- United States

- /

- Diversified Financial

- /

- NYSE:LDI

3 Promising Penny Stocks With Market Caps As Low As $200M

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new heights, closing above 48,000 for the first time amid optimism about an end to the U.S. government shutdown, investors are keenly observing market dynamics that may influence their portfolios. Penny stocks, though a term from earlier market days, remain relevant as they often represent smaller or less-established companies with potential value. By focusing on those with strong financials and clear growth prospects, investors can uncover opportunities in these lesser-known stocks that might offer both stability and potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.73 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.20 | $924.51M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.63 | $607.59M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.15 | $713.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.19 | $26.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.02B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8975 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.25 | $72.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.30 | $10.2M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 356 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Atea Pharmaceuticals (AVIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing oral antiviral therapeutics for serious viral infections, with a market cap of $268.23 million.

Operations: Currently, Atea Pharmaceuticals does not report any revenue segments.

Market Cap: $268.23M

Atea Pharmaceuticals, with a market cap of US$268.23 million, is pre-revenue and currently unprofitable, reporting a net loss of US$42.05 million for Q3 2025. Despite this, the company remains debt-free and has sufficient cash runway for over three years based on current free cash flow levels. Recent data presented at The Liver Meeting® 2025 highlights promising developments in Atea's hepatitis C treatment regimen, which could position it as a potential best-in-class solution due to its high efficacy and flexibility in administration. However, earnings are forecasted to decline by an average of 4.5% annually over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Atea Pharmaceuticals.

- Understand Atea Pharmaceuticals' earnings outlook by examining our growth report.

Erasca (ERAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erasca, Inc. is a clinical-stage precision oncology company dedicated to discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers, with a market cap of approximately $669.46 million.

Operations: Erasca, Inc. does not currently report any revenue segments as it is focused on the clinical-stage development of therapies for RAS/MAPK pathway-driven cancers.

Market Cap: $669.46M

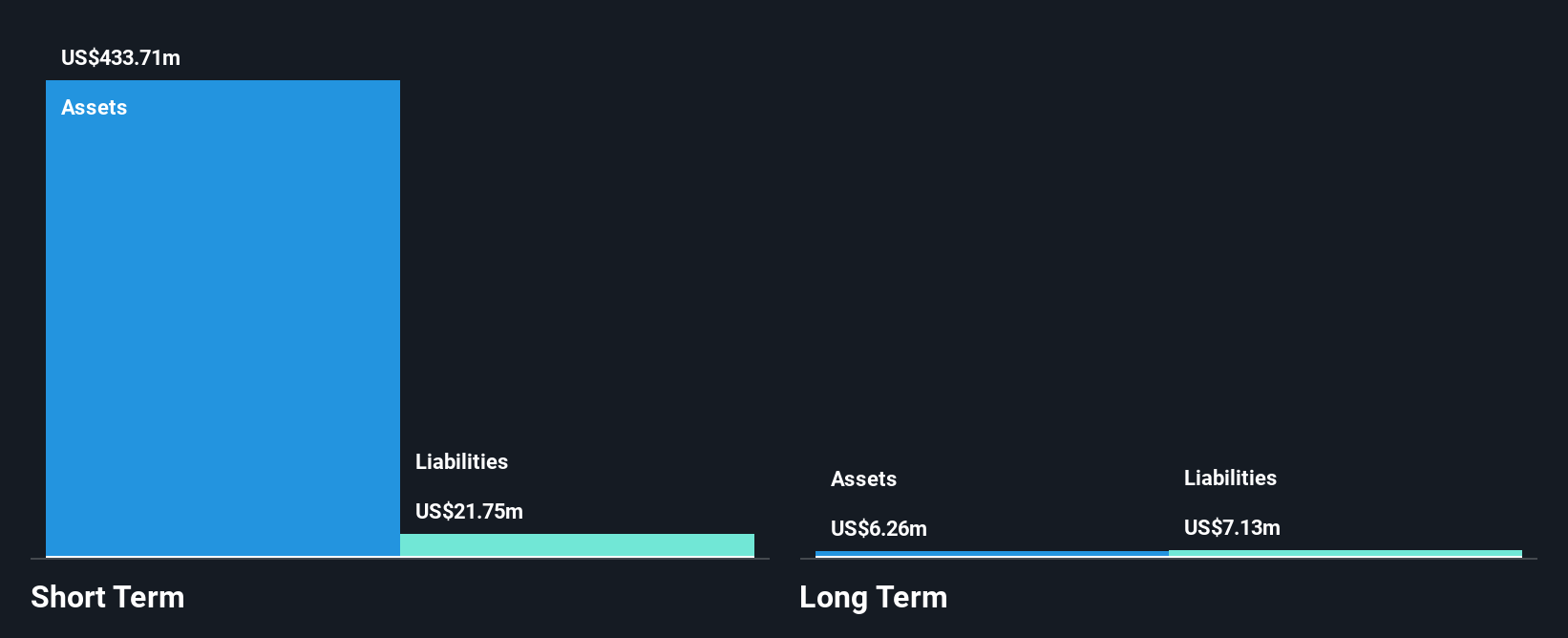

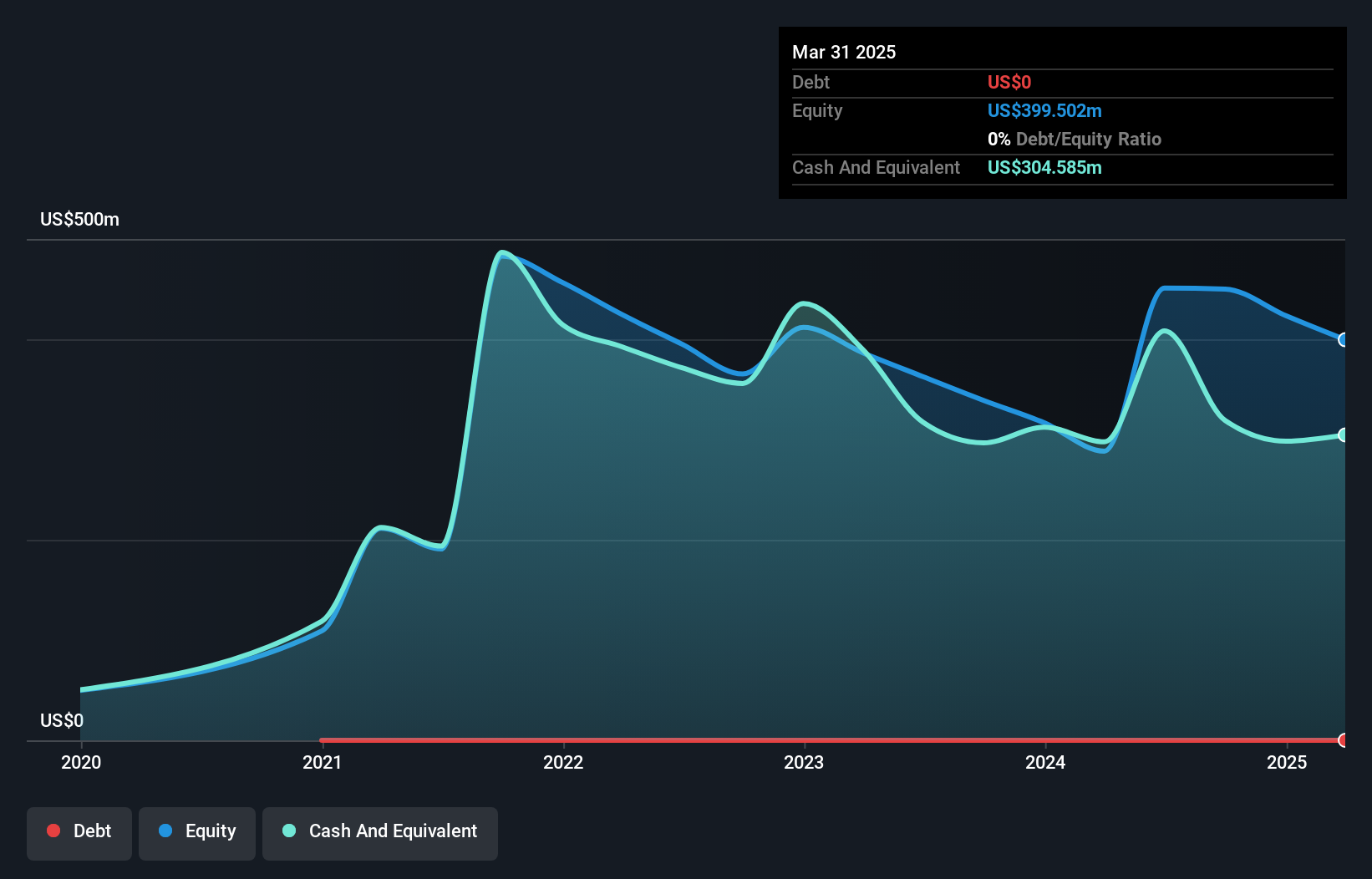

Erasca, Inc., with a market cap of US$669.46 million, is pre-revenue and focused on developing oncology therapies. The company remains debt-free and has sufficient cash runway for over two years, assuming historical reductions in free cash flow continue. Despite its unprofitability and forecasted earnings decline of 6.3% annually over the next three years, Erasca's short-term assets significantly exceed its liabilities. Recent presentations at major healthcare conferences reflect ongoing engagement with the investor community. However, the stock exhibits high volatility compared to most U.S. stocks, indicating potential risks for investors interested in penny stocks within the biotech sector.

- Get an in-depth perspective on Erasca's performance by reading our balance sheet health report here.

- Explore Erasca's analyst forecasts in our growth report.

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $973.05 million.

Operations: The company's revenue is primarily derived from the originating, financing, and selling of mortgage loans, totaling $1.10 billion.

Market Cap: $973.05M

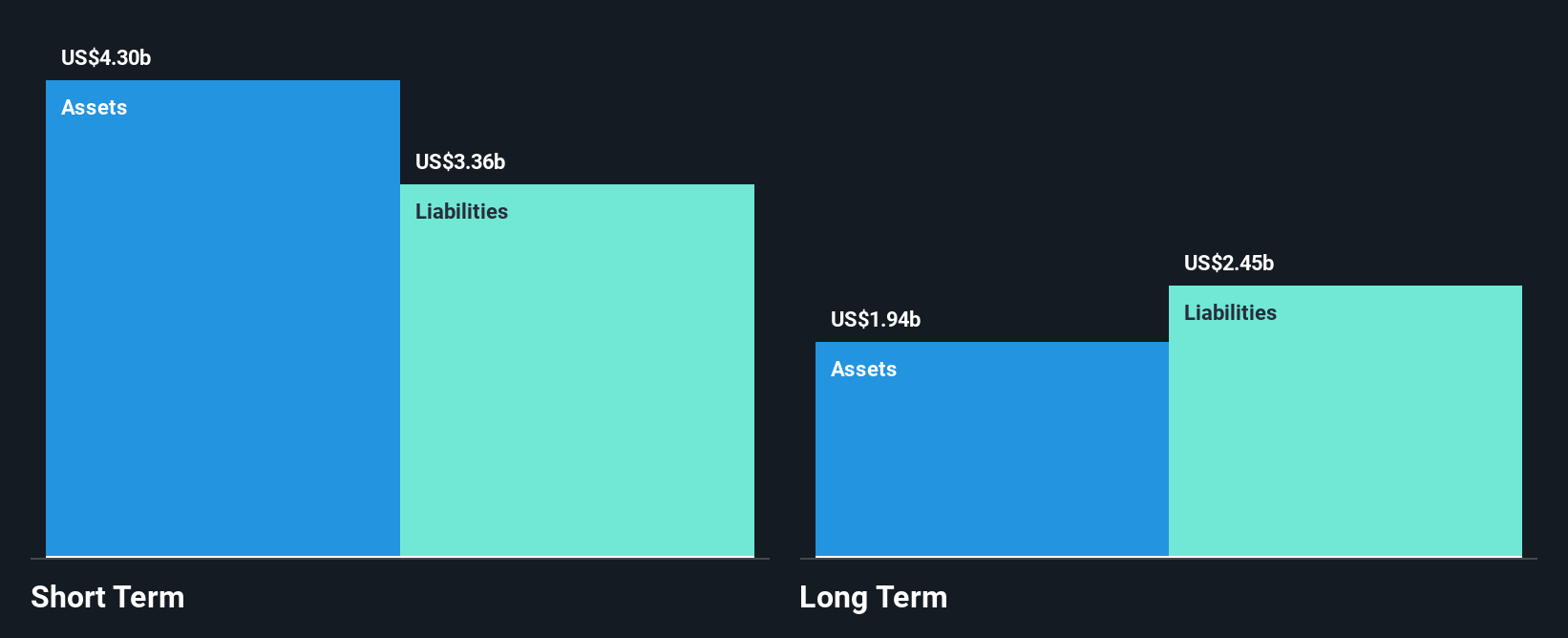

loanDepot, Inc., with a market cap of approximately US$973.05 million, operates in the mortgage sector and faces challenges typical of penny stocks. The company reported a net loss for the recent quarter despite revenue growth to US$323.32 million. While its short-term assets exceed liabilities, high debt levels remain concerning with a net debt to equity ratio at 1108.4%. Recent leadership changes aim to drive growth and operational efficiency through technology adoption and strategic initiatives. Despite unprofitability, loanDepot has over three years of cash runway supported by positive free cash flow growth, offering some financial stability amidst volatility concerns.

- Click here to discover the nuances of loanDepot with our detailed analytical financial health report.

- Review our growth performance report to gain insights into loanDepot's future.

Where To Now?

- Gain an insight into the universe of 356 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if loanDepot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDI

loanDepot

Engages in originating, financing, selling, and servicing residential mortgage loans in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives