- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Exelixis (NASDAQ:EXEL) shareholders have earned a 7.9% CAGR over the last five years

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd like to see the share price move up more than the market average. But Exelixis, Inc. (NASDAQ:EXEL) has fallen short of that second goal, with a share price rise of 46% over five years, which is below the market return. On a brighter note, more newer shareholders are probably rather content with the 24% share price gain over twelve months.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Exelixis

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Exelixis actually saw its EPS drop 11% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 17% per year is probably viewed as evidence that Exelixis is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

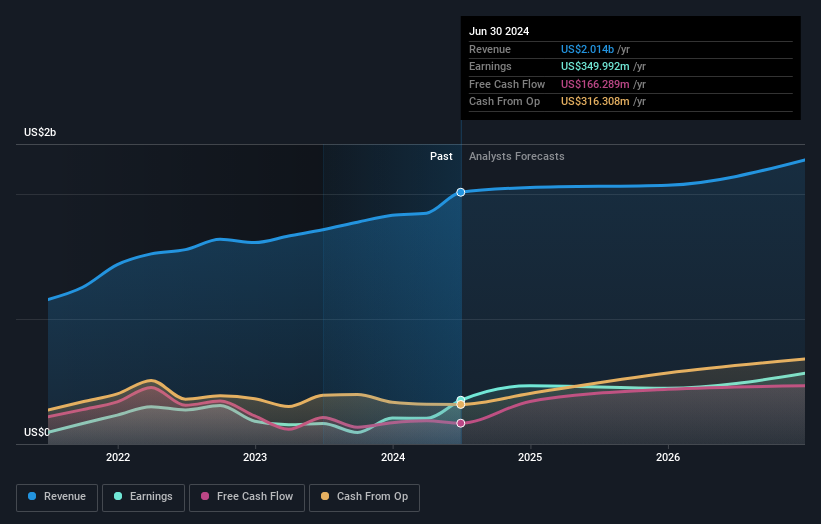

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Exelixis is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Exelixis stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Exelixis shareholders gained a total return of 24% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 8% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Exelixis is showing 1 warning sign in our investment analysis , you should know about...

We will like Exelixis better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Flawless balance sheet with high growth potential.