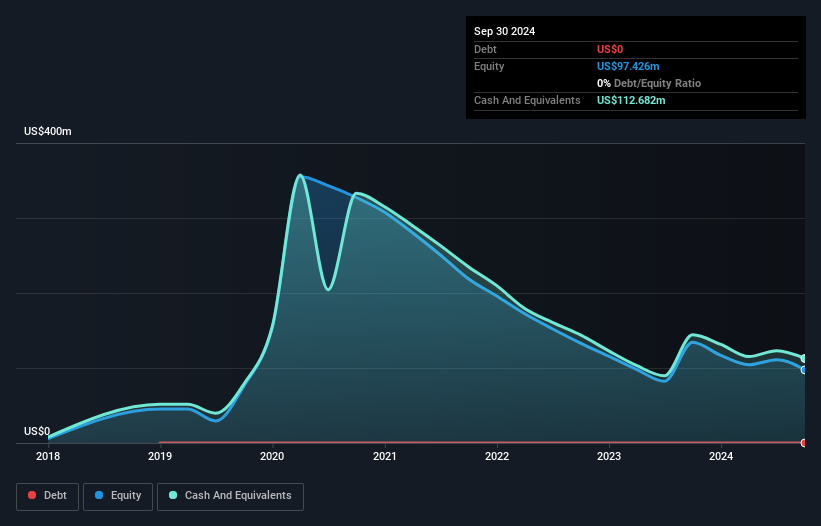

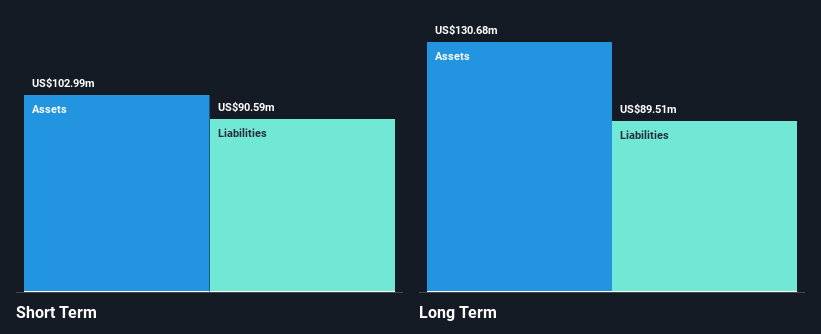

BRC Inc., with a market cap of US$557.39 million, is unprofitable but maintains a stable position in the coffee industry, generating significant revenue from its Consumer Products Business. The company has not experienced meaningful shareholder dilution over the past year and benefits from a cash runway exceeding three years, despite shrinking free cash flow. While BRC's short-term assets (US$103 million) cover both short-term and long-term liabilities, its high net debt to equity ratio (107.5%) is concerning. Recent guidance reaffirms 2024 net revenue expectations between US$390 million and US$395 million, highlighting potential growth amidst financial challenges.

- Click here to discover the nuances of BRC with our detailed analytical financial health report.

- Evaluate BRC's prospects by accessing our earnings growth report.

Make It Happen

- Click this link to deep-dive into the 702 companies within our US Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRCC

BRC

Through its subsidiaries, purchases, roasts, and sells coffee, coffee accessories, and branded apparel in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives