- United States

- /

- Software

- /

- OTCPK:SDCH

FibroBiologics And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market reacts to recent developments in tariffs and corporate earnings, investors are on the lookout for opportunities that may not be immediately apparent in larger indices. Penny stocks, a term often associated with speculative investments, represent an intriguing segment of the market where smaller or newer companies can offer potential growth at accessible price points. Despite their vintage label, these stocks can provide substantial value when backed by strong financials and fundamentals, making them worthy of attention for those seeking hidden gems in today's economic landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8975 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2651 | $10.4M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.91 | $89.18M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.45 | $48.18M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.94 | $52.92M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.24 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9305 | $85.11M | ★★★★★☆ |

| SideChannel (OTCPK:SDCH) | $0.04 | $9.02M | ★★★★★★ |

Click here to see the full list of 715 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

FibroBiologics (NasdaqGM:FBLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FibroBiologics, Inc. is a cell therapy and regenerative medicine company with a market cap of $56.49 million.

Operations: FibroBiologics, Inc. currently does not report any revenue segments.

Market Cap: $56.49M

FibroBiologics, Inc., with a market cap of US$56.49 million, is a pre-revenue company in the biotech sector. Recent activities include filing multiple shelf registrations, notably closing one for US$93.77 million and entering into equity agreements to bolster its cash position. Despite these capital-raising efforts, the company remains unprofitable with increasing losses over five years at 51% annually and forecasts suggest further earnings decline by 16.7% per year over the next three years. FibroBiologics' short-term assets exceed liabilities, but its volatile share price reflects ongoing financial instability as it navigates early-stage development challenges.

- Click to explore a detailed breakdown of our findings in FibroBiologics' financial health report.

- Understand FibroBiologics' earnings outlook by examining our growth report.

Sypris Solutions (NasdaqGM:SYPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sypris Solutions, Inc. operates in North America and Mexico, providing truck components, oil and gas pipeline components, and aerospace and defense electronics, with a market cap of $49.22 million.

Operations: The company's revenue is divided between Sypris Electronics, which generated $66.78 million, and Sypris Technologies, contributing $74.69 million.

Market Cap: $49.22M

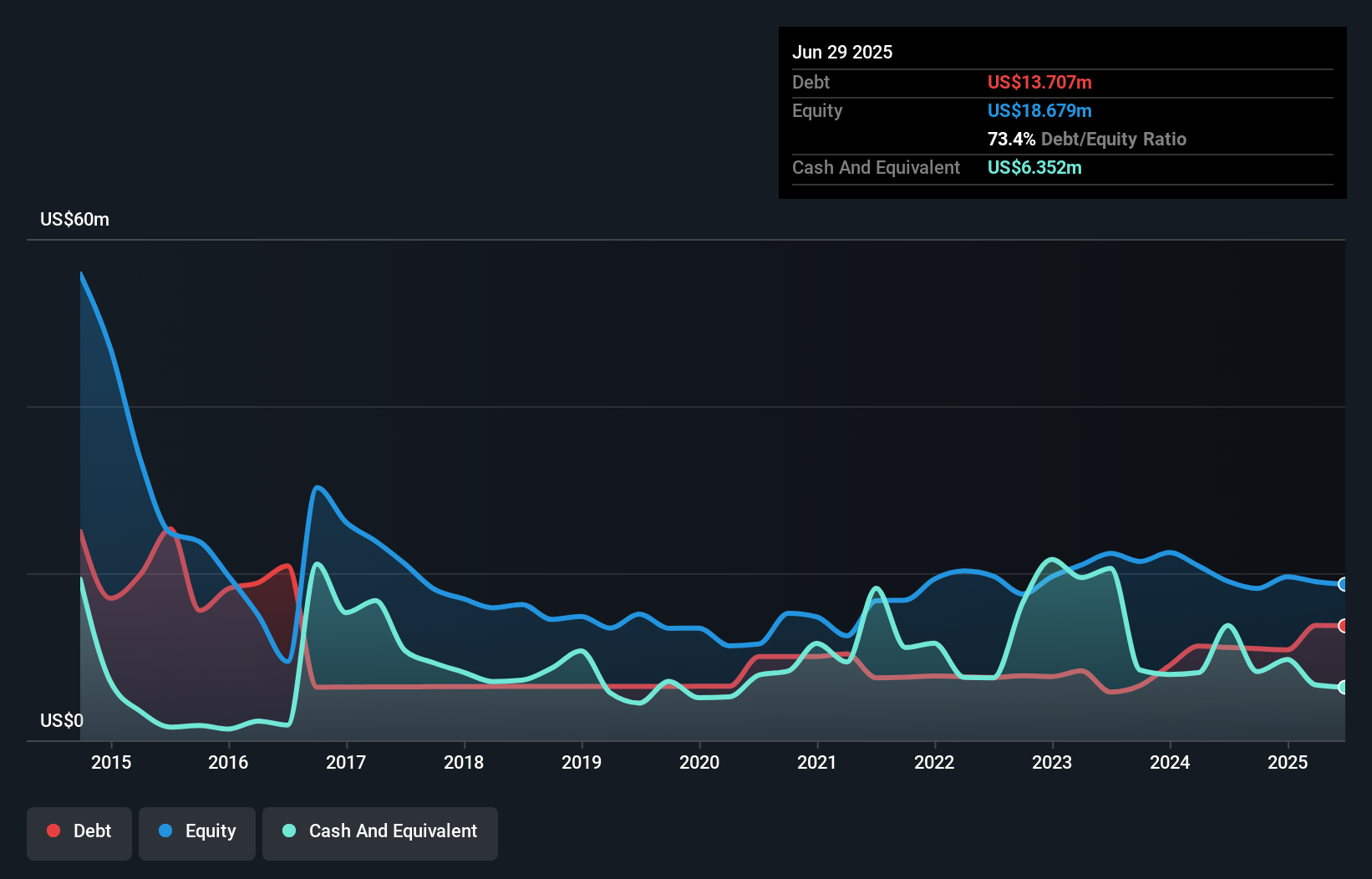

Sypris Solutions, Inc., with a market cap of US$49.22 million, operates in the truck components and electronics sectors. Despite recent improvements in quarterly net income to US$0.39 million, the company remains unprofitable over the past five years with increasing losses at 17.1% annually. Its short-term assets of US$99.4 million exceed liabilities, providing some financial stability amidst high share price volatility and increased debt levels from 48.2% to 60.3%. While management is experienced and debt levels are satisfactory at a net debt to equity ratio of 15.1%, earnings growth remains challenging due to production delays and industry competition.

- Click here to discover the nuances of Sypris Solutions with our detailed analytical financial health report.

- Explore historical data to track Sypris Solutions' performance over time in our past results report.

SideChannel (OTCPK:SDCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SideChannel, Inc. focuses on identifying, developing, and deploying cybersecurity solutions in North America with a market cap of $9.02 million.

Operations: The company generates $7.4 million in revenue from the research, development, and commercialization of its technology.

Market Cap: $9.02M

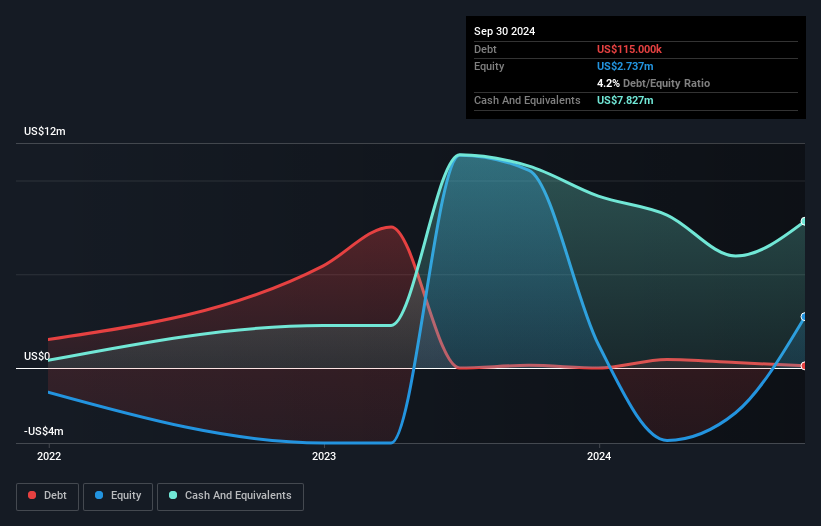

SideChannel, Inc., with a market cap of US$9.02 million, reported sales of US$7.42 million for the year ending September 30, 2024, reflecting modest revenue growth. Despite being unprofitable and experiencing a net loss of US$0.785 million, the company has no debt and maintains a strong cash runway exceeding three years due to positive free cash flow. The board's inexperience contrasts with an experienced management team averaging 4.6 years in tenure. Recent bylaw amendments propose a reverse stock split to be decided at the upcoming AGM on February 12, 2025, potentially impacting share liquidity and volatility further.

- Navigate through the intricacies of SideChannel with our comprehensive balance sheet health report here.

- Explore SideChannel's analyst forecasts in our growth report.

Next Steps

- Jump into our full catalog of 715 US Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SDCH

SideChannel

SideChannel, Inc. identifies, develops, and deploys of v solutions in North America.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives