- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Exelixis (EXEL): Evaluating Valuation After Phase 3 Study Halt, Revenue Miss, and Legal Investigation News

Reviewed by Simply Wall St

If you’re holding or eyeing shares of Exelixis (EXEL), you’re probably watching the recent news very closely. The company just revealed it will not move forward to phase 3 of its STELLAR-305 study and also reported product revenue that came in lower than expected. To add to the uncertainty, an investor rights law firm has launched an investigation into possible securities law violations related to these disclosures. These updates have put a spotlight on Exelixis, raising fresh questions about its future drug pipeline and near-term growth trajectory.

It’s not surprising, then, that Exelixis stock has been on the move. Shares recently dropped about 17%, a sharp reversal from what had been steady gains earlier this year. Even with that decline, the stock remains up by 48% over the past year and has earned back more than 110% for those who stayed patient over the last three years. In just the last three months, though, momentum has swung negative, calling into question whether recent setbacks are shifting the narrative for Exelixis. Outside these headlines, management changes in the R&D leadership and regular appearances at industry conferences have also added to the mix of signals investors are weighing right now.

So after a wild year marked by both impressive gains and sudden swings, is Exelixis now undervalued, or is the market simply recalibrating to new realities and pricing in future risks?

Most Popular Narrative: 14% Undervalued

According to the most popular narrative, Exelixis shares are currently trading below their estimated fair value. Analysts view the stock as undervalued, supported by expectations for robust future growth and ongoing innovations in its oncology pipeline.

Positive top-line results from pivotal trials (e.g., STELLAR-303 for zanzalintinib in colorectal cancer) and an advancing late-stage pipeline provide significant potential for new product approvals and label expansions. This supports future earnings growth and further diversifies revenue streams as precision medicine and targeted therapy adoption accelerates across global oncology markets.

Curious what fuels this bold undervaluation call? The narrative is built on aggressive projections of future growth and profitability, driven by pipeline breakthroughs and operational scaling. Eager to discover the growth estimates and margin targets hidden beneath the surface? The path to Exelixis’s fair value might surprise you.

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as Exelixis's reliance on a single drug and the potential for rising competitive threats in key cancer markets.

Find out about the key risks to this Exelixis narrative.Another View: A Different Take on Value

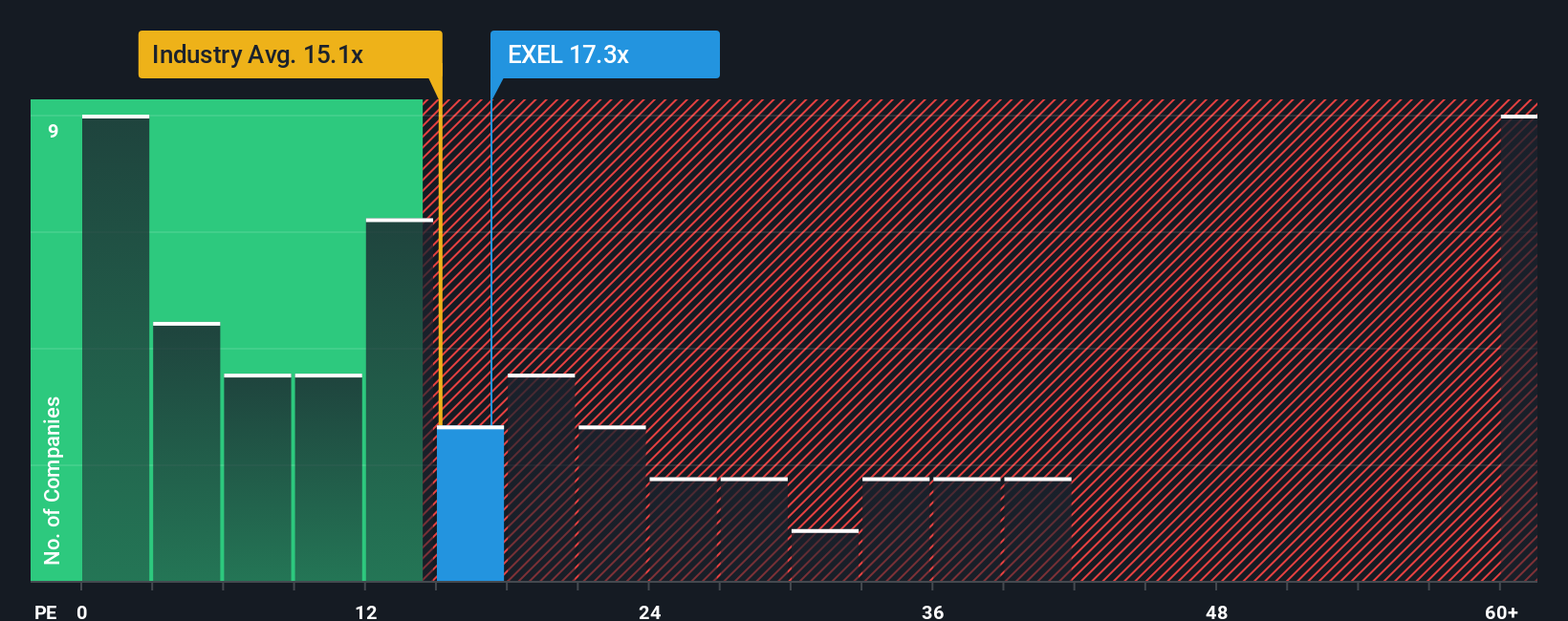

Looking at Exelixis through the lens of market comparisons, the company is currently priced higher than the industry average for similar stocks. Does this valuation signal hidden strength or warn of overexuberance?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Exelixis to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Exelixis Narrative

If you see things differently or want to dig deeper on your own, you can shape your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exelixis.

Looking for More Investment Ideas?

Now’s the perfect time to seize unique opportunities beyond Exelixis. Give yourself an edge by targeting stocks primed for growth with our powerful screening tools.

- Spot undervalued gems that might be flying under the radar using our undervalued stocks based on cash flows for exceptional value opportunities.

- Uncover the strongest income-generators with dividend stocks with yields > 3% and pinpoint companies delivering impressive yields above 3%.

- Catch breakthroughs in digital currencies by harnessing cryptocurrency and blockchain stocks to find trailblazers in cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives