- United States

- /

- Pharma

- /

- NasdaqGM:FULC

Fulcrum Therapeutics (NASDAQ:FULC) shareholders are up 16% this past week, but still in the red over the last five years

Fulcrum Therapeutics, Inc. (NASDAQ:FULC) shareholders will doubtless be very grateful to see the share price up 97% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 65% in the period. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the stock has risen 16% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

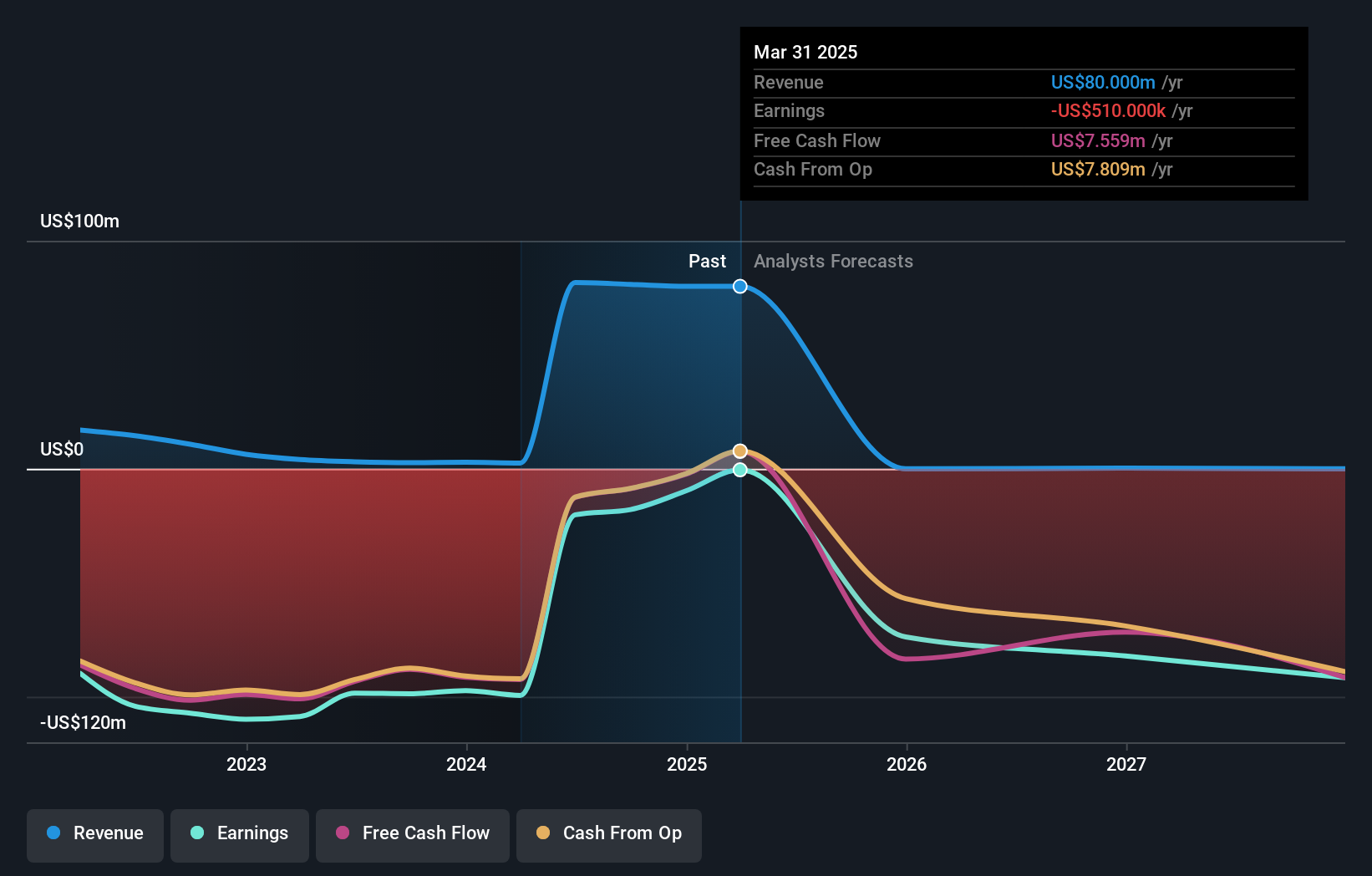

Fulcrum Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Fulcrum Therapeutics grew its revenue at 54% per year. That's better than most loss-making companies. Unfortunately for shareholders the share price has dropped 11% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Fulcrum Therapeutics will earn in the future (free profit forecasts).

A Different Perspective

Investors in Fulcrum Therapeutics had a tough year, with a total loss of 7.6%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Fulcrum Therapeutics (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

We will like Fulcrum Therapeutics better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FULC

Fulcrum Therapeutics

A clinical-stage biopharmaceutical company, develops small molecules to improve the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives