- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Does Fortrea (FTRE)–SCTbio Tie-Up Hint At A Deeper Shift In Its CGT Strategy?

Reviewed by Sasha Jovanovic

- In late November 2025, SCTbio and Fortrea Holdings announced a collaboration designed to align clinical trial logistics with GMP manufacturing readiness for cell and gene therapies, aiming to shorten development timelines and improve cost-efficiency across the full development lifecycle.

- This model of closer coordination between a CRO and a CDMO offers a differentiated way to support the more than 4,400 advanced therapies currently in development, potentially reducing program risk for sponsors.

- We’ll now examine how this SCTbio partnership, which targets smoother cell and gene therapy development, could reshape Fortrea’s broader investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Fortrea Holdings Investment Narrative Recap

To own Fortrea, you have to believe that its contract research platform can convert solid demand for outsourced trials into improving margins, despite recent losses and share price volatility. The SCTbio alliance fits this story by deepening Fortrea’s role in complex cell and gene therapy programs, but it does not materially change the near term focus on rebuilding investor confidence and addressing questions around disclosure practices.

Among recent announcements, the completion of Fortrea’s tender offer for US$75,743,000 of its 7.500% Senior Secured Notes due 2030 stands out, as it modestly reduces leverage and interest obligations. For investors watching catalysts, that balance sheet adjustment sits alongside the SCTbio collaboration as part of a wider effort to sharpen Fortrea’s profile in higher value services while stabilizing its financial footing.

Yet, alongside these developments, the shareholder investigation into alleged misstatements around revenue and EBITDA targets is something investors should be aware of...

Read the full narrative on Fortrea Holdings (it's free!)

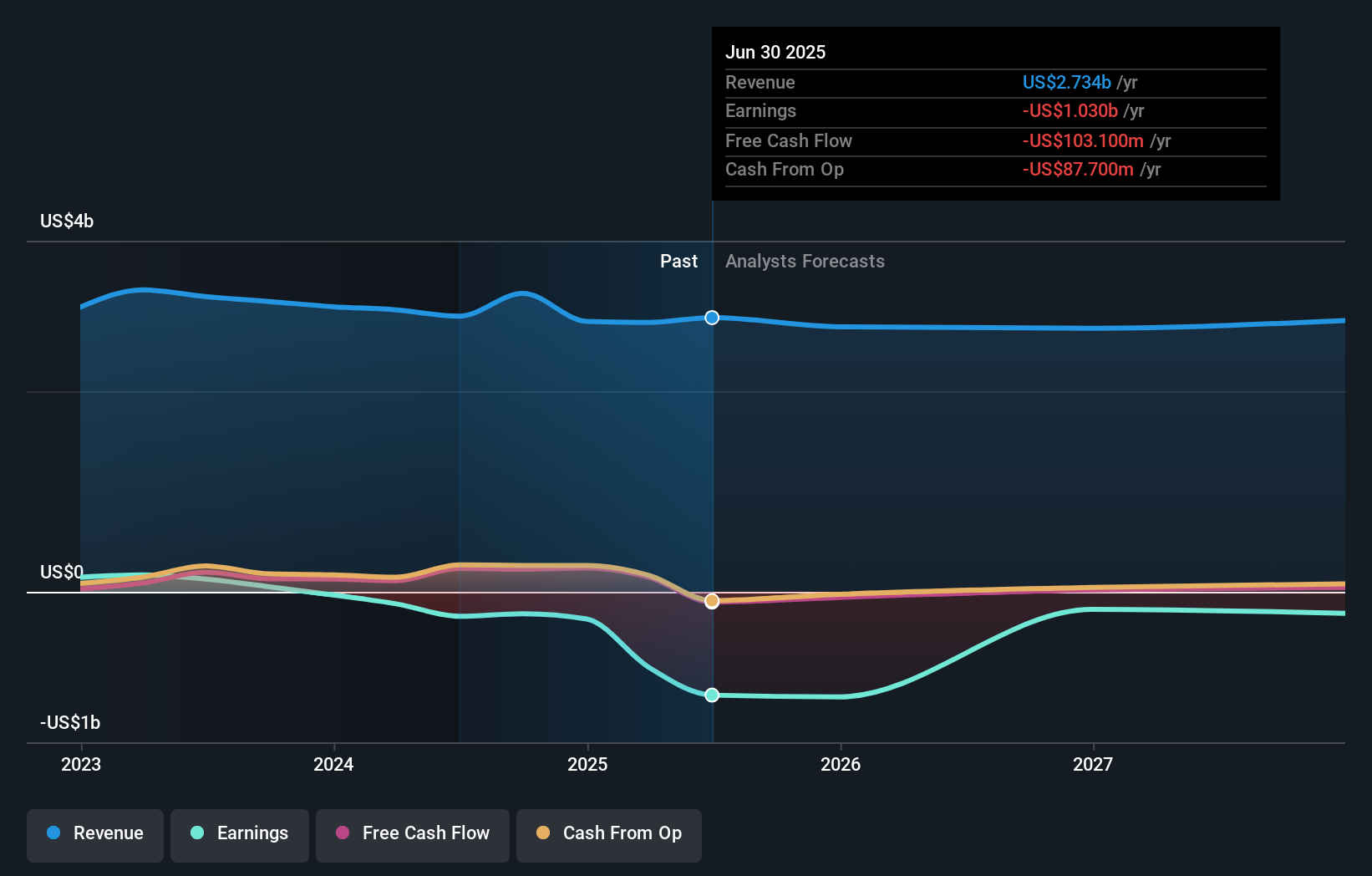

Fortrea Holdings' narrative projects $2.7 billion revenue and $388.5 million earnings by 2028. This implies a 0.1% yearly revenue decline and an earnings increase of about $1.4 billion from -$1.0 billion today.

Uncover how Fortrea Holdings' forecasts yield a $11.21 fair value, a 23% downside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from US$11.21 to US$36.79 per share, reflecting very different expectations. When you set these opinions against ongoing concerns about customer concentration risk, it underlines why many readers may want to compare several viewpoints before forming a view on Fortrea’s longer term performance.

Explore 2 other fair value estimates on Fortrea Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Fortrea Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fortrea Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortrea Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026