- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Gilead Sciences (NasdaqGS:GILD) Faces Shareholder Proposals As Stock Rises 5%

Reviewed by Simply Wall St

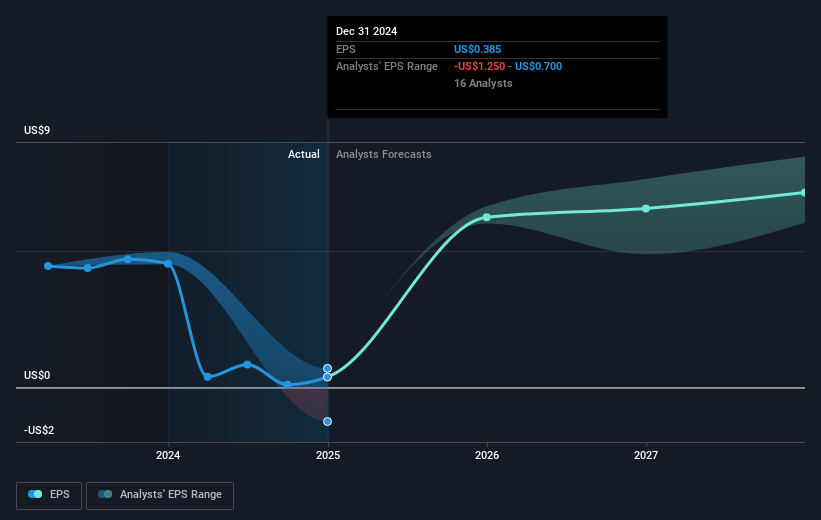

Gilead Sciences (NasdaqGS:GILD) has been the center of investor activism, facing several shareholder proposals, including the separation of the Chairman and CEO roles and developing a comprehensive human rights policy. The company advised voting against these proposals, slated for discussion at the upcoming annual meeting. Despite broader market challenges like the Dow's 1.7% decline and inflation concerns, Gilead's stock rose 18% over the last quarter, potentially buoyed by its robust Q4 earnings report and strategic initiatives like its partnership with LEO Pharma. Overall, these developments may have contributed to the positive sentiment around the company's stock performance.

Over the past three years, Gilead Sciences has achieved a total shareholder return of 110.17%, a significant accomplishment. This impressive long-term growth can be attributed to several key developments. The company has successfully expanded its portfolio in critical therapeutic areas like HIV, liver disease, and oncology, with new therapies such as lenacapavir promising to redefine the market. Their sophisticated management of expenses and strategic product launches have strengthened margins and generated higher earnings for the company.

Gilead's robust financial performance also included increased revenues and a series of collaborative efforts, such as its partnership with LEO Pharma. The resilience is further highlighted against industry dynamics, as Gilead outperformed the US Biotechs industry which saw an 8.3% decline over the past year. Additionally, Gilead's authoritative expansion in oncology with programs like Trodelvy and Yescarta has helped solidify its position in the competitive biopharmaceutical landscape, contributing to its strong shareholder returns over this period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives