- United States

- /

- Biotech

- /

- NasdaqGS:GERN

High Growth Tech Stocks To Watch This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, but over the past 12 months, it has risen by an impressive 33%, with earnings forecast to grow by 15% annually. In such a dynamic environment, identifying high growth tech stocks that can capitalize on these trends becomes crucial for investors looking to enhance their portfolios.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 255 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

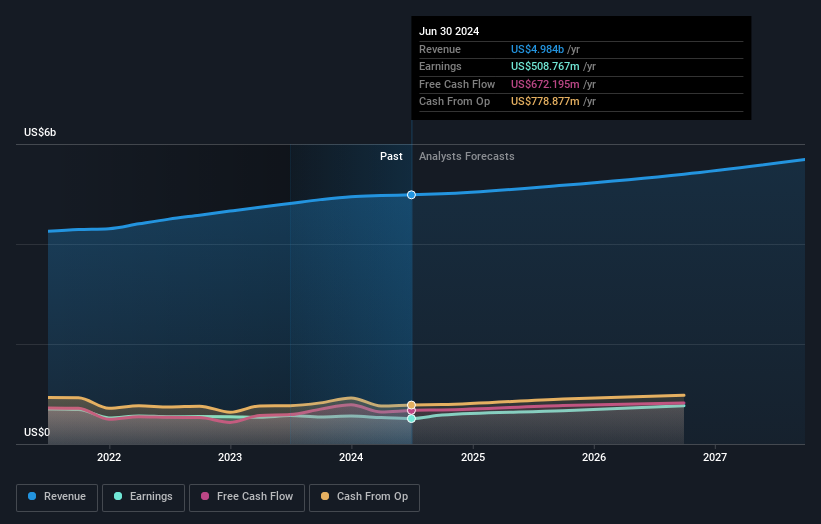

Amdocs (NasdaqGS:DOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amdocs Limited, through its subsidiaries, provides software and services worldwide with a market cap of $10.03 billion.

Operations: Amdocs generates revenue primarily from providing software products and services, amounting to $4.98 billion. The company's market cap stands at $10.03 billion.

Amdocs, a player in the tech sector, is navigating through a challenging landscape with mixed financial signals. Despite a recent drop from the FTSE All-World Index, Amdocs has been proactive; its earnings are expected to surge by 24.1% annually over the next three years. This growth is notably higher than the US market average of 15.2%. The company's commitment to innovation is evident in its R&D spending, which remains robust as it seeks to enhance operational efficiencies and customer experiences through projects like the unified BSS and OSS platform for Vodafone Ireland. Additionally, strategic moves into cloud solutions with major telecom firms underscore its adaptability and focus on future technologies, positioning it well for sustained growth despite current market adversities.

- Dive into the specifics of Amdocs here with our thorough health report.

Gain insights into Amdocs' historical performance by reviewing our past performance report.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geron Corporation, a late-stage clinical biopharmaceutical company, focuses on developing and commercializing therapeutics for myeloid hematologic malignancies and has a market cap of $2.75 billion.

Operations: Geron generates revenue primarily from the development of therapeutic products for oncology, totaling $1.37 million. The company focuses on advancing treatments specifically for myeloid hematologic malignancies.

Geron, while not yet profitable, is poised for significant growth with projected annual revenue increases of 51.8% and an anticipated shift to profitability within three years. Recent executive changes, including the appointment of Jim Ziegler as EVP and Chief Commercial Officer, underscore a strategic push towards enhancing global commercial strategies. This leadership refresh aligns with Geron's R&D commitment where expenses are strategically channeled to fuel innovations like RYTELO(TM), potentially accelerating its trajectory in the biotech landscape amidst a challenging market environment.

- Click to explore a detailed breakdown of our findings in Geron's health report.

Gain insights into Geron's past trends and performance with our Past report.

Emergent BioSolutions (NYSE:EBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emergent BioSolutions Inc. (NYSE:EBS) is a life sciences company that offers preparedness and response solutions for various public health threats in the United States, with a market cap of approximately $404.61 million.

Operations: Emergent BioSolutions generates revenue primarily from three segments: Services ($118.20 million), MCM Products ($464.50 million), and Commercial Products ($491.70 million). The company focuses on providing solutions for accidental, deliberate, and naturally occurring public health threats in the United States.

Emergent BioSolutions, recently added to the S&P Biotechnology Select Industry Index, reflects a nuanced trajectory in the high-tech biotech sector. Despite a challenging financial outlook with a net loss widening this year, its strategic R&D investments are noteworthy. In 2024 alone, R&D expenses surged by 106.4%, underscoring its commitment to innovation amid rising operational costs. This aggressive focus on research has propelled developments like the FDA-approved ACAM2000 vaccine for mpox prevention—highlighting Emergent's pivotal role in addressing global health crises. Moreover, securing substantial debt financing underscores its resolve to sustain intensive growth initiatives and manage liquidity strategically—a critical move as it navigates through profitability challenges and competitive market dynamics.

- Get an in-depth perspective on Emergent BioSolutions' performance by reading our health report here.

Evaluate Emergent BioSolutions' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 255 US High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GERN

Geron

A late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies.

High growth potential with adequate balance sheet.