- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Exact Sciences (NASDAQ:EXAS) shareholders have endured a 31% loss from investing in the stock three years ago

While not a mind-blowing move, it is good to see that the Exact Sciences Corporation (NASDAQ:EXAS) share price has gained 25% in the last three months. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 31% in the last three years, falling well short of the market return.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for Exact Sciences

Exact Sciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Exact Sciences grew revenue at 15% per year. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 9% per year. This implies the market had higher expectations of Exact Sciences. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

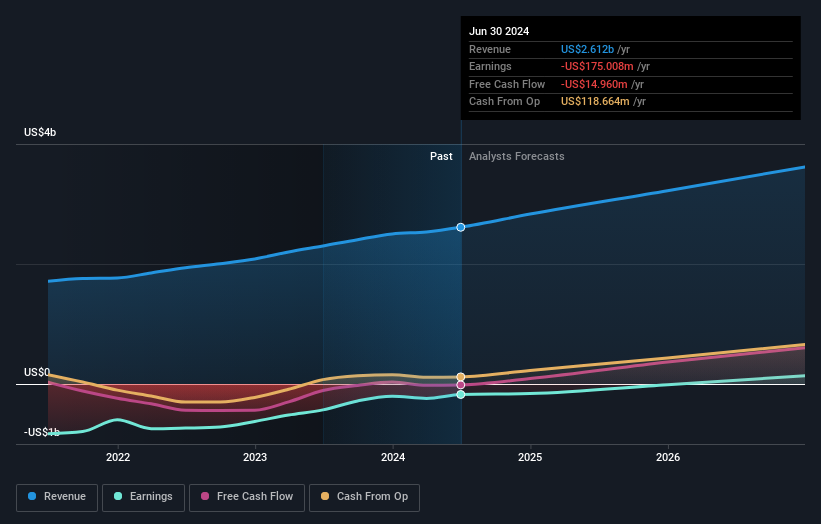

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Exact Sciences is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Exact Sciences stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Exact Sciences shareholders gained a total return of 4.1% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 3% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Exact Sciences better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Exact Sciences , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.