- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Will Exelixis' (EXEL) New R&D Leadership Shape Its Competitive Edge in Oncology Innovation?

Reviewed by Simply Wall St

- Exelixis recently appointed Dana T. Aftab, Ph.D., as Executive Vice President of Research and Development, placing him in charge of all drug discovery, translational research, product development, and medical affairs activities; this follows the departure of Amy Peterson, M.D., from her executive and chief medical officer roles.

- Dr. Aftab's extensive history with Exelixis and his contribution to the development of CABOMETYX may signal a renewed focus on pipeline leadership as the company seeks to sustain its position in fast-evolving oncology markets.

- We'll examine how this change in scientific leadership could influence Exelixis's innovation strategy and R&D execution in the coming years.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Exelixis Investment Narrative Recap

To be a shareholder in Exelixis, one must believe that the company's pipeline can help offset future revenue dependency on CABOMETYX as competition and pricing headwinds intensify. The appointment of Dr. Dana Aftab as EVP of R&D, following Dr. Peterson's departure, is a continuity move and does not materially alter the near-term catalysts, namely, clinical trial outcomes for late-stage pipeline assets, or the primary risk, which remains product concentration. Amid these leadership changes, the most relevant announcement for investors remains the positive topline results from the STELLAR-303 trial in metastatic colorectal cancer, as it supports diversification of future revenue streams critical to reducing reliance on CABOMETYX. Management’s focus on pipeline execution, reflected in both the leadership appointment and ongoing development milestones, is closely tied to how quickly new products can achieve regulatory and commercial success. Yet, despite these efforts, investors should be alert to a contrasting consideration: if CABOMETYX's market position weakens before pipeline assets reach scale...

Read the full narrative on Exelixis (it's free!)

Exelixis' outlook anticipates $3.1 billion in revenue and $1.2 billion in earnings by 2028. This scenario assumes an 11.9% annual revenue growth rate and an increase in earnings of $597.7 million from the current $602.3 million.

Uncover how Exelixis' forecasts yield a $44.68 fair value, a 18% upside to its current price.

Exploring Other Perspectives

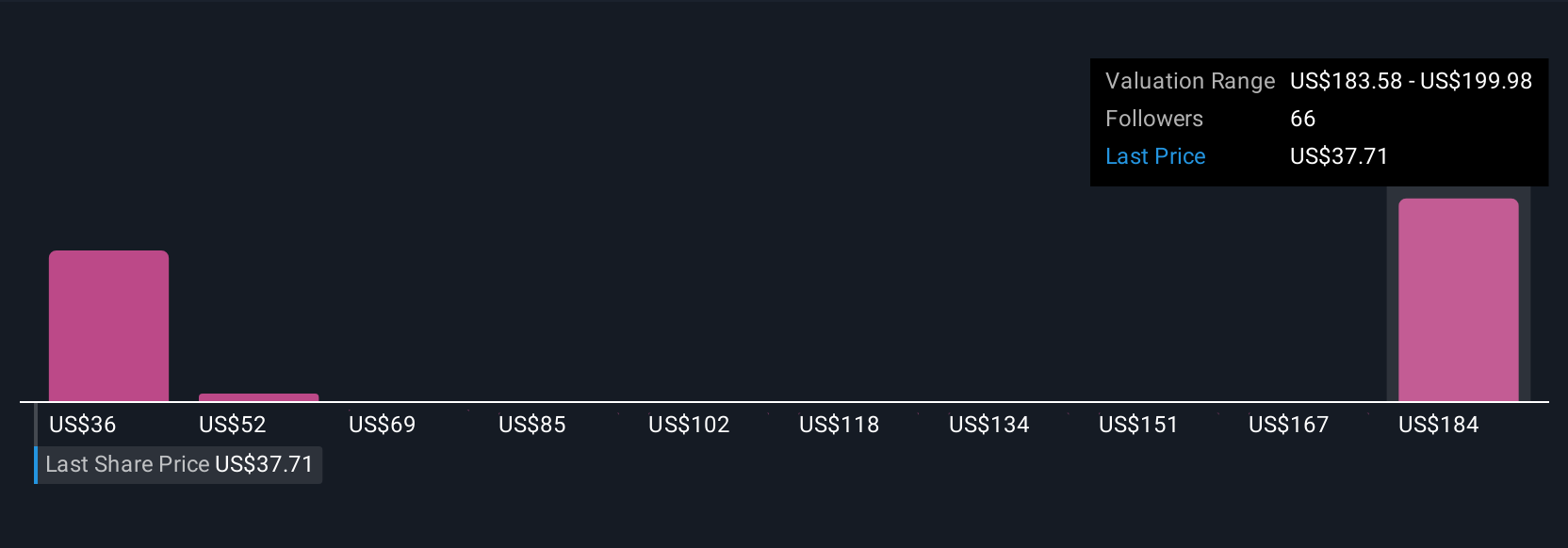

Fair value estimates from nine Simply Wall St Community members span US$36 to US$199.98 per share, with many above current trading levels. With so much riding on pipeline launches, the range of outlooks shows just how differently the potential risks and rewards are viewed, explore the collection of these viewpoints yourself.

Explore 9 other fair value estimates on Exelixis - why the stock might be worth just $36.00!

Build Your Own Exelixis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exelixis research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Exelixis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exelixis' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives