- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Does Exelixis Offer Value After Recent Stock Drop and Earnings Results?

Reviewed by Simply Wall St

Approach 1: Exelixis Cash Flows

A Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting them back to their present value. This approach helps estimate what a business is truly worth today based on how much money it can generate over time.

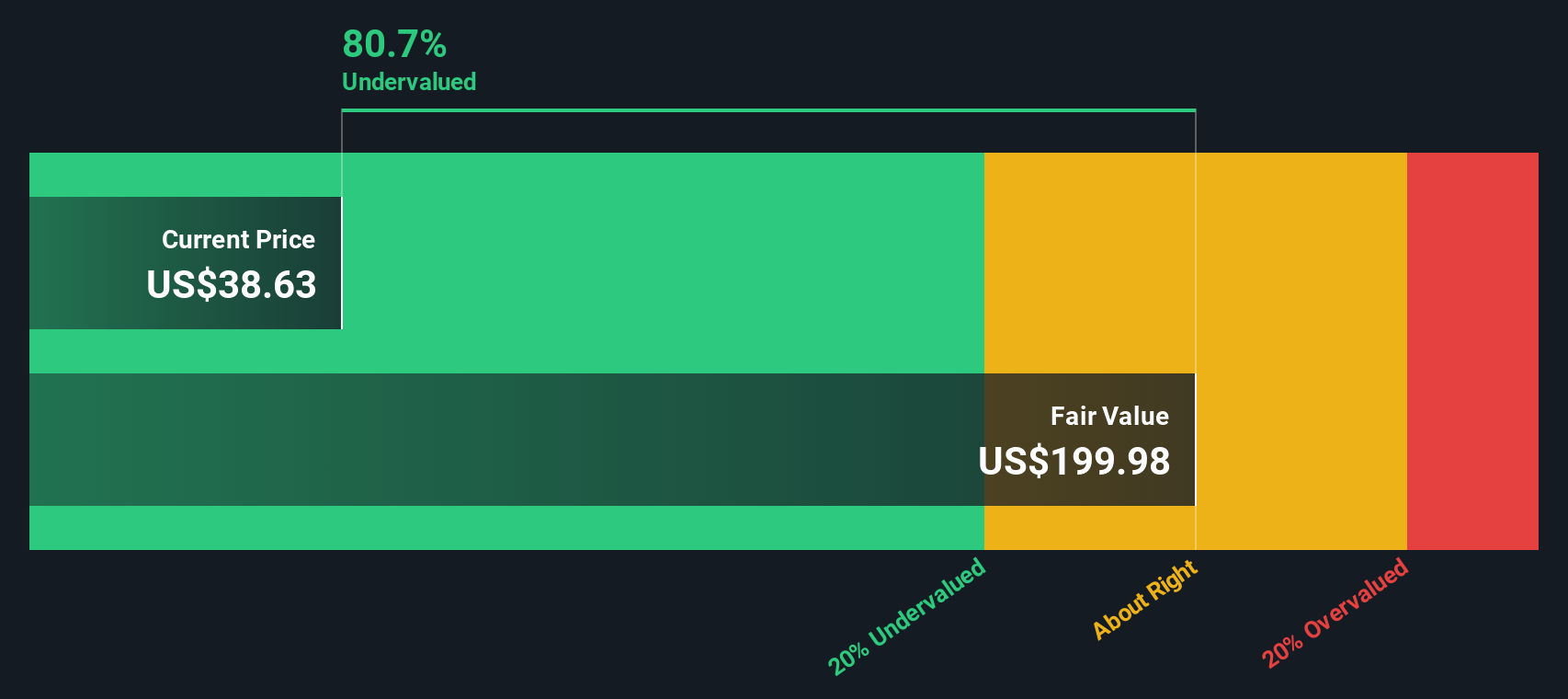

For Exelixis, the most recent twelve months of Free Cash Flow came in at $631 million. Analysts project this figure will grow steadily, reaching as high as $1.77 billion by the end of 2029 as the company's business expands. Looking even further ahead, ten-year projections suggest continued growth, with future free cash flows climbing each year.

Using these numbers in a two-stage Free Cash Flow to Equity model, the estimated intrinsic value of Exelixis is about $200 per share. This represents a significant difference from the current share price, suggesting the stock is 81.1% undervalued compared to where the DCF model sets fair value.

In summary, based on the discounted cash flow analysis, Exelixis appears to be trading well below the potential supported by its projected future cash generation if the forecasts are realized.

Result: UNDERVALUED

Approach 2: Exelixis Price vs Earnings

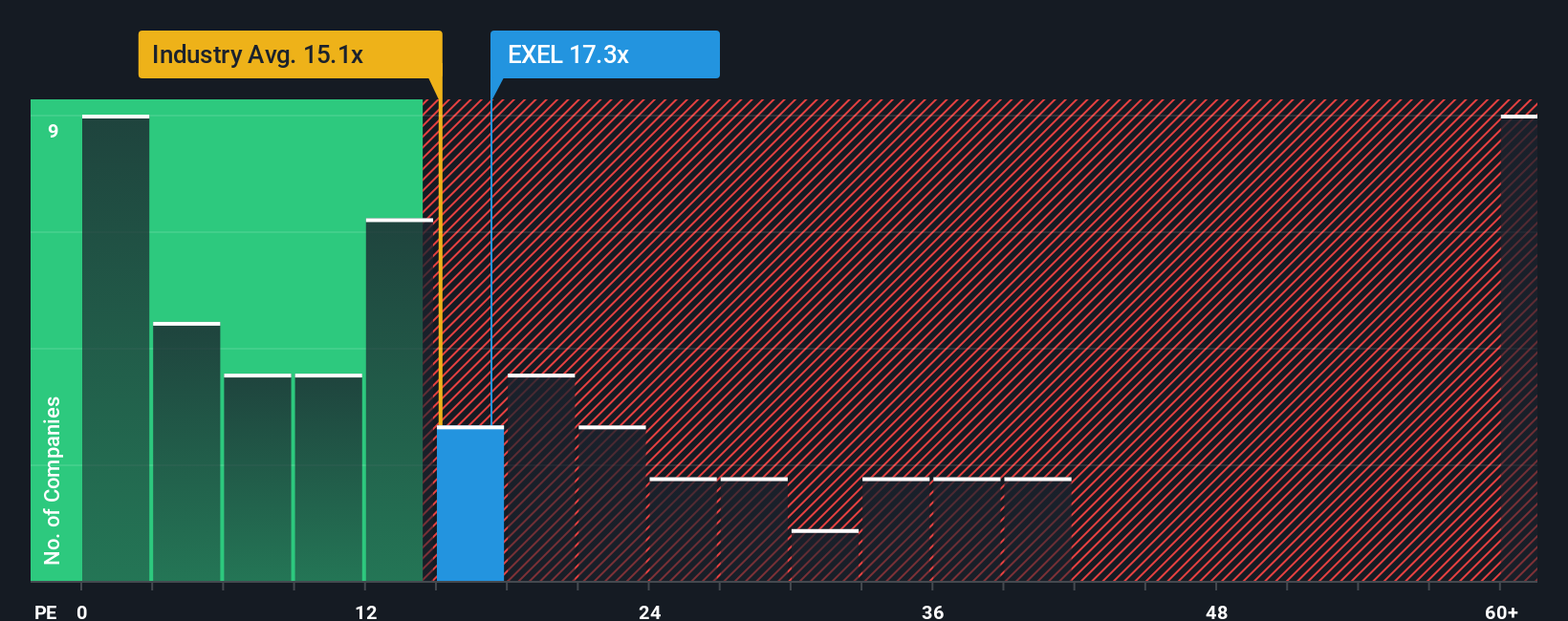

For profitable companies like Exelixis, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. It gives investors a simple way to compare how much they are paying for each dollar of earnings, and works especially well for businesses with a history of consistent profitability.

A company’s PE ratio reflects how the market views its future growth prospects and risks. Typically, higher growth rates and lower risks justify a higher PE, while companies expected to face slowdowns or more uncertainty tend to trade at lower multiples. Understanding how Exelixis’s PE compares to benchmarks can help clarify whether the current price is reasonable.

