- United States

- /

- Biotech

- /

- NasdaqGM:FATE

Fate Therapeutics, Inc.'s (NASDAQ:FATE) Shares Bounce 30% But Its Business Still Trails The Industry

The Fate Therapeutics, Inc. (NASDAQ:FATE) share price has done very well over the last month, posting an excellent gain of 30%. But the last month did very little to improve the 75% share price decline over the last year.

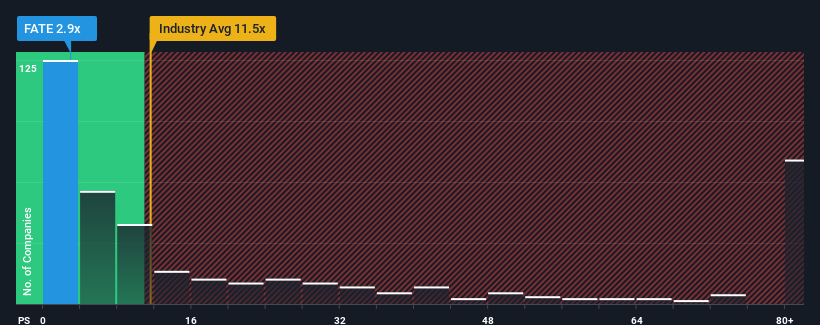

Although its price has surged higher, Fate Therapeutics may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.9x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.5x and even P/S higher than 49x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Fate Therapeutics

How Has Fate Therapeutics Performed Recently?

Recent times have been advantageous for Fate Therapeutics as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Fate Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Fate Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Fate Therapeutics would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 58% each year as estimated by the analysts watching the company. Meanwhile, the broader industry is forecast to expand by 222% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Fate Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Fate Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Fate Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Fate Therapeutics (1 shouldn't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Fate Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FATE

Fate Therapeutics

A clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders in the United States and internationally.

Flawless balance sheet low.