- United States

- /

- Tech Hardware

- /

- NasdaqGM:TBCH

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.1%, yet it remains up by an impressive 22% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate robust innovation and scalability potential to thrive amidst these market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Turtle Beach (NasdaqGM:HEAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Turtle Beach Corporation is an audio technology company with operations spanning North America, Europe, the Middle East, and the Asia Pacific, and it has a market capitalization of approximately $339.74 million.

Operations: The company generates revenue primarily from its Audio/Video Products segment, which contributed $326.23 million.

Turtle Beach has demonstrated a robust turnaround, transitioning from a net loss to generating substantial profits with third-quarter sales soaring to $94.36 million from $59.16 million year-over-year. This growth is underpinned by aggressive expansion into international markets, notably through product launches in Latin America and Canada, enhancing its global footprint in the gaming accessory space. Additionally, the company's commitment to shareholder returns is evident from its recent repurchase of 688,389 shares for $10.13 million, reflecting confidence in its financial health and future prospects. With earnings expected to climb by 65.17% annually and revenue projections set to outpace the US market significantly at an annual rate of 14.7%, Turtle Beach appears well-positioned for sustained growth driven by strategic market expansions and innovative product offerings.

- Take a closer look at Turtle Beach's potential here in our health report.

Gain insights into Turtle Beach's past trends and performance with our Past report.

Corsair Gaming (NasdaqGS:CRSR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corsair Gaming, Inc. is a company that designs, develops, markets, and sells gaming and streaming peripherals as well as components and systems across various regions including the Americas, Europe, the Middle East, and the Asia Pacific with a market capitalization of approximately $685.26 million.

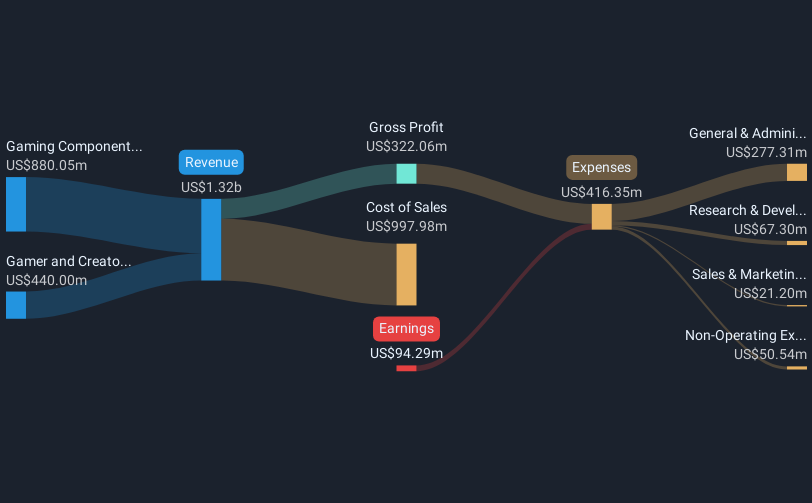

Operations: Corsair Gaming generates revenue primarily from two segments: Gamer and Creator Peripherals, which account for $440 million, and Gaming Components and Systems, contributing $880 million. The company operates across multiple regions including the Americas, Europe, the Middle East, and the Asia Pacific.

Despite facing a challenging year, Corsair Gaming has demonstrated resilience and strategic agility. The company's recent product launches, including the K65 PLUS WIRELESS keyboard and M75 WIRELESS mouse, specifically tailored for Mac users, underscore its commitment to diversifying its portfolio and enhancing user experience. These efforts are reflected in Corsair's maintained revenue forecast of $1.25 billion to $1.35 billion for 2024. Moreover, their active participation in major technology conferences highlights ongoing initiatives to strengthen investor relations and market presence. While currently unprofitable with a net loss widening this year compared to last, Corsair’s projected return to profitability over the next three years alongside an expected revenue growth rate of 10.2% per annum—surpassing the US market average—signals potential for recovery and growth driven by innovation and strategic market expansions.

- Click here to discover the nuances of Corsair Gaming with our detailed analytical health report.

Examine Corsair Gaming's past performance report to understand how it has performed in the past.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geron Corporation is a late-stage clinical biopharmaceutical company dedicated to developing and commercializing therapeutics for myeloid hematologic malignancies, with a market cap of approximately $2.03 billion.

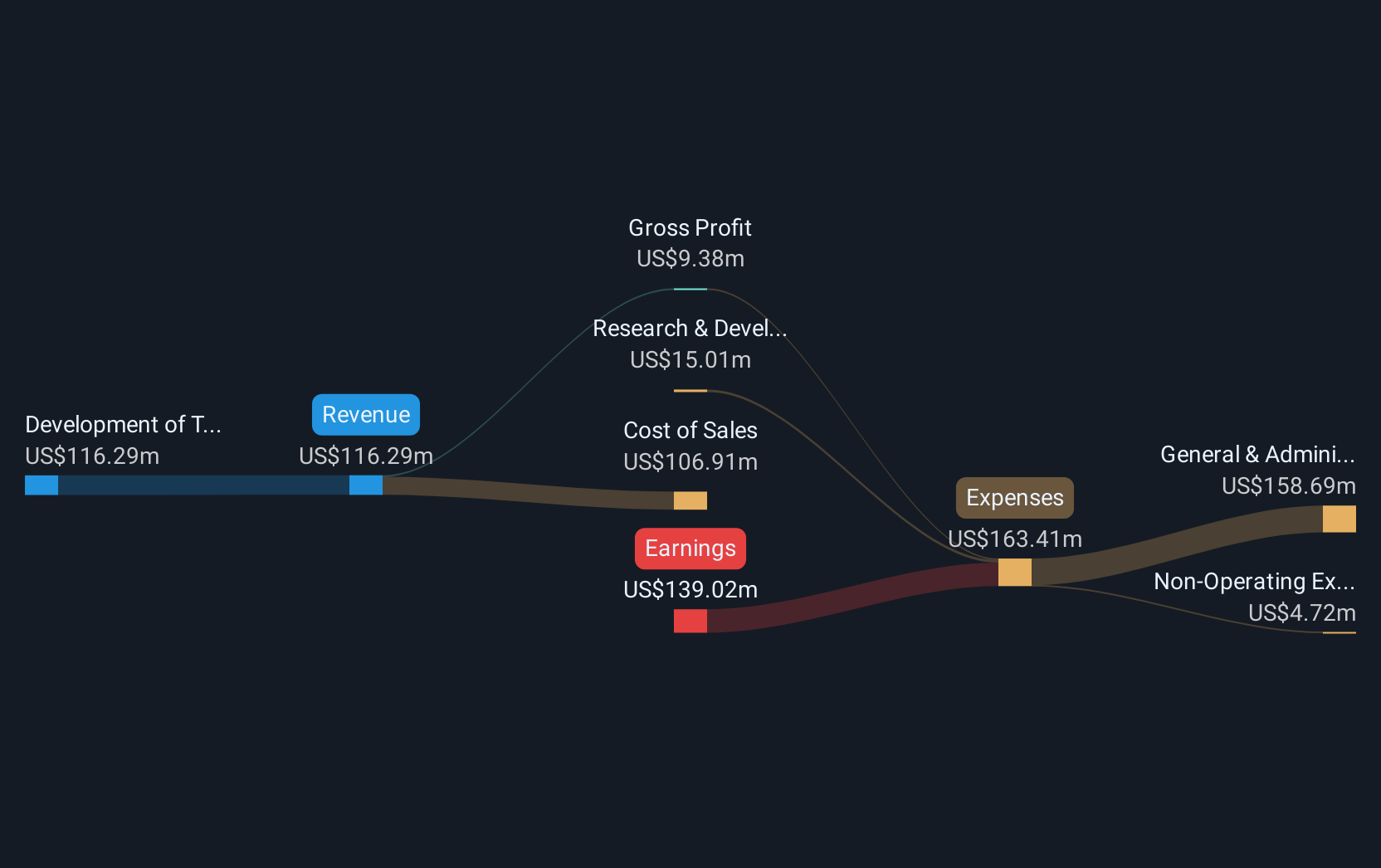

Operations: Geron Corporation generates revenue primarily from the development of therapeutic products for oncology, amounting to $29.48 million. The company focuses on advancing treatments for myeloid hematologic malignancies as part of its core business operations.

Geron Corporation, a pioneer in telomerase inhibition, recently received a positive nod from the CHMP for RYTELO, marking a significant stride in treating myelodysplastic syndromes (MDS). This approval underscores Geron's commitment to addressing unmet medical needs through innovative therapies. Despite challenges, including potential regulatory hurdles and manufacturing demands outlined during recent announcements, Geron's strategic focus on expanding its clinical trials for hematologic malignancies demonstrates its potential resilience and growth within biotech. The company’s substantial investment in R&D aligns with this strategy, aiming to drive future advancements and therapeutic breakthroughs.

- Dive into the specifics of Geron here with our thorough health report.

Review our historical performance report to gain insights into Geron's's past performance.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 233 US High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turtle Beach might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TBCH

Turtle Beach

Operates as an audio technology company in North America, Europe, the Middle East, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives