- United States

- /

- Pharma

- /

- NasdaqGM:FULC

There's Reason For Concern Over Fulcrum Therapeutics, Inc.'s (NASDAQ:FULC) Massive 34% Price Jump

Fulcrum Therapeutics, Inc. (NASDAQ:FULC) shareholders have had their patience rewarded with a 34% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

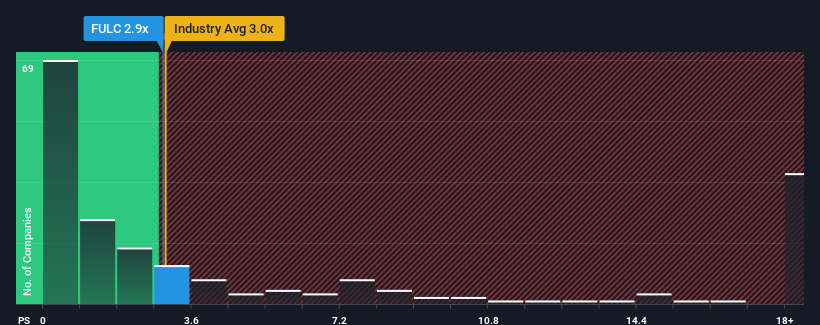

In spite of the firm bounce in price, it's still not a stretch to say that Fulcrum Therapeutics' price-to-sales (or "P/S") ratio of 2.9x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in the United States, where the median P/S ratio is around 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Fulcrum Therapeutics

How Has Fulcrum Therapeutics Performed Recently?

Recent times have been advantageous for Fulcrum Therapeutics as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fulcrum Therapeutics.How Is Fulcrum Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Fulcrum Therapeutics would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 100% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 20% per year, which paints a poor picture.

In light of this, it's somewhat alarming that Fulcrum Therapeutics' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Fulcrum Therapeutics' P/S Mean For Investors?

Fulcrum Therapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Fulcrum Therapeutics' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Fulcrum Therapeutics (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FULC

Fulcrum Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing products for improving the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives