- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Is Gilead’s Global Lenacapavir Access Deal Reframing the Investment Case for GILD?

Reviewed by Simply Wall St

- Recently, Gilead Sciences announced a multi-year partnership with the U.S. State Department and PEPFAR to deliver its twice-yearly HIV prevention therapy, lenacapavir, to up to two million people in PEPFAR- and Global Fund-supported countries, alongside new manufacturing and product expansion efforts.

- This initiative not only extends the global reach of Gilead’s innovative HIV therapy but also highlights the company’s recognized leadership in HIV philanthropy and advances in biopharma technology.

- We’ll explore how Gilead’s expanded global access for lenacapavir influences its long-term growth and diversification narrative for investors.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Gilead Sciences Investment Narrative Recap

To be a Gilead shareholder, you need to believe the company’s lead in HIV innovation and expanding partnerships will deliver ongoing global growth, even as it faces policy and pricing pressure risks. The recent alliance with PEPFAR may significantly boost Gilead’s international presence in HIV prevention but does not fully resolve short-term concerns around future pricing reforms or overreliance on the HIV portfolio.

One of the most interesting updates alongside this partnership is Gilead’s major U.S. investment in advanced manufacturing at Foster City. This new facility could strengthen the launch and scaling of pipeline assets, directly addressing future access and diversification catalysts while also supporting efforts to maintain operating margin and supply flexibility.

But on the other hand, investors should be alert to added policy uncertainty and the risk of compressed pricing in Gilead’s core markets, especially as...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences' narrative projects $32.3 billion in revenue and $10.0 billion in earnings by 2028. This requires 3.8% yearly revenue growth and a $3.7 billion earnings increase from the current earnings of $6.3 billion.

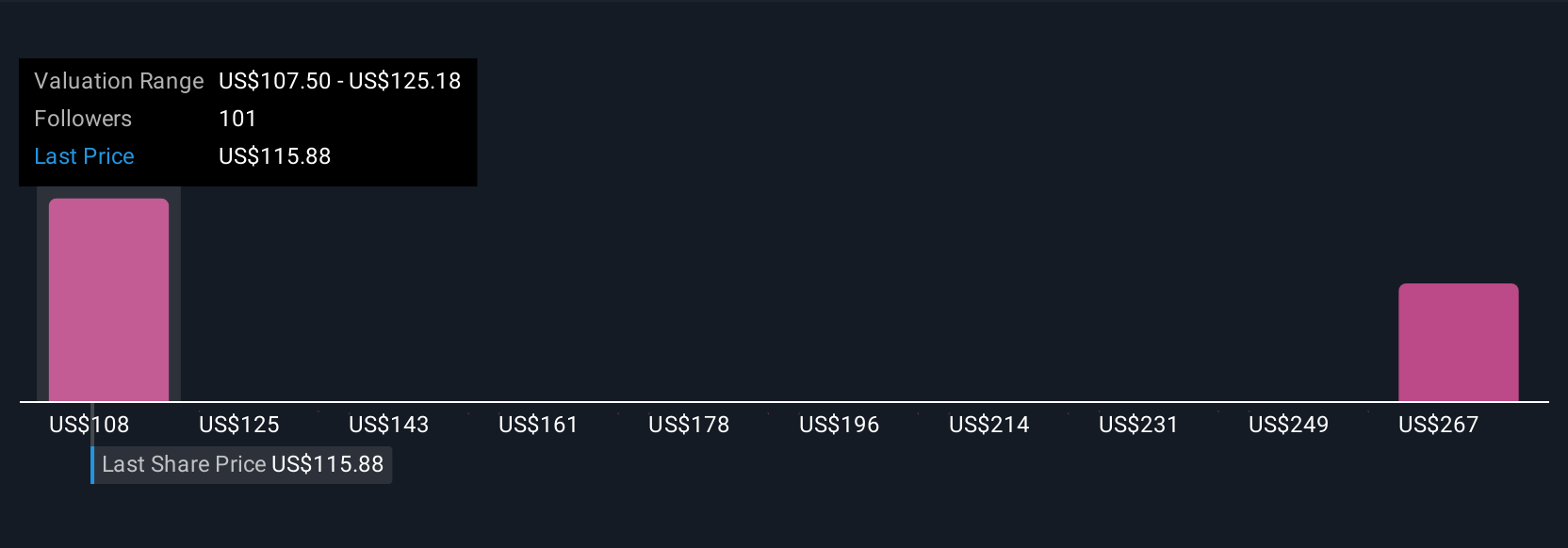

Uncover how Gilead Sciences' forecasts yield a $124.37 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Some analysts think Gilead’s new product launches like lenacapavir and Trodelvy could drive revenue as high as US$33.9 billion and earnings over US$10.8 billion by 2028. This is a much more optimistic viewpoint than consensus and shows how expectations for future growth can diverge, especially if the news around expanded access proves pivotal.

Explore 9 other fair value estimates on Gilead Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives