- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Gilead Sciences (NasdaqGS:GILD) Announces Promising Phase 3 Results For Trodelvy In Breast Cancer

Reviewed by Simply Wall St

Gilead Sciences (NasdaqGS:GILD) recently announced positive results from its ASCENT-03 study, leading to a significant role in treating metastatic triple-negative breast cancer. This likely bolstered investor confidence, as evident by a 6% increase in its share price over the past week. Amid broader market declines, with major indexes experiencing downturns due to renewed trade worries and tech sector declines, Gilead's news appears to have countered these negative trends. The pharmaceutical advancements provided a strong narrative against a backdrop of declining tech shares and tariffs uncertainties, highlighting Gilead's resilience in an otherwise challenging market.

Gilead Sciences has 2 possible red flags we think you should know about.

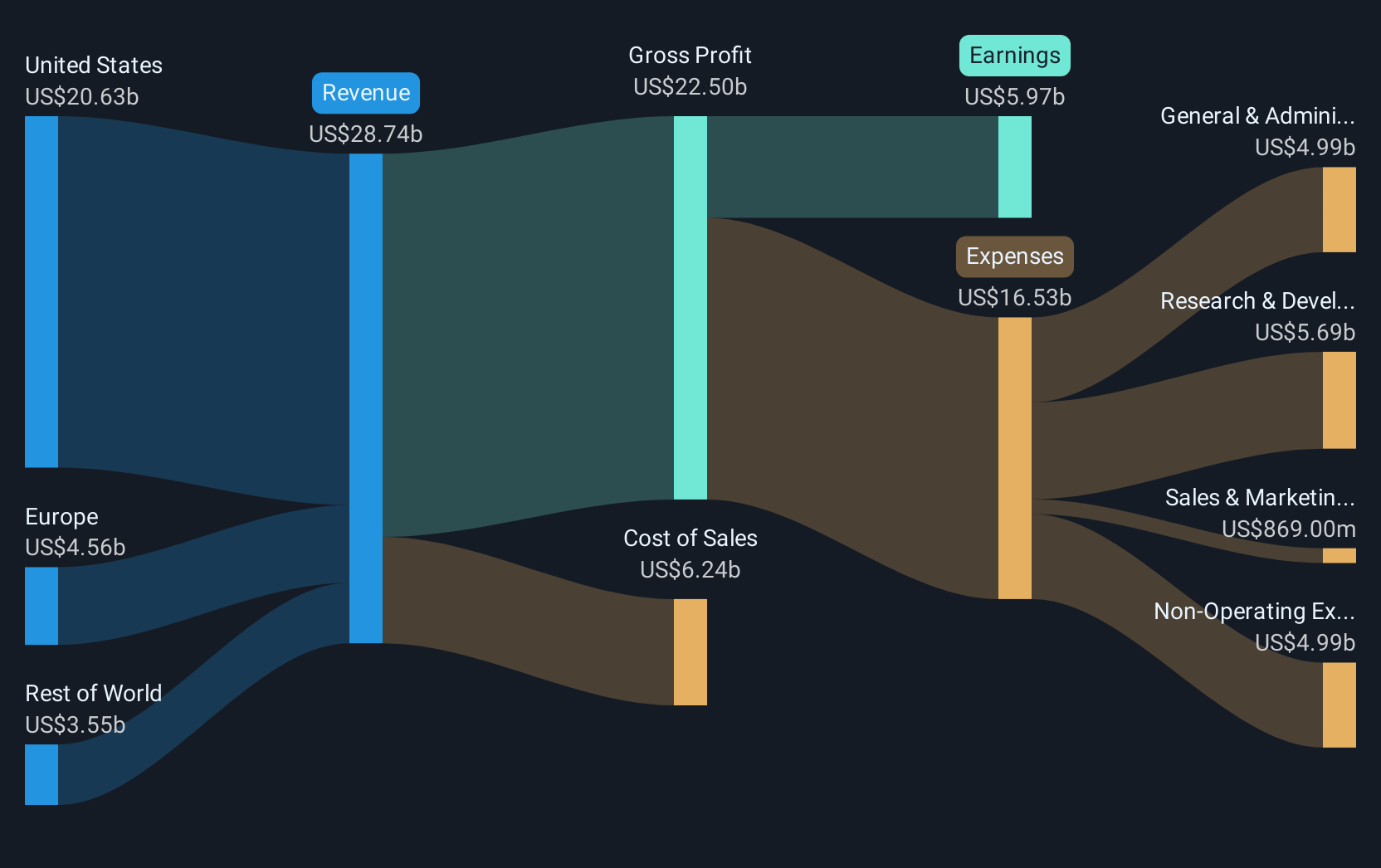

The recent positive results from Gilead Sciences' ASCENT-03 study underscore its potential in advancing treatments for metastatic triple-negative breast cancer, integrating well into a narrative of expanding its reach within oncology and HIV therapies. This aligns with the company's strategy of driving revenue growth through innovative product launches, including lenacapavir and Trodelvy, positioning Gilead to tap into expanding markets. The news could bolster revenue and earnings forecasts by enhancing its market position and supporting margin expansion.

Over the past three years, Gilead's total shareholder returns, inclusive of both share price appreciation and dividends, amounted to 86.1%. In contrast, its performance over the past year exceeded that of the broader US Biotechs industry, with the industry seeing a 13% decline. Such robust longer-term returns indicate Gilead's ability to deliver consistent value to its shareholders despite shorter-term market fluctuations.

Despite an initial 6% share price increase following the study results, Gilead's stock still trades at a discount to the consensus analyst price target of US$115.04. This suggests potential further upside as analysts anticipate continued growth driven by successful drug launches and strategic R&D advancements. The positive news may enhance investor confidence in Gilead's ability to meet or exceed revenue and earnings expectations, supporting a trajectory towards achieving or surpassing these price targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Gilead Sciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives