- United States

- /

- Biotech

- /

- NasdaqGM:FATE

Fate Therapeutics, Inc. (NASDAQ:FATE) Held Back By Insufficient Growth Even After Shares Climb 57%

Despite an already strong run, Fate Therapeutics, Inc. (NASDAQ:FATE) shares have been powering on, with a gain of 57% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

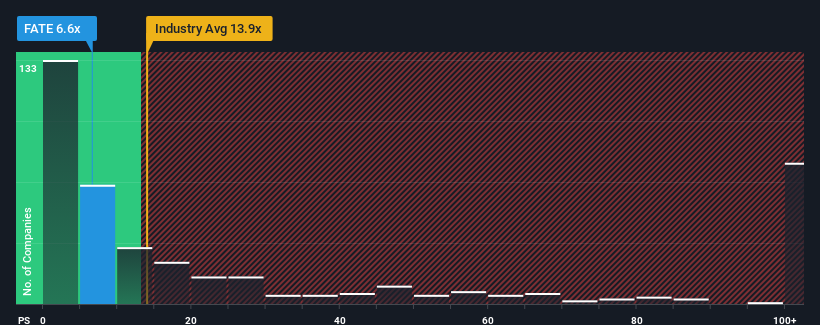

In spite of the firm bounce in price, Fate Therapeutics may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 6.6x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.9x and even P/S higher than 62x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Fate Therapeutics

How Fate Therapeutics Has Been Performing

Fate Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fate Therapeutics.Is There Any Revenue Growth Forecasted For Fate Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Fate Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 54% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 59% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 252% each year, which paints a poor picture.

In light of this, it's understandable that Fate Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Fate Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Fate Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Fate Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for Fate Therapeutics (1 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Fate Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FATE

Fate Therapeutics

A clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders in the United States and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives