- United States

- /

- Pharma

- /

- NasdaqGM:FULC

Analysts Are Upgrading Fulcrum Therapeutics, Inc. (NASDAQ:FULC) After Its Latest Results

Fulcrum Therapeutics, Inc. (NASDAQ:FULC) investors will be delighted, with the company turning in some strong numbers with its latest results. Revenues of US$4.4m beat estimates by a substantial 129% margin. Unfortunately, Fulcrum Therapeutics also reported a statutory loss of US$0.60 per share, which at least was smaller than the analysts expected. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Fulcrum Therapeutics

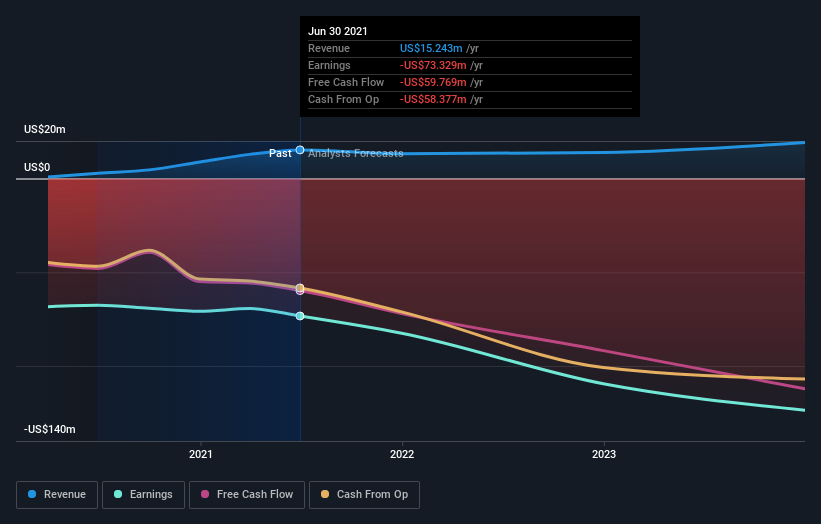

Following the recent earnings report, the consensus from seven analysts covering Fulcrum Therapeutics is for revenues of US$13.2m in 2021, implying a chunky 14% decline in sales compared to the last 12 months. Losses are expected to hold steady at around US$2.47. Before this latest report, the consensus had been expecting revenues of US$9.70m and US$2.63 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

It will come as no surprise to learn thatthe analysts have increased their price target for Fulcrum Therapeutics 27% to US$26.29on the back of these upgrades. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Fulcrum Therapeutics analyst has a price target of US$45.00 per share, while the most pessimistic values it at US$11.00. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 25% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 454% over the last year. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.6% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Fulcrum Therapeutics is expected to lag the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Fulcrum Therapeutics analysts - going out to 2023, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for Fulcrum Therapeutics (1 can't be ignored!) that you need to take into consideration.

If you’re looking to trade Fulcrum Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FULC

Fulcrum Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing products for improving the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives