- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Is Now the Time to Reassess Exelixis After 50% Rally and FDA Filing News?

Reviewed by Bailey Pemberton

Thinking about what to do with your shares of Exelixis, or maybe you’re considering jumping in for the first time? You’re not alone. Over the last few years, Exelixis stock has given seasoned traders and curious newcomers plenty to talk about. Just in the past year, shares climbed an impressive 50.0%, and they’re up 146.3% over three years. These are numbers that turn heads in any portfolio. Mind you, there’s been plenty of volatility, with a dip of 6.7% in the last week, but a look at the longer term reveals strong momentum, partly fueled by shifting market sentiment toward targeted oncology companies like Exelixis as research advances and new therapies gain attention.

Of course, when a stock surges for years but starts to wobble in the short term, it’s natural to ask: is there real value left, or did the market already price in all the good news? That’s exactly what a valuation analysis can help us uncover. For Exelixis, the numbers suggest it’s worth a closer look since it scores a 4 out of 6 across multiple undervaluation tests, meaning most indicators still point to an attractive buying opportunity. But those are just the numbers on the surface. Next, let’s break down the different valuation approaches used, and later on, I’ll share a perspective that could give you an even sharper edge on understanding what the market might be missing.

Approach 1: Exelixis Discounted Cash Flow (DCF) Analysis

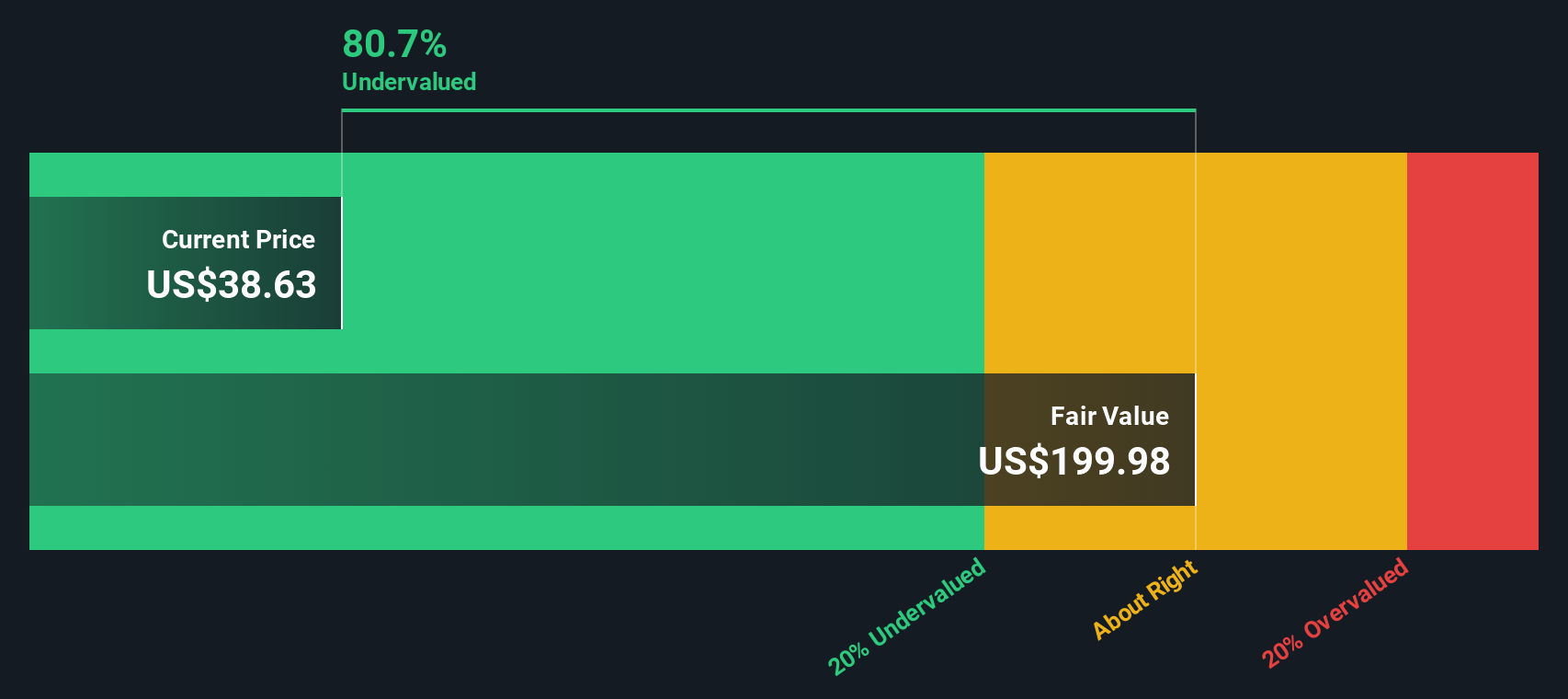

The Discounted Cash Flow (DCF) model estimates the true value of a business by projecting its future cash flows and discounting them back to today's value using a required rate of return. For Exelixis, this involves looking at how much cash the company generates now, forecasting how that will grow over the coming years, and then evaluating those future dollars as less valuable than money in hand today.

Currently, Exelixis reports $631 million in free cash flow, a number derived from its most recent filings. Analyst estimates project significant growth ahead, with free cash flow expected to climb to about $1.77 billion by the end of 2029. These projections rely on both analyst inputs for the next five years and longer-term forecasts extrapolated by Simply Wall St to stretch out to the end of the decade.

The conclusion of this cash flow analysis points to an intrinsic value per share of $198.21. When compared to the current market price, this suggests Exelixis is trading at an 80.5% discount to its calculated value. In straightforward terms, based on its projected ability to generate cash, the stock appears deeply undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exelixis is undervalued by 80.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

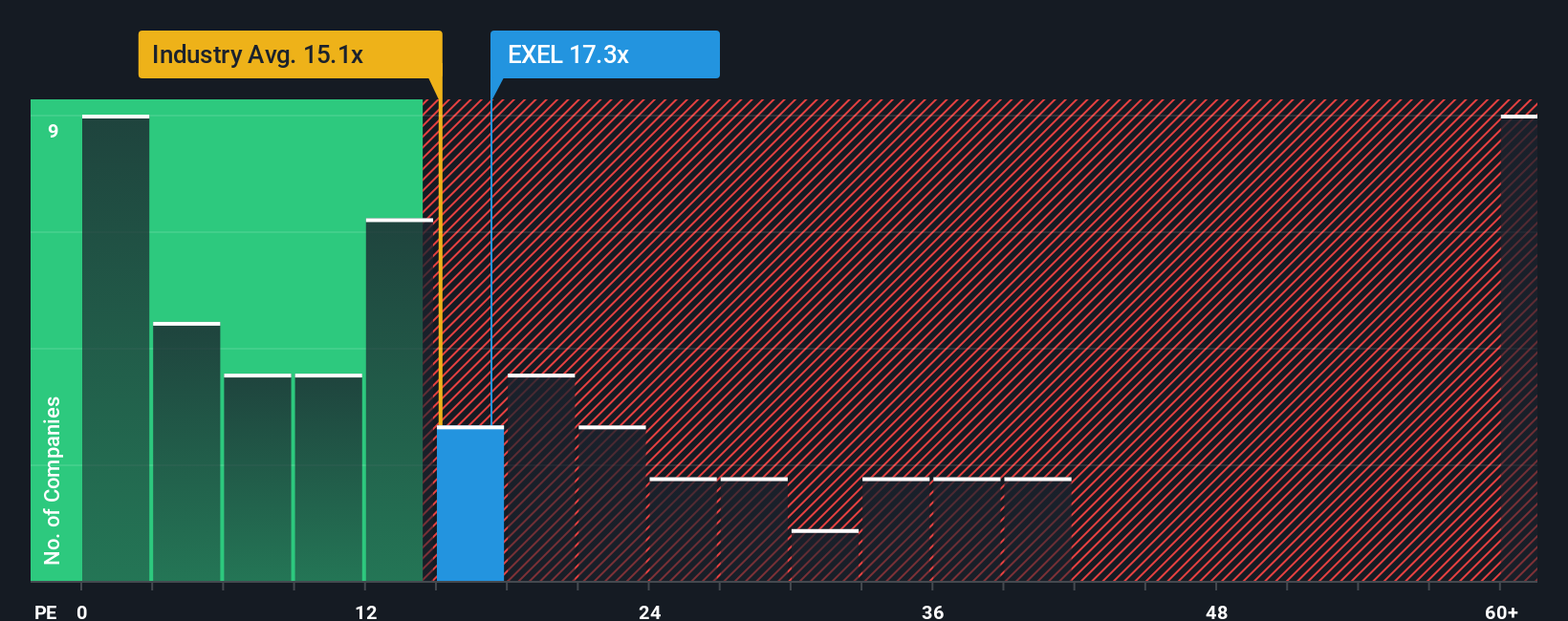

Approach 2: Exelixis Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored valuation metric when a company has consistent and positive earnings, making it well suited for companies like Exelixis that are currently profitable. This ratio quickly gauges how much investors are willing to pay for each dollar of earnings, which can be particularly insightful in the biotech industry where growth rates and risk profiles can vary widely.

Growth expectations and risk play a big role in what makes a “fair” PE ratio. If a company is expected to grow earnings faster than its peers or has a lower risk profile, the market may justify a higher PE. Conversely, high risk or slow growth can weigh the ratio down. Right now, Exelixis trades at a PE of 17.2x. That is just above the biotech industry average of 17.0x, but below the average for peers at 22.0x, suggesting modestly lower market expectations compared to some competitors.

Simply Wall St’s “Fair Ratio” adds more nuance by considering not just sector and peer comparisons, but also Exelixis’ own unique growth prospects, profit margins, and risk profile. For Exelixis, the Fair PE Ratio is 23.2x, a figure specifically tailored to the company’s circumstances, making it a more holistic benchmark than a generic industry average. Comparing this Fair PE to the current level, Exelixis stock comes across as materially undervalued, since the current PE is well below what the company arguably deserves based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exelixis Narrative

Earlier, we mentioned a smarter way to understand valuation, so let’s introduce you to Narratives, a dynamic tool that lets you connect the story behind Exelixis with the numbers and see how different perspectives shape fair value.

A Narrative is simply your own view of what the company’s future holds, turning research, insights, and forecasts about Exelixis’s performance into a concrete financial outcome. With Narratives, you combine your expectations for things like revenue growth, margins, or market shifts with valuation models. This makes the link between Exelixis’s corporate journey and the share price deeply personal and crystal clear.

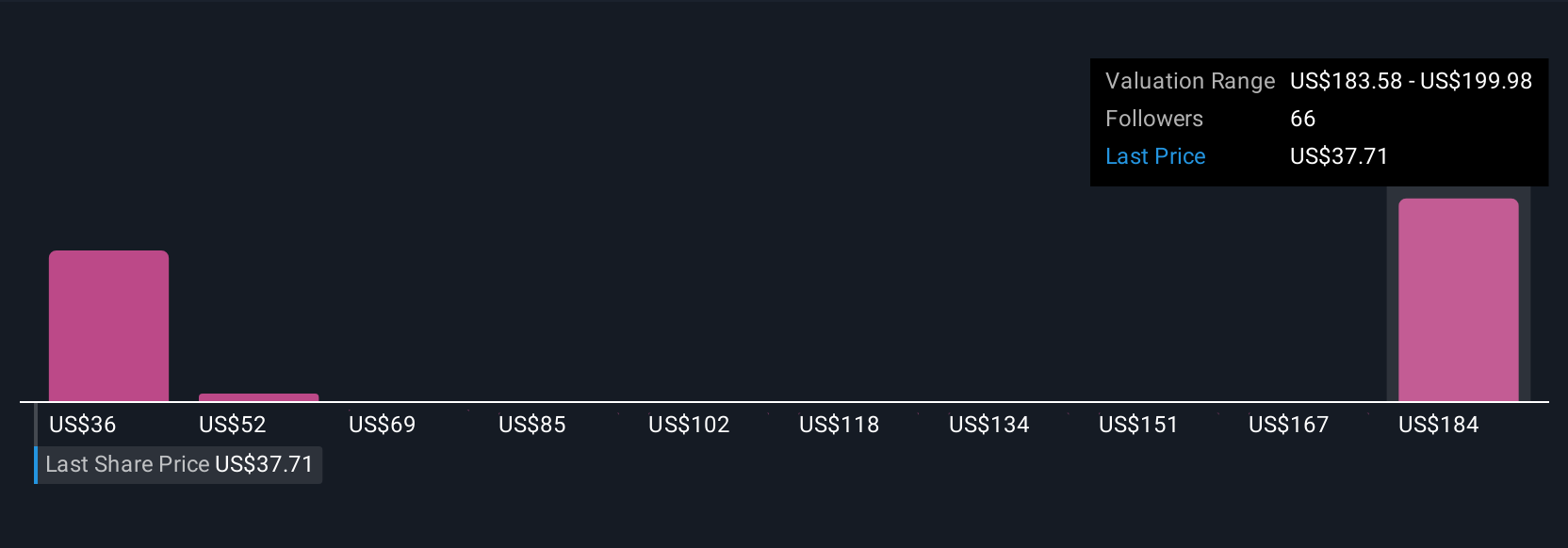

Narratives are easy to create or explore right within the Community page on Simply Wall St, where millions of investors compare, discuss, and update their views as new information comes in. This means you can quickly see when the Fair Value for Exelixis changes, helping you decide if the current price is an opportunity to buy or a signal to sell.

For example, some users expect robust global expansion and forecast a fair value as high as $60.00 per share, while others are more cautious about pipeline risks, setting it closer to $36.00. This shows just how much individual Narratives can influence your confidence in an investment decision.

Do you think there's more to the story for Exelixis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)