- United States

- /

- Biotech

- /

- NasdaqGM:FATE

Fate Therapeutics, Inc.'s (NASDAQ:FATE) 28% Dip In Price Shows Sentiment Is Matching Revenues

Fate Therapeutics, Inc. (NASDAQ:FATE) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

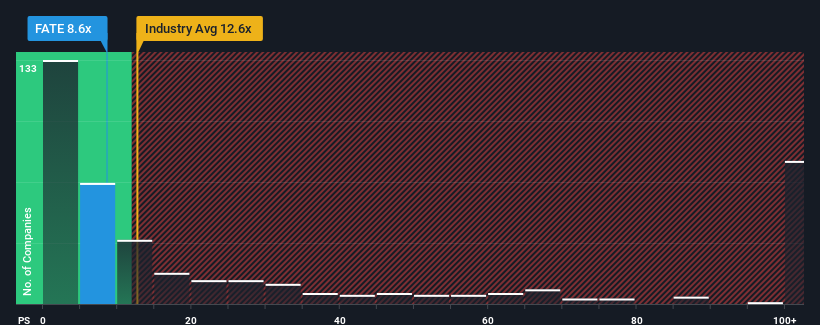

Since its price has dipped substantially, Fate Therapeutics may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 8.6x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.6x and even P/S higher than 63x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Fate Therapeutics

How Fate Therapeutics Has Been Performing

While the industry has experienced revenue growth lately, Fate Therapeutics' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Fate Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Fate Therapeutics would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. Even so, admirably revenue has lifted 102% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 54% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 162% per year, which paints a poor picture.

In light of this, it's understandable that Fate Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Fate Therapeutics' recently weak share price has pulled its P/S back below other Biotechs companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Fate Therapeutics' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Fate Therapeutics (1 is a bit concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FATE

Fate Therapeutics

A clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders in the United States and internationally.

Flawless balance sheet low.