At present, Exelixis trades at a PE of 16.92x. This is slightly below both the average for its biotech peers at 20.24x and the broader industry average of 16.93x. Simply Wall St’s proprietary Fair Ratio for Exelixis, which incorporates its earnings growth outlook, industry position, and risks, stands at 20.94x. This suggests that Exelixis’s current valuation is under where this model indicates it could be, potentially leaving room for upside if the business meets growth expectations.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Exelixis Narrative

Investing is not just about numbers; it is also about the story you believe in for a company. That is where Narratives come in. A Narrative is your personal investment thesis: the story and assumptions you think best explain where Exelixis is headed, tying together its business future (such as growth drivers and risks) with your own forecasts for revenue, earnings, and what is a fair value for the shares today.

Narratives link the “why” behind the numbers with a clear financial forecast and current fair value, turning abstract data into actionable investment ideas. This approach makes it much easier to decide if and when to buy or sell, all within the Simply Wall St platform and its community of millions of investors.

Whenever new news or earnings are released, Narratives are updated dynamically so your assumptions and fair valuation automatically reflect the latest facts.

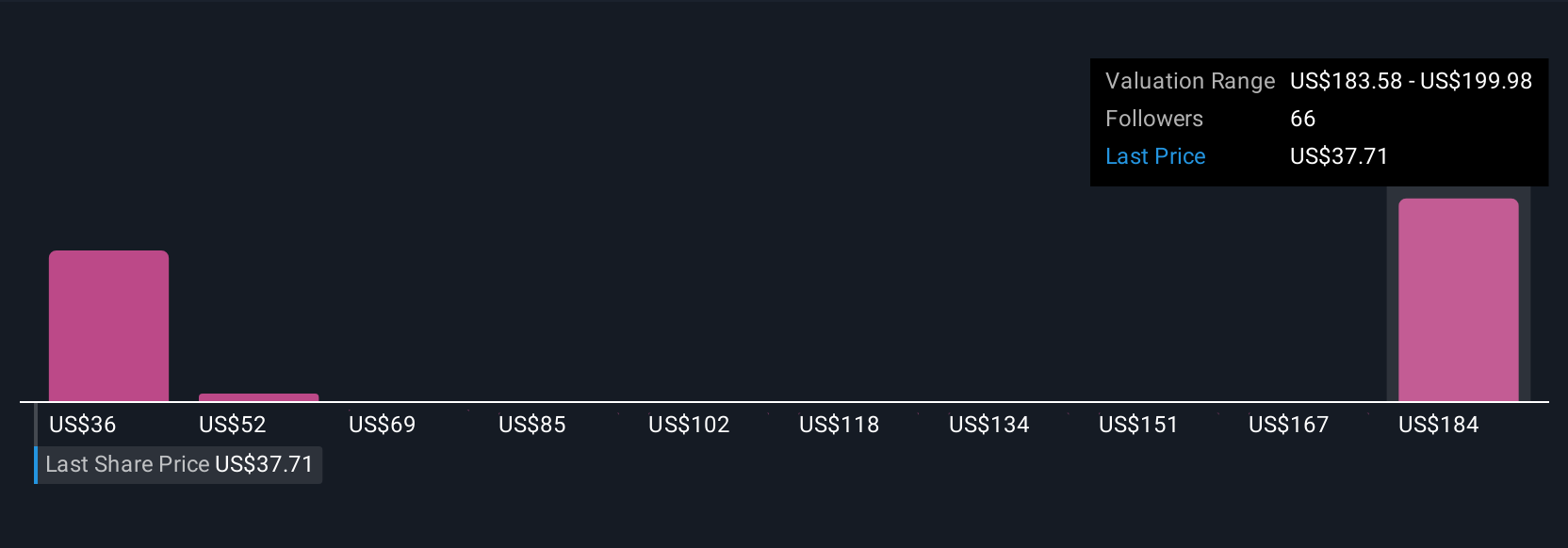

For example, using Exelixis, one investor’s Narrative driven by confidence in global oncology growth sees a price target as high as $60, reflecting bullish revenue and pipeline success. Another investor, focusing on competition or margin risks, may set fair value as low as $36. Your own Narrative helps you decide where you stand.

Do you think there's more to the story for Exelixis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives