- United States

- /

- Biotech

- /

- NasdaqGS:FGEN

Benign Growth For FibroGen, Inc. (NASDAQ:FGEN) Underpins Stock's 28% Plummet

Unfortunately for some shareholders, the FibroGen, Inc. (NASDAQ:FGEN) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 93% share price decline.

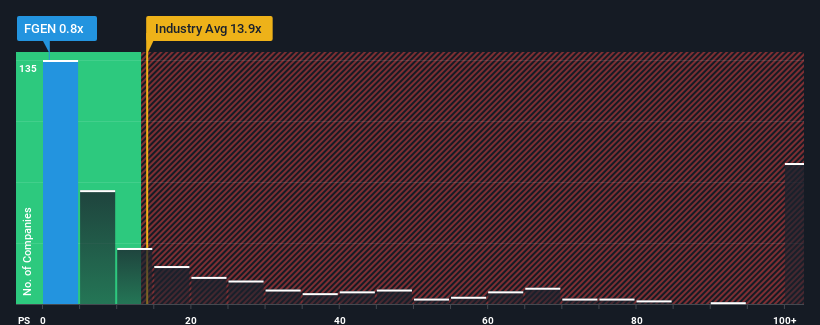

Since its price has dipped substantially, FibroGen may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.9x and even P/S higher than 66x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for FibroGen

What Does FibroGen's Recent Performance Look Like?

Recent times haven't been great for FibroGen as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on FibroGen will help you uncover what's on the horizon.How Is FibroGen's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as FibroGen's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 5.0%. However, this wasn't enough as the latest three year period has seen an unpleasant 16% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the three analysts watching the company. With the industry predicted to deliver 151% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that FibroGen's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

FibroGen's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that FibroGen maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider and we've discovered 5 warning signs for FibroGen (3 can't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade FibroGen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FGEN

FibroGen

A biopharmaceutical company, discovers, develops, and commercializes therapeutics to treat serious unmet medical needs.

Slight and slightly overvalued.